Vital Metals (ASX:VML), the Australian-based rare earths producer, has announced a pause in the construction of its Saskatoon processing facility, which is the only rare earths processing facility in Canada. The company has cited concerns over the economic viability of its plans to market an intermediate product from the plant as the main reason for the pause.

Before the trading halt on April 18th, shares in Vital Metals were down by more than a quarter, falling to A1.1¢ on the ASX, leading to a market cap of A$43.8 million. The shares have traded between A1¢ and A7.2¢ over the past year.

In a release on Wednesday, Vital Metals stated that it was not able to sell its intermediate REE product “on commercially satisfactory terms”. The company pinpointed both higher plant costs and lower rare earth prices as factors in its decision to pause plant construction.

Vital Metals’ interim chairman, Richard Crookes, said that “there is no economic imperative to complete this demonstration project at the current time.” He added that the Saskatoon processing facility could provide valuable intermediate processing capacity for a downstream rare earth hub in Saskatchewan. He further noted that North America needs independent downstream processing to further enable the transition to the green economy, and Vital is looking forward to working with like-minded parties to deliver a completed project.

The company has also said that it is now completing a three-month strategic review of the plant while it seeks out new funding sources and partnerships with third parties to “build a sustainable business model”. In December 2021, Vital Metals had previously announced that it would slow down construction of the plant as costs to complete it had doubled to around C$55 million.

At the time, the company said it would defer completion of the plant to the second half of 2024 when its offtake customer REEtec would be ready to receive product for further processing at its plant, now under construction in Norway. Vital had also said that putting on hold the hydrometallurgical leaching, purification, and rare earth precipitation circuits would save it nearly C$16 million. However, the company had stated that it would still finish the calcine circuit at the plant by the third quarter of 2023 in order to produce an intermediate rare earth oxide product.

The recent decline in rare earths prices has also played a significant role in Vital Metals’ decision. According to a recent edition of the newsletter Critical Metals for a Sustainable World, rare earths prices “plunged” in March and early April based on China’s slowing economy and modest growth forecasts. The Apr. 17 report said prices for light rare earths are the lowest they’ve been since late 2020 or early 2021.

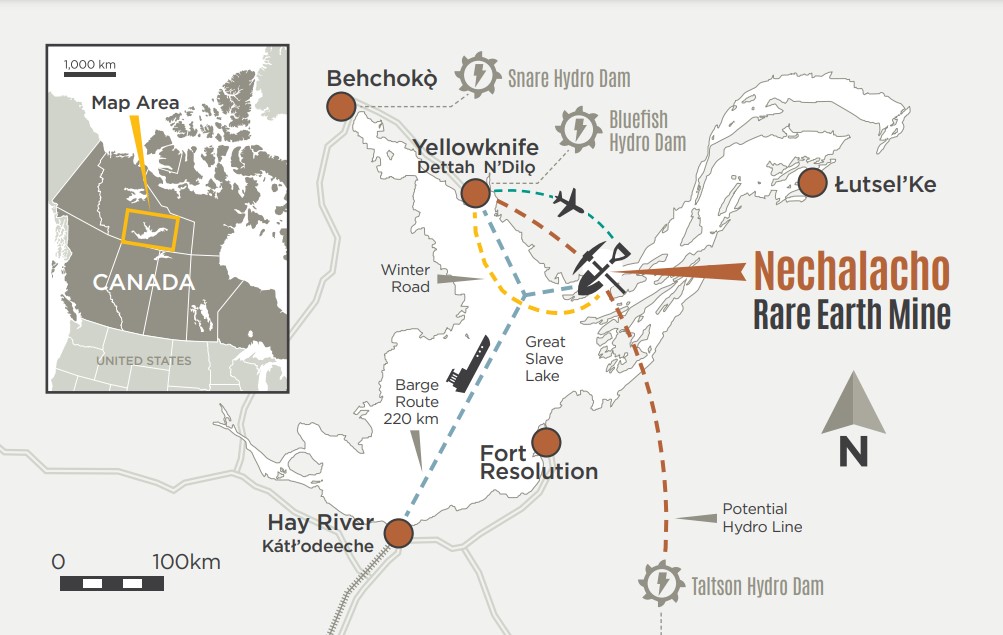

Despite the pause in construction, Vital Metals recently completed a drill program of more than 6,600 metres at its Tardiff deposit, with assay results and a resource update expected in the second half of the year. Vital has the rights to the near-surface Tardiff zones of the Nechalacho deposit, located 110km southeast of Yellowknife. Vital’s Yellowknife-based subsidiary, Cheetah Resources, began mining at the site, which is permitted for demonstration-scale production, in June 2021. Avalon Advanced Materials (TSX: AVL) holds the rights to mineralization below 150 metres at the project.

According to a February resource update, Tardiff contains 4.6 million measured tonnes at 1.6% total rare earth oxides (TREO), including 0.31% neodymium oxide and 0.08% praseodymium oxide; 6.3 million indicated tonnes at 1.5% TREO; and 108.1 million inferred tonnes at 1.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.