Western Copper and Gold (TSX:WRN) has announced the commencement of a metallurgical testing program for its wholly-owned Casino Copper-Gold Project. The program, which was prepared by Western’s Technical and Sustainability Committee, consisting of members from Western, Rio Tinto Canada Inc., and Mitsubishi Materials Corporation, will utilize fifteen composite samples obtained from core acquired during the company’s 2023 drill program.

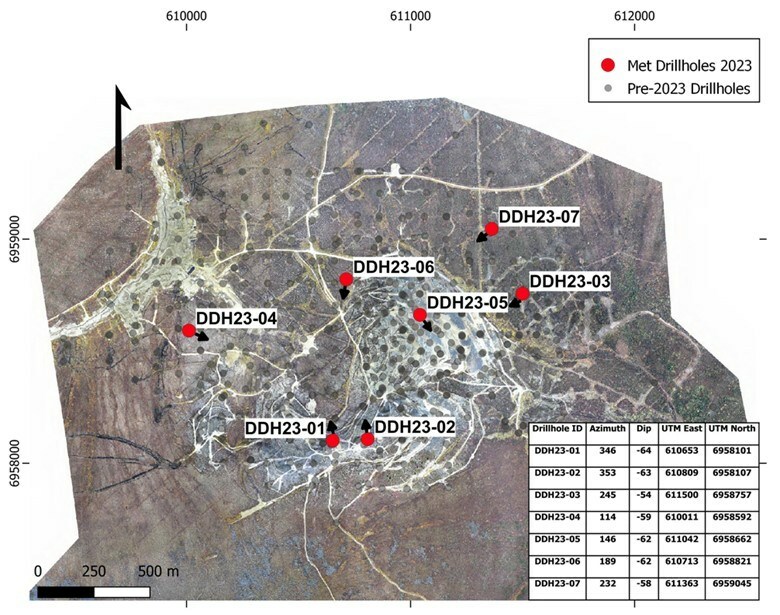

The 2023 drill program, which was also designed by the Technical and Sustainability Committee, consisted of seven holes totaling 2,244 meters in length, with individual holes ranging from 130 meters to 556 meters. The drill holes were strategically located within the current pit boundaries to provide a diverse range of grades, host rocks, and mineralogy for the metallurgical testing program. Additionally, the drill holes were selected with the goal of converting indicated resources to measured status.

The drill results continue to highlight the significance of the Core Zone, where relatively higher grades are encountered. This is exemplified by DDH23-05, which intersected 158.5 meters of supergene mineralization, partially oxidized, with a copper equivalent grade of 0.82%. Furthermore, DDH23-04, located approximately one kilometer west of the Core Zone, and DDH23-06, situated at the northwest edge of the Core Zone, intercepted 86.0 meters of 0.56% copper equivalent and 174.0 meters of 0.52% copper equivalent, respectively, in the supergene zone.

The fifteen composite samples, representing both supergene and hypogene mineralization at various grades, will undergo comminution and flotation tests to produce a definitive concentrate from each composite. The results from this testing will be instrumental in developing a more comprehensive geometallurgical model of the deposit. The test program is being conducted at ALS Metallurgy in Kamloops, British Columbia, under the supervision of personnel from Western, Rio Tinto Canada Inc., and Mitsubishi Materials Corporation.

The launch of the metallurgical testing program marks a significant step forward for Western Copper and Gold Corporation in advancing the Casino Copper-Gold Project. The program’s findings will provide valuable insights into the project’s potential and contribute to the ongoing development and optimization of the mining operation. The collaboration between Western, Rio Tinto Canada Inc., and Mitsubishi Materials Corporation in overseeing the drill and metallurgical programs demonstrates the strong partnership and shared commitment to the success of the Casino project.

As the metallurgical testing program progresses, Western Copper and Gold Corporation is expected to provide further updates on the results and their implications for the Casino Copper-Gold Project. The company remains focused on advancing the project while prioritizing sustainability and working closely with its partners to maximize the value of this significant copper-gold resource.

Highlights from the program are as follows:

Table 1: 2023 drill program results

|

Zone3 |

From |

To |

Length |

Cu (%) |

Au (g/t) |

Mo (%) |

Ag (g/t) |

CuEq1 |

|

DDH23-01 |

||||||||

|

CAP |

0.0 |

100.2 |

100.2 |

0.02 |

0.28 |

0.011 |

2.3 |

0.28 |

|

Supergene |

100.2 |

244.2 |

144.0 |

0.19 |

0.31 |

0.008 |

2.3 |

0.46 |

|

SUS |

100.2 |

244.2 |

144.0 |

0.19 |

0.31 |

0.008 |

2.3 |

0.46 |

|

HYP |

244.2 |

400.0 |

155.8 |

0.08 |

0.13 |

0.002 |

1.0 |

0.19 |

|

DDH23-02 |

||||||||

|

CAP |

3.2 |

72.2 |

69.0 |

0.02 |

0.25 |

0.006 |

1.4 |

0.22 |

|

Supergene |

72.2 |

229.0 |

156.8 |

0.21 |

0.32 |

0.013 |

1.9 |

0.50 |

|

SOX |

72.2 |

92.5 |

20.3 |

0.11 |

0.25 |

0.006 |

1.5 |

0.31 |

|

SUS |

92.5 |

229.0 |

136.5 |

0.22 |

0.33 |

0.014 |

1.9 |

0.52 |

|

HYP |

229.0 |

556.0 |

327.0 |

0.17 |

0.21 |

0.016 |

1.2 |

0.38 |

|

DDH23-03 |

||||||||

|

CAP |

22.1 |

25.1 |

3.0 |

0.06 |

0.10 |

0.002 |

0.7 |

0.14 |

|

Supergene |

25.1 |

109.5 |

84.5 |

0.24 |

0.22 |

0.006 |

1.5 |

0.43 |

|

SOX |

25.1 |

42.6 |

17.5 |

0.19 |

0.19 |

0.003 |

1.3 |

0.34 |

|

SUS |

42.6 |

109.5 |

66.9 |

0.26 |

0.23 |

0.006 |

1.6 |

0.45 |

|

HYP |

109.5 |

528.0 |

418.5 |

0.18 |

0.23 |

0.018 |

2.4 |

0.43 |

|

DDH23-04 |

||||||||

|

CAP |

4.7 |

56.6 |

51.9 |

0.04 |

0.15 |

0.021 |

1.9 |

0.25 |

|

Supergene |

56.6 |

142.6 |

86.0 |

0.30 |

0.20 |

0.027 |

2.4 |

0.56 |

|

SUS |

56.6 |

142.6 |

86.0 |

0.30 |

0.20 |

0.027 |

2.4 |

0.56 |

|

DDH23-05 |

||||||||

|

CAP |

5.6 |

72.0 |

66.4 |

0.03 |

0.21 |

0.031 |

1.0 |

0.31 |

|

Supergene |

72.0 |

230.5 |

158.5 |

0.37 |

0.41 |

0.039 |

1.6 |

0.82 |

|

SOX |

72.0 |

159.0 |

87.0 |

0.39 |

0.39 |

0.043 |

1.5 |

0.84 |

|

SUS |

159.0 |

230.5 |

71.5 |

0.35 |

0.44 |

0.032 |

1.9 |

0.79 |

|

DDH23-06 |

||||||||

|

CAP |

8.5 |

20.5 |

12.0 |

0.07 |

0.40 |

0.010 |

2.2 |

0.41 |

|

Supergene |

20.5 |

194.5 |

174.0 |

0.21 |

0.36 |

0.013 |

1.6 |

0.52 |

|

SOX |

20.5 |

86.5 |

66.0 |

0.25 |

0.53 |

0.013 |

2.0 |

0.69 |

|

SUS |

86.5 |

194.5 |

108.0 |

0.18 |

0.25 |

0.012 |

1.4 |

0.41 |

|

HYP |

194.5 |

256.8 |

62.3 |

0.06 |

0.07 |

0.011 |

0.6 |

0.16 |

|

DDH23-07 |

||||||||

|

CAP |

– |

– |

– |

– |

– |

– |

– |

|

|

Supergene |

34.2 |

77.1 |

42.9 |

0.22 |

0.18 |

0.006 |

1.3 |

0.39 |

|

SUS |

34.2 |

77.1 |

42.9 |

0.22 |

0.18 |

0.006 |

1.3 |

0.39 |

|

HYP |

77.1 |

130.3 |

53.2 |

0.24 |

0.25 |

0.014 |

1.8 |

0.48 |

|

1CuEq metal prices: $US 3.60/lb Cu, $US 1700/oz Au, $US 14/lb Mo, $US 22/lb Ag with no adjustment for metallurgical recovery. |

|

2Widths are core length, not true width of mineralized intersection |

|

3CAP – leached cap, SUS – supergene sulphide, SOX – supergene oxide, HYP – hypogene |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.