After a busy and successful 2021, Canada-based junior gold mining company Collective Mining (TSXV:CNL) is charting a path forward for 2022 that will highlight it’s Guayabales and San Antonio projects in Caldas, Colombia. After being listed on the TSX Venture Exchange through an RTO on May 28, 2021, the company went on to achieve a number of successful exploration campaigns at the Guayabales and San Antonio projects.

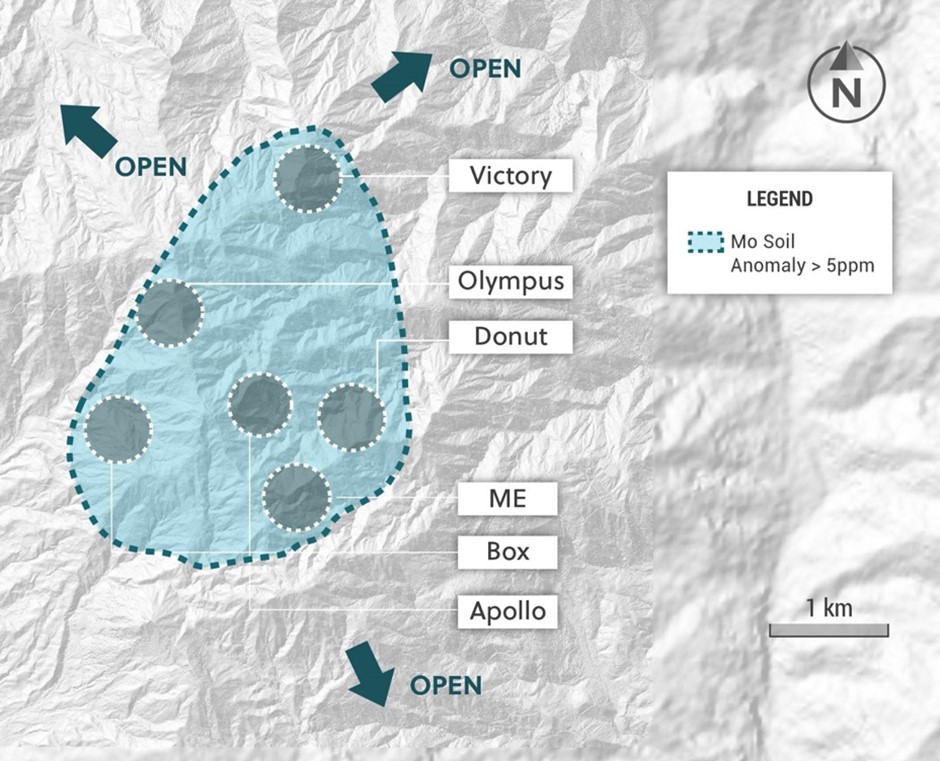

As a result of the success of the drill programs and discoveries, the company has decided to focus on some key targets in the new year. At Guayabales, the Olympus and Victory targets will be the focus of the drill campaign, but the company is also planning additional metres of drilling at the Donut and Box targets. The company has pushed up deadlines thanks to the success of the program so far and may do so again. If the exploration results in the first half of 2022 are successful, Collective could begin to test the earlier-stage Apollo and ME targets.

On the other side of the 20,000+ metre diamond drilling program, a deep penetrating ground IP survey will bein in January 2022 at San Antonio. Upon completion of the survey, the company will begin its follow-up drill program at the Pound target. Collective Mining is also looking at the possibility of testing the COP target at San Antonio for the first time during this period.

2022 is set to be an exciting year for the company, with an accelerated timeline in place for the 20,000+ metre drill program at Guayabales and San Antonio. If 2021 is anything to go by, then it could be another year of discoveries and advancing these two highly prospective properties in Colombia.

Some of the highlights from 2021 include:

Guayabales Project (Figure 1)

4,838 metres of diamond drilling has been completed at the project as of December 22, 2021.

Due to the operating team’s extensive Colombian experience, the Company was able to rapidly advance surface exploration at Guayabales, which in turn lead to the discovery of a 3.5 kilometre x 3 kilometre cluster encompassing six porphyry targets for diamond drilling.

Donut Target: The Company made a significant grassroots discovery with multiple broad drill intercepts in predominantly breccia beginning at surface. Highlights from holes completed to date are as follows:

* AuEq (g/t) is calculated as follows: (Au (g/t) x 0.95) + (Ag g/t x 0.016 x 0.90) + (Cu (%) x 1.83 x 0.92) + (Mo (%) x 4.57 x 0.92), utilizing metal prices of Cu – US$4.00/lb, Mo – US$10.00/lb, Ag – $24/oz and Au – US$1,500/oz and recovery rates of 95% for Au, 90% for Ag, 92% for Cu and Mo. Recovery rate assumptions are speculative as no metallurgical work has been completed to date.

** A 0.1 g/t AuEq cut-off grade was employed with no more than 10% internal dilution. True widths are unknown, and grades are uncut.

Assays for several completed drill holes remain outstanding and will be announced once received in Q1, 2022.

Olympus Target: A high-grade porphyry related, carbonate base metal (“CBM”) vein system, measuring 1,000 metres x 600 metres and open in all directions has been outlined through detailed surface sampling and geophysics. High-grade samples have been collected throughout the target area with highlights as follows:

*The reader should be cautioned that grab samples are selective in nature and as a result should not be relied upon as being representative of average grades anticipated in any future resource estimate or mining scenario.

** Only samples CM003570 and CM003571 reported above were analyzed for base metal grades.

A maiden diamond drilling program utilizing two rigs commenced at the Olympus target on December 1, 2021, and visual logging of the two completed holes to date highlights the discovery of multiple mineralized CBM veins hosted within intensely altered porphyry diorite and hydrothermal breccia units. Initial assay results are expected in January 2022.

Box Target: Three reconnaissance diamond drill holes were recently completed at the Box Target to test an altered and mineralized porphyry target with associated carbonate base metal veins. Visual inspection of the core for drill holes 1 and 3 indicates that multiple CBM veins and altered porphyry style mineralization were intercepted but appears to be distal to a potassic core of a porphyry system. Assay results are expected in mid to late Q1, 2022.

Victory Target: Extensive reconnaissance work is ongoing and has both significantly enhanced the 1000 metre x 600 metre porphyry target and has resulted in the discovery of a new carbonate base metal vein system directly flanking the eastern edge of the porphyry target. Multiple samples from both the porphyry and the Victory East vein target have been collected with results expected in Q1, 2022.

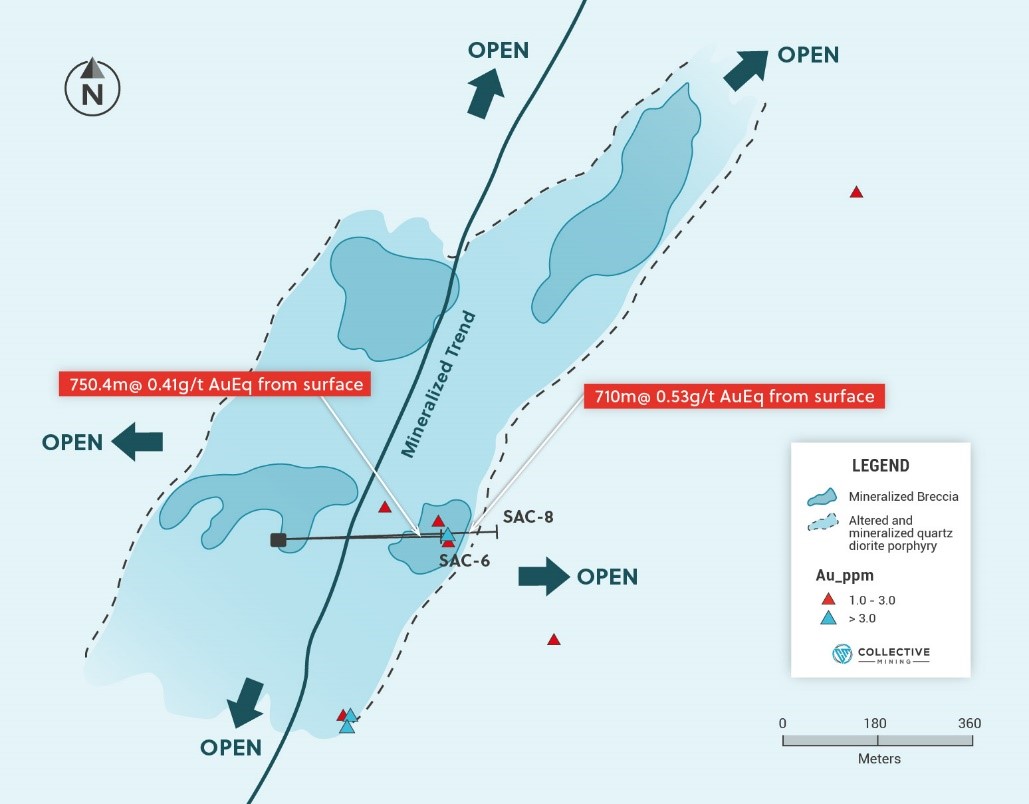

San Antonio Project (Figure 2)

4,310 metres of diamond drilling was completed at the project in 2021 resulting in a significant bulk tonnage grassroots discovery at the Pound Target. Mineralization at Pound, which begins from surface, is related to hydrothermal breccia and highly altered quartz diorite intrusive which have been overprinted by late stage, polymetallic veins. Subsequent follow up exploration has expanded the strike length of the target to at least 1.3 kilometres with assay results as follows:

* AuEq (g/t) = (Au (g/t) x 0.95) + (Ag g/t x 0.013 x 0.90) + (Cu (%) x 1.83 x 0.92) + (Mo (%) x 4.57 x 0.92), utilizing metal prices of Cu – US$4.00/lb, Mo – US$10.00/lb, Ag – $20/oz and Au – US$1,500/oz and recovery rates of 95% for Au, 90% for Ag, 92% for Cu and Mo.

** a 0.1 g/t AuEq cut-off grade was employed with no more than 10% internal dilution. True widths are unknown and grades are uncut.

Corporate and Sustainability

The Company successfully completed an RTO and was listed on the TSX Venture Exchange on May 28, 2021.

The Company raised C$28.5 million through a combination of a private placement financing and the exercise of warrants related to said financing.

As a result of successful exploration campaigns during the course of the year, the Company’s share price gained approximately 200% from the date of listing on the TSXVenture Exchange.

The Company’s multi-pronged and comprehensive ESG program for 2021 resulted in the recognition by local stakeholders as a transparent and trustworthy entity. Numerous programs were implemented throughout the year highlighted by the strategic alliance with the National Coffee Federation of Colombia and the Municipality of Supía to promote water utilities, infrastructure improvements, as well as to provide technical assistance for more than 400 coffee-growing families representing 6,000 people from 35 different communities.

Source: Collective Mining

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.