B2Gold’s (NYSE:BTG) strong 2021 production numbers are overshadowed by its underperforming Gold Miners Index (GDX) by nearly 20%.

The drop was partly due to a record comparative earnings year in 2020 as well as perceived risk in Mali. If recent sanctions do not impact mining operations, B2Gold’s price could start to better reflect its solid fundamentals.

Low cost producer with strong cash position

Annual production for FY2021 was 1.04M oz. with all-in sustaining costs (AISC) between $870 and $910. AISC for FY2022 are projected to be $1,010-$1,050 due to inflationary pressures. Even so, B2G is poised to remain among the lowest cost producers in the industry.

2021 cash flow from operations is estimated at $650M. The strong cash position with virtually no debt gives the company options for exploration and M&A. $29M has been allocated to grassroots exploration for 2022, highlighting their ambition to continue to grow by drilling.

In the words of chief executive Clive Johnson, “we’ve always been very entrepreneurial, yet we’re very good at the bricks and mortar of our business…. We’ll do deals that other companies may not do.”

Perceived Mali risks but no impact on production

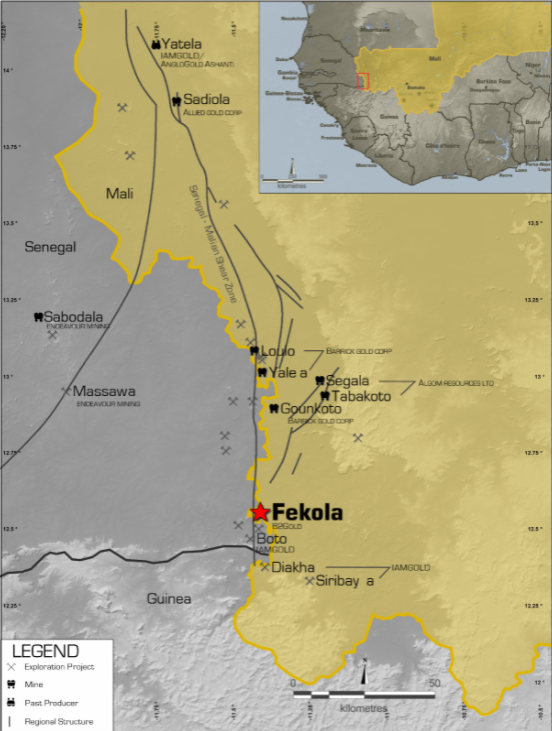

Over half of B2Gold’s production comes from the Fekola Mine in Mali, where regulatory and geopolitical events have been an ongoing theme.

There was a military coup in May which, while not impacting operations, created some negative investor sentiment regarding one of Africa’s biggest gold producers. The government’s revocation of an exploration permit for B2Gold’s Menankoto property also caused negative market reaction. Although a permitting agreement was reached in December, recent sanctions on the country imposed by the Economic Community of West African States (ECOWAS) raise the possibility of supply disruptions.

Nonetheless, Fekola exceeded 2021 production estimates with 567,795 oz. and CEO Clive Johnson maintains that it will withstand supply disruptions and meet 2022 targets.

Image source: b2gold.com

Underexplored jurisdictions

Part of B2Gold’s strategy is to operate and develop in jurisdictions which, while relatively underexplored, are often perceived as higher risk compared to, for instance, Canada, Nevada, or Australia. As Clive Johnson states, “a core part of our strategy is to go where others fear to tread.”

Aside from core operations in Mali, The Philippines, and Namibia, the company has exploration projects in Uzbekistan and Finland as well as a JV development in Colombia. In July 2021, they signed exploration contracts in Egypt.

In the face of perceived geopolitical risks, Johnson highlights the solid economic foundation gold miners brought to countries during COVID and anticipates B2Gold’s experience and reputation will set it apart.

Valuation fundamentals

B2Gold offers one of the highest dividends in the industry (4.38%). It is trading at 8.67 times earnings and has healthy current and quick ratios of 4.89 and 2.90, respectively. Price to forward earnings and price to cash flow are both below industry averages.

If perceived Mali risks begin to ease and gold continues to show a strong hand in volatile markets, B2Gold’s value could start to be better reflected in the price.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.