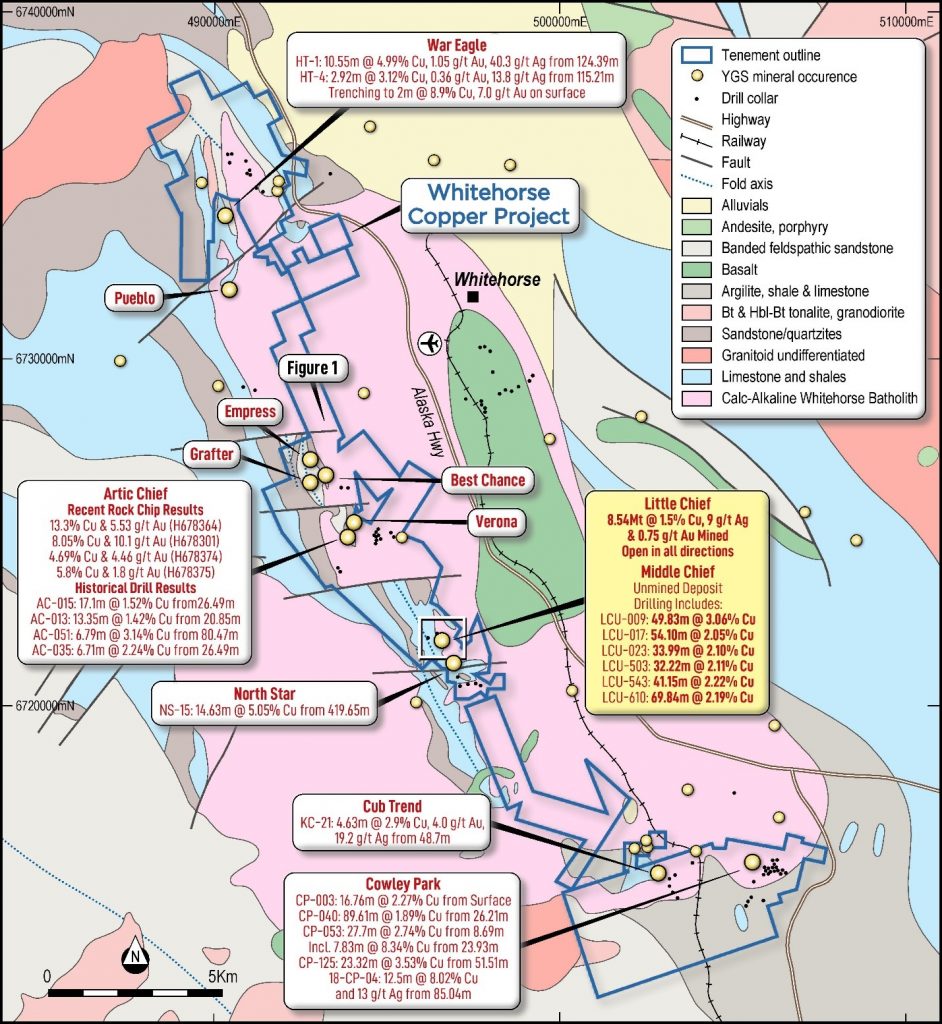

Gladiator Metals (TSXV:GLAD) has provided a comprehensive update on its ongoing drilling programs and exploration activities at the Whitehorse Copper Project located west of Whitehorse, Yukon, Canada. The company is targeting significant widths of unmined, high-grade copper-gold skarn mineralization along the historic Little Chief mine trend, which extends over 700 meters of strike length.

Gladiator CEO, Jason Bontempo commented in a press release: “Gladiator has commenced the first diamond drilling campaign at the Middle Chief Prospect since mine closure in 1982. The planned 10,000m diamond drilling is designed to test areas of high-grade copper skarn mineralization identified from its data compilation of historic drilling datasets at the Middle Chief target as well as near mine extensions to the historic Little Chief mine. These targets represent near surface areas of mineralization open in all directions with limited exploration or development away from historical underground infrastructure.”

The former Little Chief mining area was the largest historical producer in the Whitehorse Copper Belt, with approximately 8.54 million tons mined grading over 1.5% copper and 0.75g/t gold according to 1984 estimates by Watson. Production from the Little Chief open pit mine started in May 1967, with mining of the open pit completed by 1969. Underground mining development began in 1971 before operations ceased in 1982 due to low copper prices.

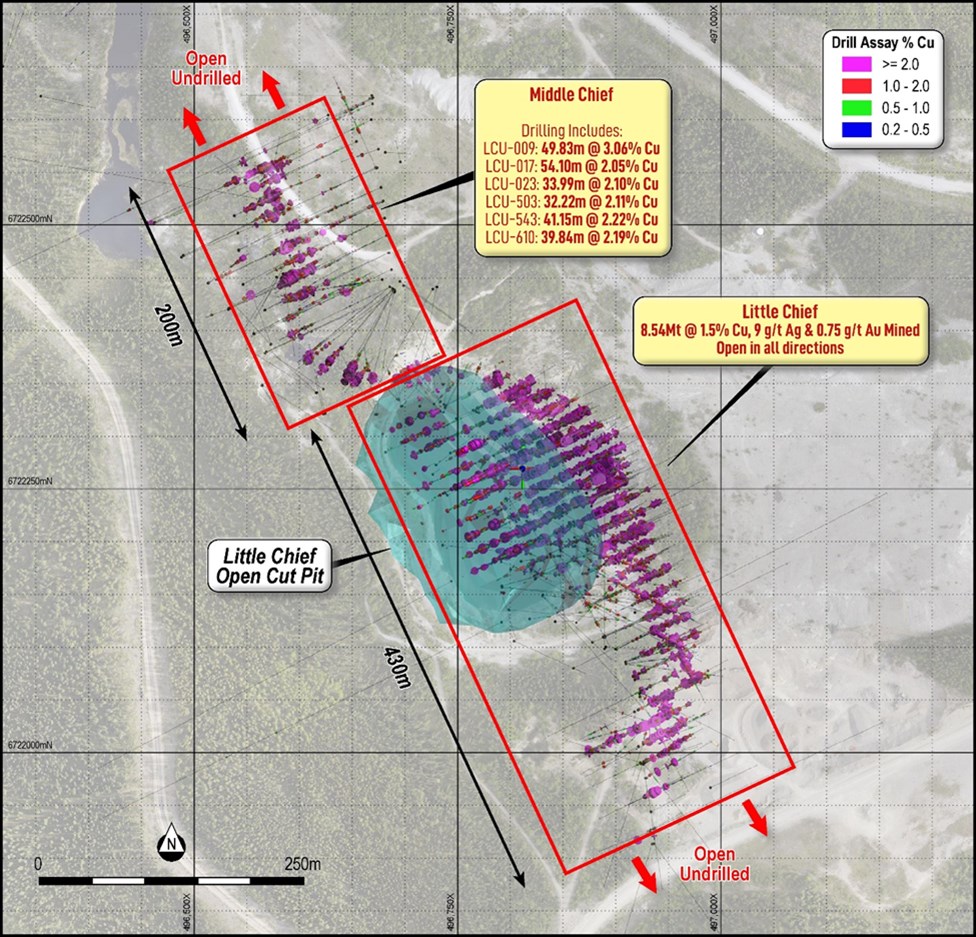

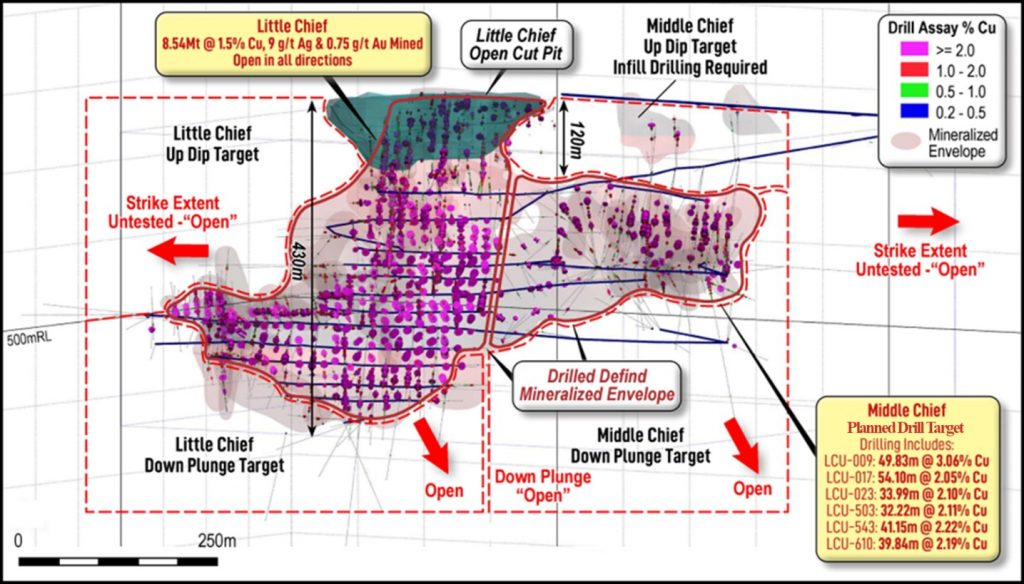

Gladiator’s review has identified excellent down-dip potential for the mineralization to continue in areas where limited or no drilling has been conducted to date. The mineralization remains open at depth and along strike from the historic Little Chief underground and open-cut mining operations.

Recent compilation of historic drilling data for the Little Chief mine has revealed a significant shallow mineralized zone measuring over 200 meters in length located only 120 meters below surface. This zone, named the Middle Chief target, appears to contain intact high-grade copper skarn mineralization based on the restricted extent of historical drilling. The compilation and 3D modelling of the Little Chief data is the first time the mineralization has been able to be visualized in three dimensions. This has provided Gladiator with clear open targets to potentially expand the known mineralization at Middle Chief and connect it to the historic Little Chief orebody which remains open in multiple directions.

Drilling commenced at Middle Chief on January 9, 2024 and will continue over the coming three months. The program consists of diamond core drilling with downhole electromagnetic (DHEM) surveys to identify extensions of the mineralization into untested areas. In contrast to selective historical sampling for only copper values, Gladiator will assay drill core and samples for a fuller range of credits including gold, silver and molybdenum.

The drill holes prefixed LCU-, D- and BC2 were collared from underground drives and declines providing access to the Little Chief mine workings. Therefore the reported downhole mineralized intercept depths do not represent true depths below surface.

At the Cowley Park copper-molybdenum skarn target, final assay results have now been received from Gladiator’s recently completed 4,000-meter diamond drill program. The results continue to demonstrate continuity of broad zones of shallow copper-molybdenum mineralization while also highlighting the potential for lower-grade envelopes to significantly expand the overall resource potential. The drilling confirms the width, grades and continuity of the previously targeted high-grade zones, with results including 15 meters at 2.36% copper and 13 meters at 2.06% copper.

The Cowley Park drill program was designed to test lateral extensions of known mineralization to aid planning of upcoming resource definition drilling. Most holes stepped out to the south and southeast of previous mineralization, such as hole 19-CP-08 which intersected 43.28m at 2.24% copper. A new zone of copper skarn was discovered 50 meters south of the main Cowley Park area, with an intercept of 10 meters at 1.23% copper. This illustrates the strong potential for further increasing the footprint of mineralization. The current drill-defined copper and molybdenum mineralization at Cowley Park remains open in all directions.

In addition to the extensive drilling, Gladiator is conducting a high-resolution drone airborne magnetic survey over the Little Chief mine trend. The survey data will be processed into a detailed 3D inversion model given the direct targeting potential of the magnetite-rich copper skarn mineralization.

Work to date, including assessment of early survey data, has identified over 30 regional drill-ready targets associated with copper-rich skarns along more than 35 kilometres of the contact between the Cretaceous Whitehorse Plutonic Suite and the older metasedimentary rocks of the Lewes River Group. This contact area is considered highly prospective but underexplored for further high grade copper +/- molybdenum +/- silver +/- gold mineralization.

The Whitehorse Copper Project encompasses the multiple past-producing skarn-hosted copper-gold deposits that occur along the deep-seated intrusive contact between the Whitehorse Plutonic Suite and Lewes River Group sediments. Gladiator is fully funded to continue its extensive drill programs and systematic exploration activities aimed at developing resources and expanding the known scope of copper-gold mineralization across its significant Whitehorse land package.

Highlights from the results are as follows:

- Gladiator plans to complete 10,000 metres of diamond drilling within the area, initially targeting Middle Chief, where a recent collation of historic data identified prospective unmined zones of mineralization, including:

- LCU-009: 49.83m @ 3.06% Cu from 70.26m

- LCU-017: 54.10m @ 2.05% Cu from 77.42m

- LCU-023: 33.99m @ 2.10% Cu from 148.89m, Incl. 15.24m @ 3.26%Cu

- LCU-503: 32.22m @ 2.11% Cu from 83.91m, Incl. 17.07m @ 3.47% Cu

- LCU-543: 13.72m @ 1.28% Cu from 66.14m and 41.15m @ 2.22% Cu from 87.48m

- LCU-610: 50.99m @ 1.87% Cu from 18.11m, Incl. 39.84m @ 2.19% Cu from 23.16m

- Drilling is planned to test:

- High grade copper skarn mineralization at Middle Chief that remains open in all directions. Unmined historic resources were established, and drilling completed just prior to the closure of the Little Chief mine in 1982, due to the prevailing low copper prices at the time.

- Compiled historical drilling data is limited to selective sampling and assaying for copper only. Gladiator intends to assay all future drilling and sampling for additional credits including Molybdenum, Silver and Gold which were proven contributors to the economics of historic operations.

| LCU-003: 53.56m @ 1.23% Cu from 88.54m LCU-009: 49.83m @ 3.06% Cu from 70.26m LCU-013 23.01m @ 2.07% Cu from 87.78m LCU-017: 54.10m @ 2.05% Cu from 77.42m LCU-023: 33.99m @ 2.10% Cu from 148.89m, Incl. 15.24m @ 3.26%Cu from 167.64m LCU-151: 32.92m @ 2.08% Cu from 86.87m LCU-371: 9.30m @ 4.73% Cu from 0m LCU-500: 22.52m @ 2.23% Cu from 79.86m LCU-503: 32.22m @ 2.11% Cu from 83.91m, LCU-528: 30.85m @ 1.68% Cu from 18.68m, LCU-542: 28.04m @ 1.84% Cu from 91.14m, |

LCU-543: 13.72m @ 1.28% Cu from 66.14m and 41.15m @ 2.22% Cu from 87.48m

LCU-550: 37.49m @ 1.90% Cu from 74.68m LCU-551: 24.9m @ 2.27% Cu from 93.97m LCU-571: 11.06m @ 3.79% Cu from 89.37m LCU-578; 30.17m @ 1.97% Cu from 31.09m LCU-580: 24.14m @ 1.86% Cu from 45.96m, LCU-604: 26.21m @ 1.86% Cu from 16.46m LCU-610: 50.99m @ 1.87% Cu from 18.11m, LCU-614: 38.22m @ 1.39% Cu from 10.24m, LCU-616: 37.79m @ 1.55% Cu from 21.34m, |

- CPG-017:

- 26m @ 1.49% Cu & 368 ppm Mo from 98m including 15m @ 2.36% Cu & 421ppm Mo from 104m and 4m @ 7.75% Cu & 686 ppm Mo from 110m.

- CPG-023:

- 13m @ 2.06% Cu and 1071 ppm Mo from 38m and

- 8m @ 1.05% Cu 513 ppm Mo from 79 m

- CPG-011D1:

- 58m @ 0.74% Cu & 1,245 ppm Mo from 81m, Including:

- 8m @ 1.65% Cu, 1,905 ppm Mo from 87m

- 12m @ 1.12% Cu & 605ppm Mo from 105m

- CPG-015:

- 17m @ 0.91% Cu from 42m, Incl. 3m @ 1.71 % Cu from 42m, 7m @ 1.45% Cu from 52m & 2m @ 3.77% Cu from 55m

- 31m @ 0.58% Cu, 642ppm Mo from 80m and

- 10m @ 1.23% Cu & 319ppm Mo from 204m

- CPG-016:

- 58m @ 0.62%Cu from 57m, Incl. 7m @ 1.99 % Cu & 867 ppm Mo from 78m

- CPG-019: 20m @ 0.82% Cu from 96m including 4m @ 2.62% Cu from 96m

- CPG-020D1: 47.2m @ 0.67% Cu from 132m

- CPG-026: 16m @ 1.06% Cu, 0.15ppm Au, 15.6 ppm Ag, and 487 ppm Mo from 106m

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.