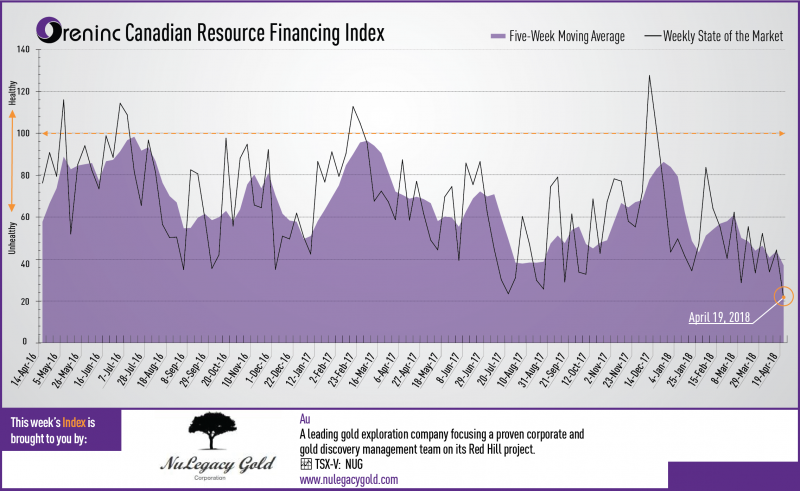

Last week index score: 44.24 (updated)

This week: 21.62

Prospero Silver (TSX-V: PSL) announced a non-brokered private placement to raise up to C$1.0 million through the issuance of up to 11.1 million units @ C$0.09.

The Oreninc Mining Deal Club sent out its sixth financing alert to its subscribers. Sign up today to get the details and an opportunity to participate: www.miningdealclub.com

The Oreninc Index halved in the week ending April 20th, 2018 to 21.62 from an updated 44.24 a week ago as broker action evaporated (again).

US tariffs and sanctions against steel and aluminium imports, particularly from Russia, are ripping through various metal markets with aluminium and nickel prices spiking. Aluminium prices have spiked 30% since the start of April to a seven-year high due to sanctions against Rusal. Fears that supplies of steel-additive nickel could come into Trump’s crosshairs if more sanctions against Russian businesses and businessmen are rolled out has seen its price spike on the London Metals Exchange, recording its highest one-day move since 2008 and hitting three-year highs.

On to the money: total fund raises announced tumbled to a paltry C$22.6 million, a six-week low, which included no brokered financings and no bought deal financings. The average offer size dropped to a barely visible C$1.1 million, a six-week low. The few financings announced and bringing with them a general return to the full warrant to attract interest.

Another week of failed expectations for gold as strong performance throughout the week fell at the end as the US dollar index strengthened following news that US initial weekly jobless claims dropped to 232,000, its lowest level in three weeks according to the Labor Department.

Gold closed down at US$1,336/oz from US$1,346/oz a week with a mid-week high of US$1,349/oz. Gold is now up 2.58% this year. Meanwhile, the US dollar index had a stronger week and closed up at 90.31 from 89.80 a week ago. The van Eck managed GDXJ saw early week gains dissipate at the close to finish the week exactly where it started at US$33.49 despite a mid-week high of US$34.06 last week. The index is down 1.88% so far in 2018. The US Global Go Gold ETF also saw strong growth but gave up less as the week ended to close up at US$13.04 from US$12.81 a week ago with a mid-week high of US$13.11. It is up 0.23% so far in 2018. The HUI Arca Gold BUGS Index closed down at 184.18 from 184.43 last week. The SPDR GLD ETF saw a week of consolidation as its inventory remains at 865.89 tonnes.

In other commodities, silver put in a growth spurt and despite losing some shine at the end of the week closed up at US$17.11/oz from US$16.65/oz a week ago wit ha mid-week high of US$17.24/oz. Coppers price growth continues and closed up at US$3.15/lb from US$3.07/lb from US$3.05/lb last week. Oil continues to post gains to close up at US$68.40 a barrel from US$67.39 a barrel a week ago. This puts its price back to levels levels last seen in December 2014. Despite US president Donald Trump saying the oil price is getting too high, it looks set to go higher as OPEC and Russia look to maintain supply restraint, even though surplus oil has largely been worked out of the system.

The Dow Jones Industrial Average closed up at 24,462 from 24,360 last week with a mid-week high of 24,786. Likewise, Canada’s S&P/TSX Composite Index grew to 15,484 from 15,273 the previous week. The S&P/TSX Venture Composite Index also closed up at 804.96 from 795.94 last week.

Summary:

- Number of financings decreased to 20, a two-week low.

- No brokered financings were announced this week, a two-week low.

- No bought-deal financing was announced this week, a two-week low.

- Total dollars tumbled to C$22.6m, a six-week low.

- Average offer size also fell to C$1.1m, a six-week low.

Financing Highlights

EnGold Mines (TSX-V: EGM) opened a C$3.5 million offering on best efforts basis.

- 10.0 million flow-through units @ C$0.30 and 2.0 million non-flow-through units @ C$0.26 with Canaccord Genuity as agent.

- Each flow-through unit consists of one share and one warrant exercisable @ C$0.40 for two years. Each common unit consists of one share and one warrant exercisable @ C$0.35 for two years.

- Over-allotment option of up 1.5 million flow-through units and 300k common units on the same terms.

- Gross proceeds will be used to continue exploration at the Lac La Hache copper, gold & silver property in the Cariboo region of BC, Canada.

Major Financing Openings:

- Engold Mines (TSX-V: EGM) opened a C$7.04 million offering on a best efforts basis. Each unit includes a warrant that expires in 24 months. The deal is expected to close on or about May 14th.

- Vela Minerals (TSX-V: VLA) opened a C$2.5 million offering on a best efforts basis.

- Renaissance Gold (TSX-V: REN) opened a C$2.5 million offering on a best efforts basis. Each unit includes a warrant that expires in 60 months.

- Coronet Metals (TSX-V: CRF) opened a C$2.02 million offering on a best efforts basis. Each unit includes a warrant that expires in 24 months.

Major Financing Closings:

- North American Nickel (TSX-V: NAN) closed a C$15 million offering on a best efforts basis. Each unit included half a warrant that expires in 24 months.

- Sama Resources (TSX-V: SME) closed a C$5.25 million offering on a strategic deal basis. Each unit included a warrant that expires in 24 months.

- Rise Gold (CSE: RISE) closed a C$3.52 million offering on a best efforts basis. Each unit included a warrant that expires in 36 months.

- Toachi Mining (TSX-V: TIM) closed a C$3 million offering on a best efforts basis.

Company News

Prospero Silver (TSX-V: PSL) announced a non-brokered private placement to raise up to C$1.0 million through the issuance of up to 11.1 million units @ C$0.09.

- Each unit will consist of one share and half of a warrant exercisable @ C$0.16 for two years.

- The net proceeds will be used for general working capital purposes, its generative exploration programs and exploration expenditures on its property portfolio in Mexico.

- Looking to drill 6,000m in 2018.

Analysis

With the initial phase of its strategic arrangement with Fortuna Silver drawing to a close, and 2018 exploration planning underway, Prospero is raising cash to be able to contribute to funding ongoing and future exploration work under the arrangement. However, given the current low stock price, it is evident that the company is also looking to minimize shareholder dilution by undertaking a minimum raise. 2018 work will look to continue to validate Prospero’s exploration strategy to discover blind epithermal systems.

About Oreinc.com:

Oreninc.com is North America’s leading provider of relevant financing information in the junior commodities space. Since 2011, the company has been keeping track of financings in the junior mining as well as oil and gas space. Logging all relevant deal and company information into its proprietary database, called the Oreninc Deal Log, Oreninc quickly became the go-to website in the mining financing space for investors, analysts, fund managers and company executives alike.

The Oreninc Deal Log keeps track of over 1,400 companies, bringing transparency to an otherwise impenetrable jungle of information. The goal is to increase the visibility of transactions and to show financings activity in a digestible format. Through its daily logging activities, Oreninc is in a position to pinpoint momentum changes in the markets, identify which commodities are trending and which projects are currently receiving funding.

Website: www.oreninc.com

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.