3. Eldorado Gold Corp. (TSX: ELD)

If you were to sum up the story of the bull market in metals in two words, then “Chinese demand” might rank as high as any other pairing. Though, as some point out, Chinese demand won’t support commodity prices forever. China’s GDP growth from 1978 to 2005 was a staggering 9.5% a year.

Yet for all the success that North American miners have had because of China, Vancouver’s Eldorado Gold, in February 2007, became the first North American company to successfully construct and operate a gold mine there when it began production at the Tanjianshan mine in Qinghai Province. This probably didn’t come as a surprise to many Eldorado shareholders as the company has shown an ability to produce at a low cost in various political and economic environments. In addition to China, the company operates in Turkey, Brazil, the United States and Greece, all while keeping its operating costs between $390 and $410 an ounce. Eldorado Gold is a favourite of Desjardins Securities analyst Brian Christie who, last week, raised his price target by $0.75 to $22 (U.S.) and maintained a “buy” rating.

Eldorado’s growth has been remarkable; from just over $179 million in revenue in fiscal 2007 to $791 million in fiscal 2010. The company has also been an earnings machine, putting more than $200 million to the bottom line in 2010. And, 2011 is shaping up to be another stellar year for Eldorado, an emerging intermediate gold producer that takes its name from a legendary city of gold.

4. Guyana Goldfields Inc. (TSX: GUY)

El Dorado, the “Lost City of Gold“, has fascinated and eluded explorers since the days of the Spanish Conquistadors. The story of El Dorado was born through a combination of myths and legends. Dating back to the 1500s, the story originated from the Muisca people who spoke of a golden city hidden in remote South America. The promise of an ancient city of gold enticed European explorers to search for El Dorado for more than two centuries. The geographical location of the mysterious city has morphed along with the myths and legends over the years. Gold coins, precious stones, and streets paved with gold are thought to be located somewhere in Columbia, Venzuela or Guyana.

Sir Walter Raleigh searched for the elusive city in 1595 and reportedly found it. He described El Dorado as a city on Lake Parime far up the Orinoco River in Guyana where “every stone they picked up promised either gold or silver“. The city was actually marked on English maps until its existence was disproved by Alexander von Humboldt during his Latin-America expedition in the early 1800s. Though many have searched and failed to find this city of gold, no evidence of such a place has ever been found.

One TSX listed company, Guyana Goldfields, has certainly not let the past failed efforts to find El Dorado prevent them from finding gold in Guyana. The company has been operating in Guyana successfully for 15 years and now boasts a resource estimate of just over 6.6 million ounces of gold from 2 different projects. UBS analyst Dan Rollins likes the company. On July 25th Rollins wrote, “Given the company’s attractive valuation, market capitalization of less than $1 billion, near-term production potential from Aurora and exploration potential at Aranka, we believe Guyana Goldfields could be an acquisition target for an intermediate or mid-cap producer seeking to expand its presence in South America.”

MiningFeeds.com recently connected with Claude Lemasson, President and COO of Guyana Goldfields, for an exclusive interview – CLICK HERE – to read more.

5. Strike Gold Corp. (TSX-V: SRK)

2G is short for second-generation wireless telephony technology. Three primary benefits of 2G networks over their predecessors were that phone conversations were digitally encrypted; 2G systems were significantly more efficient; and 2G introduced data services for mobile like SMS text messages. What does 2G have to do with a newly listed TSX-V junior? Strike Gold is going after “2 Gs”; specifically, gold and graphite. An interesting proposition considering gold and graphite are two of the hottest sectors in mining today. There is another obscure 2G Strike Gold reference, but we’ll get to that in a moment.

On September 1st, 2011, Strike Gold announced an agreement to acquire a 100% interest in the Deep Bay East and Simon Lake Graphite Properties both located in northern Saskatchewan. Some historic drilling and trenching was completed at Deep Bay East and the exploration identified some high grades of graphite across thick intervals including 35 meters grading 8.58% graphitic carbon. About the acquisition, Geoff Balderson, Strike Gold’s president & CEO, remarked, “We are delighted to have secured these two properties and give our shareholders investment exposure in what many believe to be such a promising resource sector.” The news of the acquisition sent Strike’s shares up 36.8% from $0.24 to $0.38. Perhaps not surprising when you consider Northern Graphite (TSX-V:NGC), a junior exploration company that completed a $0.50 IPO just 4 months ago, last closed at $1.35.

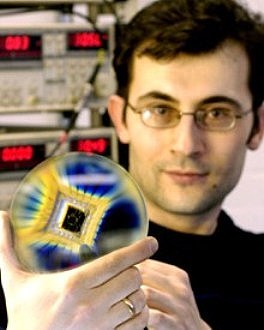

In 2010, scientists at the University of Manchester won the Noble Prize in Physics for isolating graphene. Graphene is a one-atom-thick planar sheet of densely packed carbon atoms; think of it as an atomic-scale chicken wire made of carbon atoms and their bonds. Scientists around the world believe that graphene is a strong candidate to replace silicon and other materials in semiconductor chips. Moore’s Law observes that the density of transistors on an integrated circuit doubles every two years. Transistors run computers and, you guessed it, 2G networks. Science has pushed the capabilities of existing transistor materials to the edge. Silicon transistors, for example, are thought to be close to the minimum size where they can remain effective. Graphene transistors can potentially run at faster speeds and cope with higher temperatures theoretically extending Moore’s Law for many years to come.

Dr. J.T. Janssen, a researcher at UK’s National Physical Laboratory states, “We’ve laid the groundwork for the future of graphene production, and will strive in our ongoing research to provide greater understanding of this exciting material. We have taken a huge step forward, and once the manufacturing processes are in place, we hope graphene will offer the world a faster and cheaper alternative to conventional semiconductors.”

For 10 Most Interesting Gold Stocks – Part 3 – CLICK HERE.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.