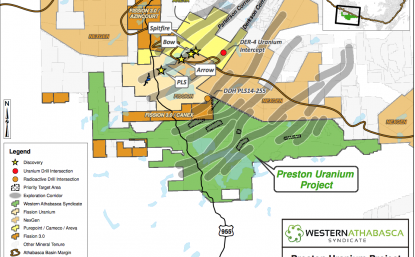

The following interview of CEO, Mr. Ryan Kalt of Athabasca Nuclear Corp, was conducted by phone & email from May 20th to May 25th. Athabasca Nuclear has been on the uranium scene since early 2013, when it acquired a 50% interest in the Preston Uranium Project. Its location in the southwestern Athabasca basin (see map below), is proximal to two of the biggest uranium discoveries of the century, one by Fission Uranium (TSX: FU) the other by NexGen Energy (TSX-V: NXE).

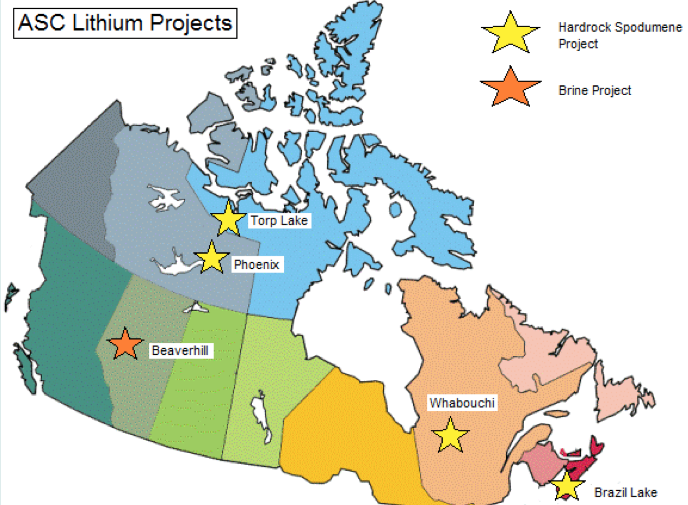

More recently, the Company has taken a shine to lithium, the metal, not the drug, best known as a key component of Li-ion batteries. To that end, it’s accumulated 5 lithium projects spread across Canada, a few of which are quite near promising lithium juniors like Nemaska Lithium (TSX-V: NMX). While lithium & uranium (in that order), are the main focus, CEO Kalt is open to any green commodity prospects that offer compelling investment value. Readers are encouraged to click on links at the bottom of the page for more information.

Please describe the new Athabasca Nuclear Corp. (TSX-V: ASC) for readers unfamiliar with the Company’s recent foray into lithium.

Athabasca Nuclear Corp. (“ASC”) has quickly emerged as a premier lithium exploration and development junior. We hold a diversified and growing portfolio of five geographically distinct lithium assets, including two development-drilling stage assets as well as major land positions in three different lithium exploration districts. As a result, ASC provides an excellent proxy to the underlying strength we are seeing in the lithium market.

We believe that the lithium market could have sustained pricing power driven by not only lithium intensive applications adopted to-date (electric cars, battery storage, etc) but also new emerging technologies that could create further consumption demand growth for lithium. ASC has created an asset portfolio that has significant torque to strength in lithium, both from a valuation level on our identified lithium deposits, but also within our large-scale lithium exploration tenure.

Athabasca Nuclear has 2 presentations on its website, one for lithium & one for Uranium. Please tell readers more about the Uranium side of the business.

We believe that both segments of our business have substantial value and so provide additional detail on our website by providing a presentation for our lithium and uranium asset portfolios on a stand-alone basis.

Specific to the uranium side, we have a 50% interest in our Preston Uranium Project, which represents one of the largest tenure positions in the emerging Western Athabasca Basin, which in turn is host to the recent discoveries by Fission and NexGen.

In fact, our Preston Uranium Project is the adjacent property for nearly the entirety of NexGen Energy’s Arrow-hosting Rook 1 project. We have developed a large number of drill prospects at the property and have, with our project partner, accumulated just under $5m of exploration expenditures at Preston over the past 36 months or so.

And on the lithium side, can you tell us more about each of the primary projects?

Absolutely. The market is beginning to understand the high-quality and diversified portfolio approach that we have taken to building up our lithium asset base. ASC shares have appreciated substantially during 2016 and we believe there is more positive news ahead in terms of the exploration and advancement of our lithium and other clean commodity assets.

At the advanced-stage of our lithium portfolio, ASC recently acquired 100% of the Torp Lake and Phoenix lithium spodumene deposits from North Arrow Minerals. This asset category provides us with drill-stage work which we can conduct to expand the drill results obtained by North Arrow Minerals. At Torp Lake, past channel sampling work on this spodumene bearing pegmatite has returned 6.0 m grading 4.5% Li2O and 7.0 m grading 3.3% Li2O. Lithium is contained in the mineral spodumene, high concentrations of which are observable within the Torp Lake (McAvoy) pegmatite over a 110m strike length with widths of 10m to 15m.

At Phoenix, there are two spodumene lithium pegmatites, Big Bird and Curlew. The Big Bird pegmatite has been mapped over an impressive 1,280m strike length with observable outcrop widths ranging from 8m to greater than 80m. Past drilling at the Big Bird pegmatite returned 1.24% Li2O over 34.3m. The Curlew pegmatite has been mapped over a strike length of 400m with widths up to 20m. Past drilling at the Curlew pegmatite returned 1.72% Li2O over 14.87m. I believe these compare well to other spodumene lithium pegmatites being advanced by other lithium juniors.

Equally exciting is our district-scale land positions that we have assembled for grass-roots lithium pegmatite exploration. Most prominently, we have one of the largest mineral tenure positions in the emerging Whabouchi lithium district, where Nemaska Lithium is advancing their very exciting Whabouchi project. ASC’s projects in the same immediate area are the Spodumene Lake Lithium Project and the Dumont Lithium project, which combined total nearly 50,000 acres.

There are already 29 mapped pegmatites which were previously identified on the Dumont Lithium Project that may be prospective for spodumene lithium. We are in the processing of developing a field work program for this summer which will serve to begin to explore that property. Elsewhere, we also have a significant land package near the Brazil Lake lithium pegmatites in Nova Scotia (just a few hundred feet from them) and we believe that area also has the potential for more spodumene lithium pegmatites to be found.

On the brine front, we have an interesting but early-stage lithium brine project in Alberta, being our Beaverhill Lithium Project. It is in an area where existing oil and gas producers are already bringing some brine-rich fluids to surface as part of their production process, so we need to examine the extent to which we and other pub-co.’s in the area might be capture that lithium at surface.

How were you able to accumulate a geographically diversified portfolio of both uranium & lithium assets?

As a company, ASC has a commitment to investing in clean commodities, being those that we feel have an important role in the clean/green economy. Importantly, clean commodities have underlying demand growth which is providing pricing power and thus creating value for shareholders exposed to the right segments of the resource complex. Commodities like lithium and uranium are among those which we believe have a very favorable future.

To that view, we have also a built a strong internal capacity using data mining and digital GIS which enables us to quickly identify areas that are experiencing elevated exploration activity and discovery success. Using those data-driven techniques, we have been able, over time, to accumulate a valuable and unique portfolio for clean commodity exploration and development. This same strategy has led to ASC’s ability to rapidly assemble a robust lithium project portfolio.

Unlike many other lithium juniors, ASC has not done expensive option deals to acquire our lithium projects. As a result, we do not have large dilutive cash payments due to vendors. This means we can put more money into exploring our ground rather than making ongoing property payments. Not all lithium deals have been created equal in this market!

Can you tell readers about your new acquisition in Quebec?

The Sun Valley project is tremendously exciting. We just locked in about 25,000 acres of highly prospective ground for Cu-Ni-PGE, with our focus on finding PGE’s. Our neighbor, Northern Shield, has suggested they are looking for a multi-million ounce PGE deposit and they had a surface sample peaking at 10.6% Cu and 16 g/t PGE. PGE’s fit well with our clean commodity focus, and we will be making this project a priority. As an aside, Northern Shield, who controls the other half of that structure sports almost a $30 million market cap.

How about your management team, Board & technical advisors? Has your team worked together in the past?

ASC has strong group of management, directors and technical advisors, driven by strength in all key disciplines including geology, accounting and legal. I am an attorney and financier by background and have more than fifteen years of senior executive experience.

Our team is also fortunate to have significant familiarity with one another as most of us were previously involved together at Gold Royalties Corporation, which we sold to NYSE-listed Sandstorm Gold Ltd. in 2015 for a 91% premium. Gold Royalties was a leading junior gold royalty company that had built up a portfolio of 18 project royalties across Canada.

The liquidity event allowed our shareholders to further partake in our assets within a well-run and senior gold royalty business that itself offered a robust asset portfolio. One of the strengths our team enhanced during that process was of course the ability to create a platform company onto which a series of asset acquisitions can be developed and integrated. This expertise translates exceptionally well into ASC’s lithium and clean commodities platform and the numerous project acquisitions that we have made during 2016 for it.

Roughly what price of uranium & lithium do you think is necessary for Athabasca Nuclear’s assets to potentially be economically viable?

We are an exploration-focused company and believe that discovery and resource-delineation drilling offers one of the more compelling return profiles within the resource space. To the extent prices are high for a commodity it will obviously make the discovery value correspondingly better. Our goal is to discover and accumulate great deposits.

Exploration is however more than just about spot prices, it is also about securing the right projects and the right mineral tenure, something that we believe that ASC is executing well on. To the extent that there is funding available – something that we have been successful at securing for both lithium and uranium exploration – it can be viewed as a project having sufficient economic potential in the eyes of third-parties for it to be advanced.

Junior companies have proven to be very good at discovery but less so with the procurement complexities associated with building mines. As a result, we expect our focus to remain on high-impact exploration which is a segment of the value-curve that we believe we can generate returns in for our fellow shareholders. To answer your question another way, I am reminded of something I was once told about the resource business (and I’m paraphrasing), that, ‘good deposits/mines make money at favorable commodity prices but great deposits/mines make money at all commodity prices.’ Wise words.

Thank you Ryan for your detailed responses. Please keep us posted on your progress.

Disclosures: The contents of this interview are for informational purposes only. Readers fully understand and agree that nothing contained in this interview by Peter Epstein, of Ryan Kalt, CEO of Athabasca Nuclear Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered, in any way whatsoever, implicit or explicit investment advice. Further, nothing contained herein is a recommendation or solicitation to buy, hold or sell any security. Peter Epstein and Epstein Research [ER] are not responsible, under any circumstances whatsoever, for investment actions taken by the reader. Peter Epstein and [ER] have never been, and are not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and neither performs market making activities.

At the time this interview was posted, Peter Epstein did not own shares in Athabasca Nuclear Corp. The Company has never been, and is not currently, a sponsor of [ER]. Mr. Epstein & [ER] are not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for its completeness. Mr. Epstein & [ER] are not expected or required to subsequently follow or cover events & news, or write about any particular company or topic.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.