Marimaca Copper (TSX:MARI) has announced assay results for gold and silver from drill hole MAD-22 at the Marimaca Copper project. The results outlined the first phase of follow-up drilling of the exciting new sulphide target identified in drill hold MAD-22, originally intersecting 120m at 1.7% CuT including 92m at 2.11% CuT. These results are the first anomalous precious metal content encountered at the Marimaca Project.

The Marimaca project is located in the Antofagasta region of northern Chile, a well-known copper mining district. Marimaca Copper. holds a 100% interest in the project. The recent drilling at the Marimaca project has been focused on exploring the potential for new sulfide mineralization. Sulfide deposits are typically higher grade than oxide deposits and can be economically attractive for mining. The discovery of a new sulfide target in MAD-22 was a significant development, and the follow-up drilling was designed to better understand the nature of this mineralization.

The assays from MAD-22 have shown that the sulfide mineralization is associated with significant gold and silver mineralization. This is the first time that anomalous precious metal content has been encountered at the Marimaca project. The results from MAD-22 also show that the gold and silver mineralization is associated with the deeper sulfide mineralization, which is consistent with other sulfide deposits in the region.

The results from MAD-22 are encouraging for Marimaca Copper Corp. and demonstrate the potential for the discovery of additional high-grade sulfide mineralization at the Marimaca project. The company plans to continue drilling to further explore the sulfide target identified in MAD-22 and to test other targets in the project area.

In addition to the sulfide targets, Marimaca Copper Corp. is also continuing to explore the oxide mineralization at the Marimaca project.

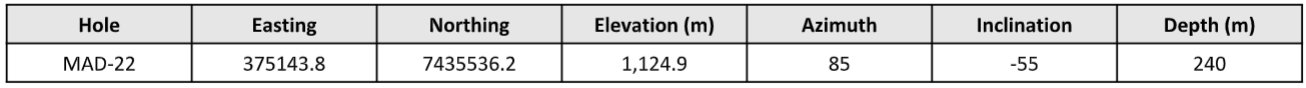

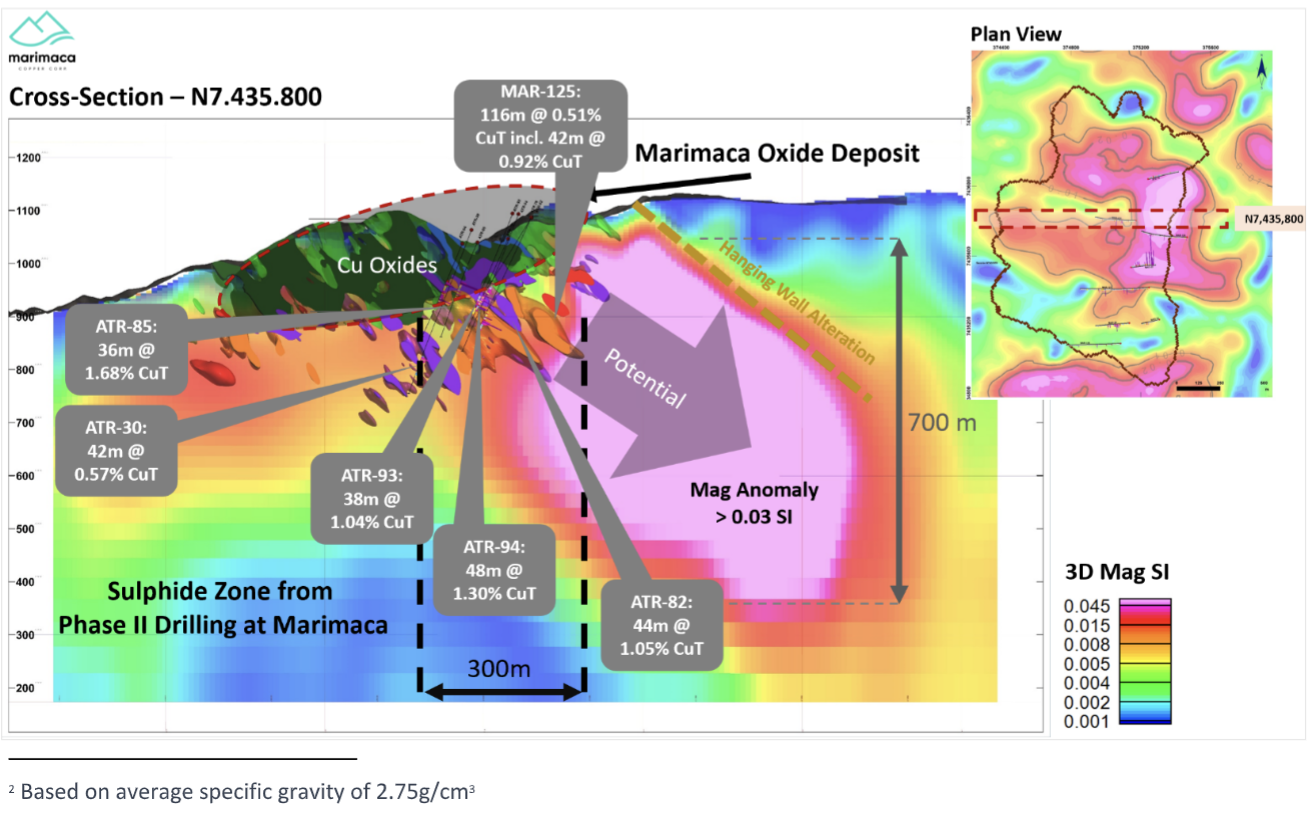

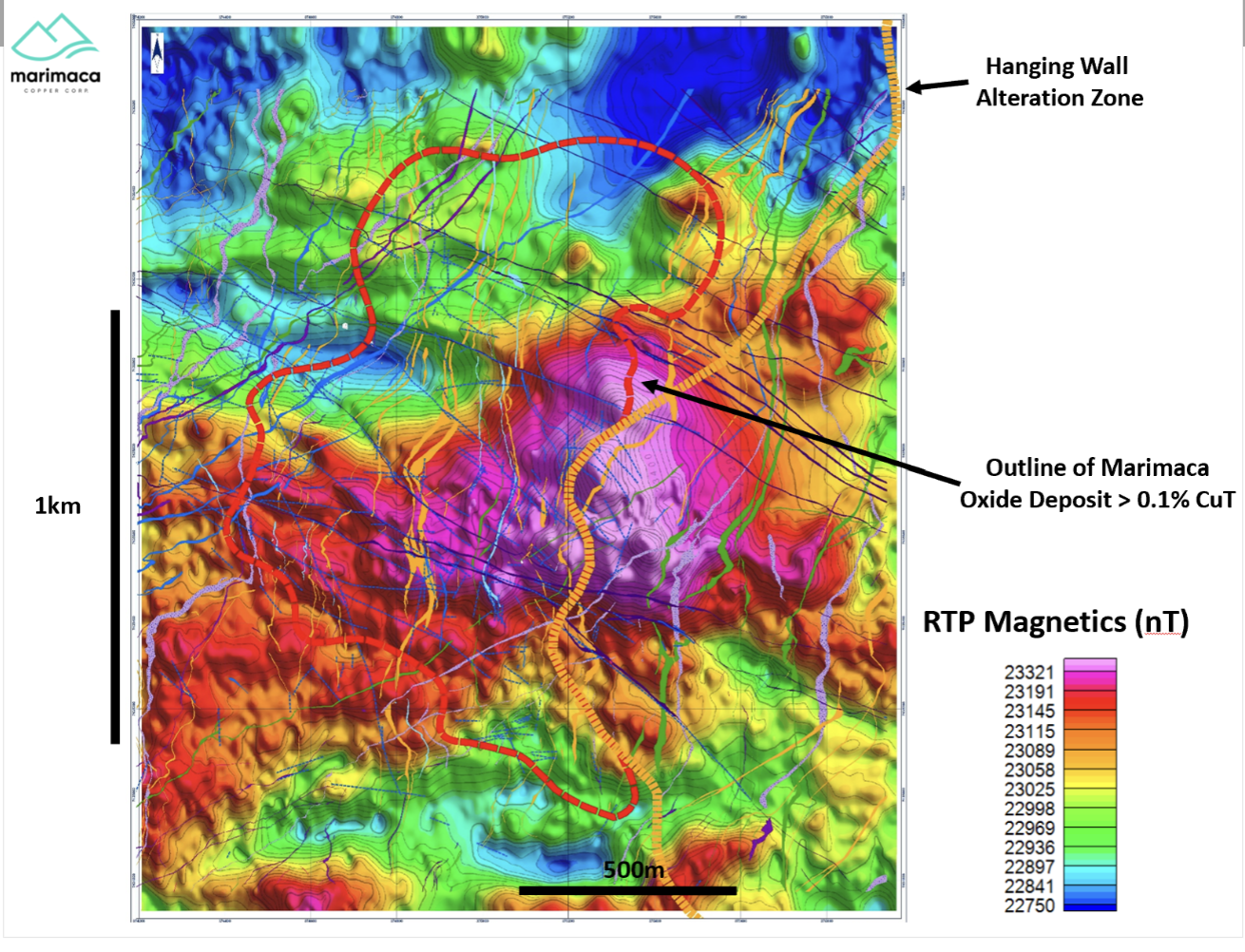

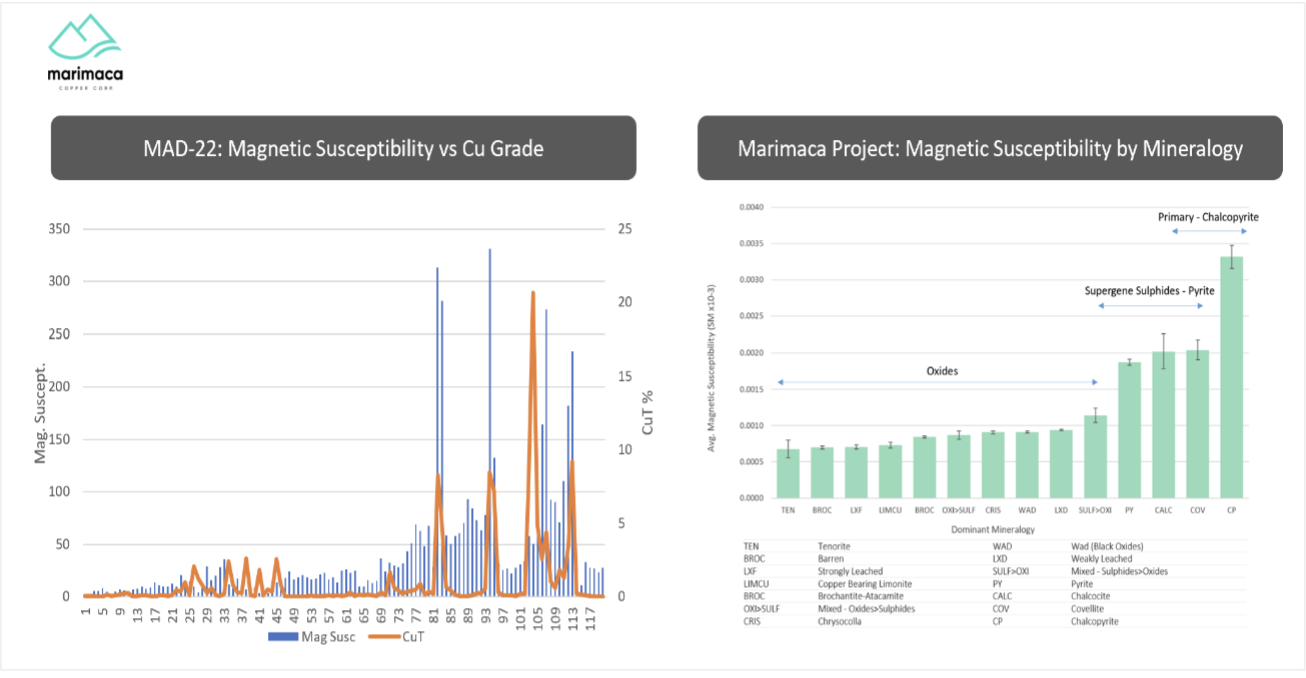

Sergio Rivera, VP Exploration of Marimaca Copper, commented in a press release: “MAD-22 was a spectacular drill hole in terms of grade, continuity and the shallow nature of mineralization, and provided us with valuable information with respect to potential sulphide feeder zones for the Project. As we have noted in previous releases, there is a strong correlation between magnetic anomalism and the presence of primary copper mineralization. MAD-22 once again strongly confirmed the relationship. It has also been noted that outcropping zones with higher prevalence of magnetite, in veins and stringers, could be a good surface vector for future exploration targeting Marimaca-style IOCG (Iron Oxide Copper Gold) deposits.

“In 2020, we completed high resolution magnetic work and developed a 3D model which highlights a large-scale magnetic anomaly, which we estimate to be over 175 million 3 meters in volume, or approximately 475 million 2 tonnes of high magnetic susceptibility rock mass. MAD-22 was drilled into the southern extent of this anomaly, which extends over strike of approximately 1.0km and to a depth of around 800m below surface.

“The result of MAD-22 is an exciting confirmation of our view that there is significant sulphide potential below the MOD. We have mobilized a rig to complete an initial follow up program to test the immediate 300m to 500m of strike around MAD-22. Based on the results we achieve we will then plan an expanded programme.”

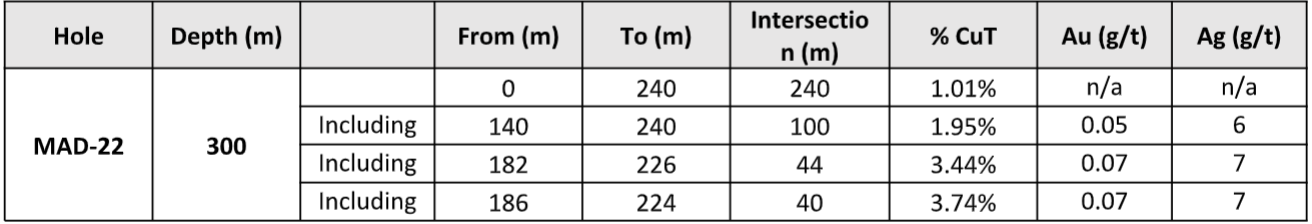

Highlights from the results are as follows:

Table 1. Summary of Anomalous Precious Metal Intervals

Table 2. Drill Collars and Survey

- First anomalous gold and silver identified at Marimaca coincident with higher grades of primary copper mineralization in MAD-22

- 100m of anomalous gold (majority >0.02g/t) and silver (majority >1g/t) from 140m

- 40m with an average grade of 3.74% CuT and 0.07g/t Au and 7g/t Ag from 186m

- Represents 40m with an average grade of 3.84% CuEq 1 from 186m

- MAD-22 intersected over 240m of continuous mineralization from surface with a high grade primary mineral zone at depth including:

- Reconfirms strong association of high-grade chalcopyrite with high magnetic susceptibility

- Encountered massive chalcopyrite over an interval of 92m with an average copper grade of 2.11% CuT from 140m

- Located immediately adjacent to the eastern wall of the whittle pit limits for the October 2022 MRE, indicating potential for high grade, open pit-able mineralization

- Indications are that mineralization relates to a second, later stage, mineralizing event when compared to the broader

Marimaca Oxide Project

- Large scale magnetic anomaly previously identified believed to be prospective for mineralization similar to the primary

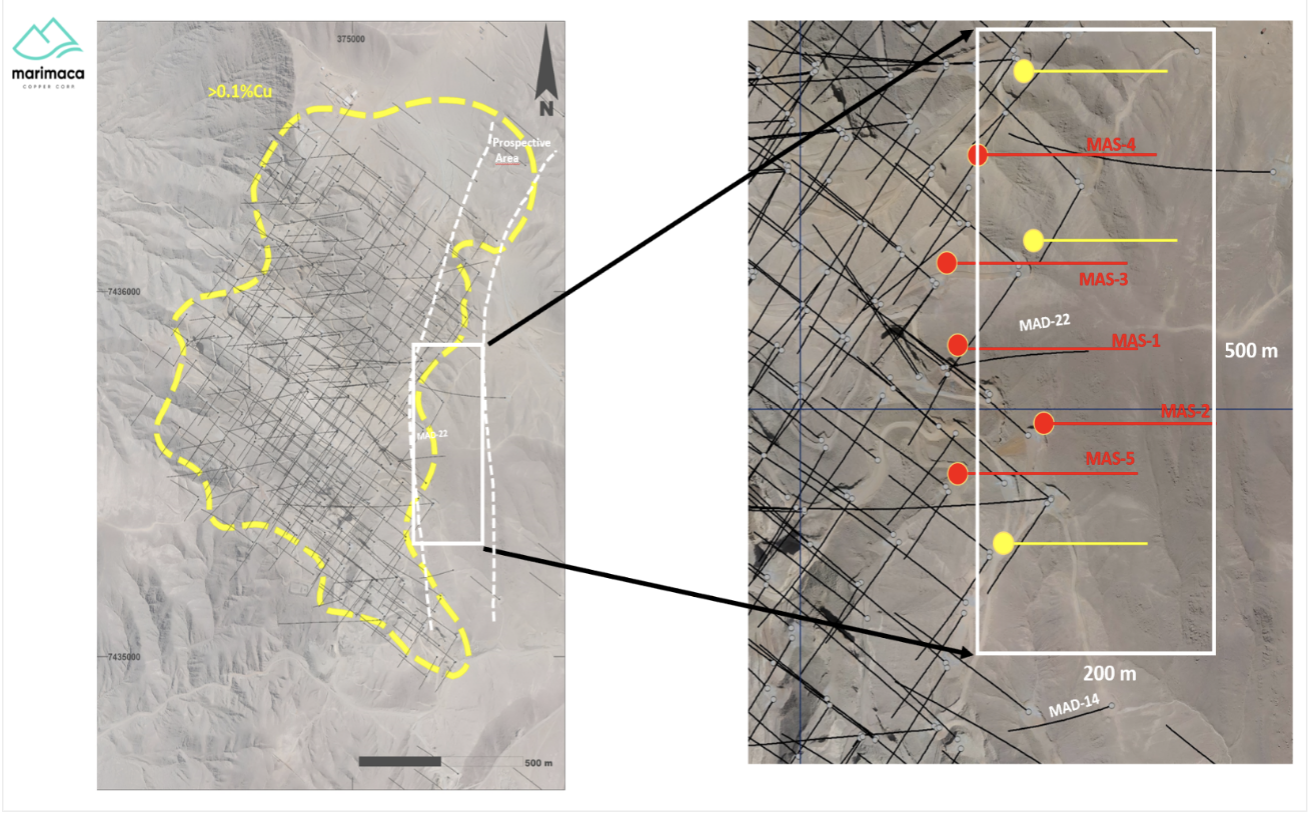

zone in MAD-22 - Five-hole diamond drilling program planned, and rig mobilised, to follow up results of MAD-22:

- 50m to 100m step outs from MAD-22

- First phase tests approximately 300m of strike potential around MAD-22 with a target width of up to 300m

- Drilling will test deeper extensions below the limit of drill hole MAD-22, which terminated in mineralization

- Second phase of up to five holes based on results of first phase increase tested strike length to 500m+

- Fully funded to test the exciting sulphide target

Figure 5: Relationship of Magnetic Susceptibility and Drilling Across the Project. Source: Marimaca Copper

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.