Reunion Gold (TSXV:RGD) has announced additional positive drill results from its Oko West gold project in Guyana. The latest results come from both resource expansion drilling below the existing deposit and infill drilling within areas of inferred resources.

Rick Howes, President and CEO of Reunion Gold, commented in a press release: “I am very pleased with the results of both the resource conversion and the resource expansion drill programs, which together continue to confirm the strong levels of continuity within the open pit resource as well as the expansion of high-grade mineralization below the previously defined MRE pit shell, down to depth of 1,000 m where it remains open. This also confirms that we have significant underground potential below what is already very significant open pit potential. Once the open pit resource model is updated and the new underground resource model is complete, both the open pit and underground mine design scenarios will be evaluated as part of the Preliminary Economic Assessment (“PEA”) work already underway with G Mining Services. This work will also determine the transition depth from the open pit to underground as well as the preferred sequencing of the open pit and underground mine. We expect to release the PEA before the end of June 2024. Permitting also continues on schedule with baseline studies nearing completion and Terms of Reference for the Environmental Impact Assessment submitted to the Guyana Environmental Protection Agency for approval.”

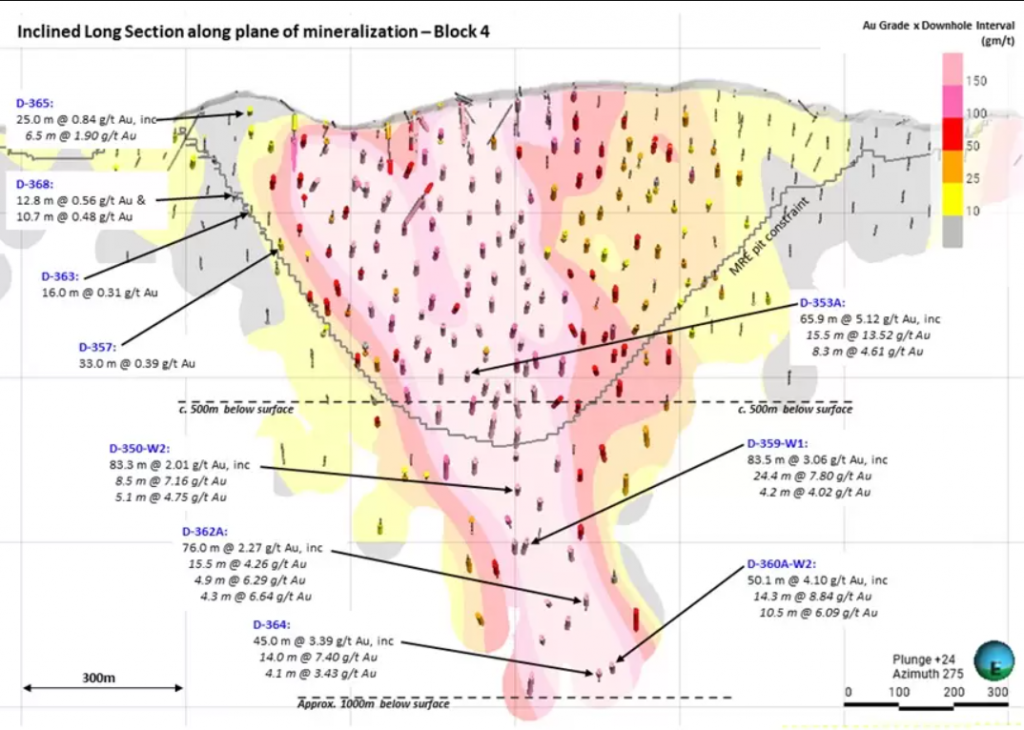

The expansion drilling continues to confirm high-grade gold mineralization within Block 4 of the Kairuni zone, extending over 1,000 meters down-dip beyond the limits of the June 2023 mineral resource estimate (MRE) pit shell. Highlights include 14.3 meters at 8.84 g/t gold and 10.5 meters at 6.09 g/t gold within 50.1 meters at 4.10 g/t gold in hole D-360A-W2 from 1039.8 meters depth. Hole D-359-W1 intersected 24.4 meters at 7.80 g/t gold and 4.2 meters at 4.02 g/t gold within 83.5 meters at 3.06 g/t gold from 721.5 meters depth. Hole D-362A intersected 15.5 meters at 4.26 g/t gold, 4.9 meters at 6.29 g/t gold and 4.3 meters at 6.64 g/t gold within 76.0 meters at 2.27 g/t gold from 991.0 meters depth. The high-grade zone remains open at depth below 1,000 meters.

Approximately 23,500 meters of drilling below the June 2023 MRE pit will be incorporated into an updated resource estimate. Reunion Gold has also commenced a 20,000-meter infill drill program targeting deeper mineralization to upgrade resources to an indicated classification before starting a feasibility study in Q3 2024.

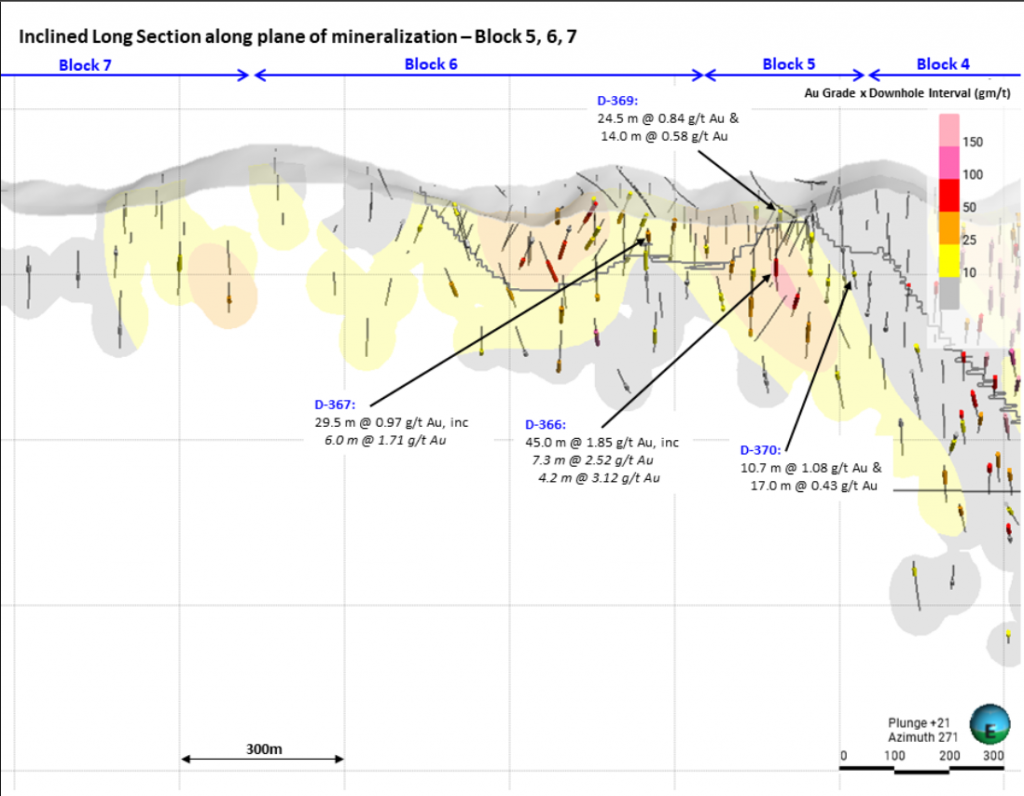

The infill drilling program continues to confirm continuity of mineralization and higher grades at depth within the existing MRE pit shell. Highlights include 65.9 meters at 5.12 g/t gold in hole D-353A, including 15.5 meters at 13.52 g/t gold and 8.3 meters at 4.61 g/t gold. Hole D-366 intersected 45.0 meters at 1.85 g/t gold, including 7.3 meters at 2.52 g/t gold and 4.2 meters at 3.12 g/t gold.

The updated MRE will include an open pit and an initial underground resource estimate. It will feed into a preliminary economic assessment expected by the end of June 2024.

Exploration drilling outside the MRE area has yielded several zones of anomalous gold, providing targets for further drilling. Geophysical surveys are also underway to identify additional targets across the Oko West project area. Reunion Gold plans to acquire and explore new projects in Guyana and Suriname to build its portfolio in the Guiana Shield region.

- Highlights from the resource expansion drill program, which intersected the down-dip continuation of high grade mineralization from Block 4 down to and below 1,000 meters (“m”) depth include hole D-360A-W2, which intersected 14.3 m @ 8.84 grams per tonne of gold (”g/t Au”) and 10.5 m @ 6.09 g/t, drill hole D-359-W1 which intersected 24.4 m @ 7.80 g/t Au, drill hole D-364, which intersected 14.0 m @ 7.40 g/t Au, and drill hole D-362A, which intersected 15.5 m @ 4.26 g/t Au, 4.9 m @ 6.29 g/t Au and 4.3 m @ 6.64 g/t Au (all reported using a 1.5 g/t cut-off grade).

- The high-grade zone remains fully open to further expansion below 1 km.

- The Company has now closed and handed over an updated database to G Mining Services for the preparation of an updated MRE expected to be announced by the end of February 2024.

Table 1 – Significant intervals reported from deep drilling beneath Block 4

| Hole ID | From (m) |

To (m) |

Downhole Interval (m) |

Au Grade (g/t) |

Grade x Downhole Interval (gm/t) |

ETT* (m) |

Cutoff ** (Au g/t) |

| OKWD23-350-W2 | 713.0 | 796.3 | 83.3 | 2.01 | 167 | 75.7 | 0.3 |

| inc. | 725.9 | 731.0 | 5.1 | 4.75 | 24 | 4.7 | 1.5 |

| inc. | 763.0 | 769.7 | 6.6 | 2.75 | 18 | 6.0 | 1.5 |

| inc. | 773.2 | 778.7 | 5.5 | 2.69 | 15 | 5.0 | 1.5 |

| inc. | 781.1 | 789.6 | 8.5 | 7.16 | 61 | 7.7 | 1.5 |

| OKWD23-359-W1 | 721.5 | 805.0 | 83.5 | 3.06 | 255 | 64.3 | 0.3 |

| inc. | 722.5 | 726.0 | 3.5 | 2.88 | 10 | 2.7 | 1.5 |

| inc. | 743.9 | 748.1 | 4.2 | 4.02 | 17 | 3.2 | 1.5 |

| inc. | 760.7 | 785.0 | 24.4 | 7.80 | 190 | 18.8 | 1.5 |

| OKWD23-360A-W2 | 1039.8 | 1089.8 | 50.1 | 4.10 | 205 | 44.9 | 0.3 |

| inc. | 1051.2 | 1061.7 | 10.5 | 6.09 | 64 | 9.4 | 1.5 |

| inc. | 1064.1 | 1078.3 | 14.3 | 8.84 | 126 | 12.8 | 1.5 |

| OKWD23-362A | 991.0 | 1067.0 | 76.0 | 2.27 | 172 | 68.0 | 0.3 |

| inc. | 991.0 | 994.0 | 3.0 | 1.82 | 5 | 2.7 | 1.5 |

| inc. | 1005.7 | 1010.0 | 4.3 | 6.64 | 29 | 3.8 | 1.5 |

| inc. | 1036.6 | 1041.5 | 4.9 | 6.29 | 31 | 4.4 | 1.5 |

| inc. | 1046.5 | 1062.0 | 15.5 | 4.26 | 66 | 13.9 | 1.5 |

| OKWD23-364 | 977.6 | 1022.6 | 45.0 | 3.39 | 152 | 37.1 | 0.3 |

| inc. | 897.3 | 903.0 | 5.7 | 1.90 | 11 | 4.6 | 1.5 |

| inc. | 981.4 | 985.5 | 4.1 | 3.43 | 14 | 3.4 | 1.5 |

| inc. | 999.0 | 1013.0 | 14.0 | 7.40 | 104 | 11.6 | 1.5 |

| * Estimated True Thickness (“ETT”) based on an average dip / dip direction of -65° / 095° to represent the orientation of the mineralized zone in Block 4. ETT only calculated for Blocks 1 and 4. | |||||||

| ** Significant intervals calculated using a 0.3 g/t Au cutoff, 10m minimum length and 10m maximum consecutive internal waste. Included intervals calculated using a 1.5 g/t Au cutoff, 3m minimum length and a 2m maximum consecutive internal waste. | |||||||

Table 2 – Significant Intervals reported from the MRE infill program.

| Hole ID | From (m) |

To (m) |

Downhole Interval (m) |

Au Grade (g/t) |

Grade x Downhole Interval (gm/t) |

ETT* (m) |

Cutoff ** (Au g/t) |

| OKWD23-353A | 487.0 | 491.0 | 4.0 | 2.03 | 8 | 3.6 | 1.5 |

| OKWD23-353A | 509.0 | 574.9 | 65.9 | 5.12 | 337 | 59.6 | 0.3 |

| inc. | 509.0 | 512.3 | 3.3 | 2.34 | 8 | 3.0 | 1.5 |

| inc. | 541.8 | 550.0 | 8.3 | 4.61 | 38 | 7.5 | 1.5 |

| inc. | 554.0 | 569.5 | 15.5 | 13.52 | 209 | 14.0 | 1.5 |

| OKWD23-365 | 18.0 | 43.0 | 25.0 | 0.84 | 21 | 22.9 | 0.3 |

| inc. | 35.0 | 41.5 | 6.5 | 1.90 | 12 | 6.0 | 1.5 |

| OKWD23-368 | 190.3 | 203.1 | 12.8 | 0.56 | 7 | 11.4 | 0.3 |

| OKWD23-368 | 272.3 | 283.0 | 10.7 | 0.48 | 5 | 9.8 | 0.3 |

| * Estimated True Thickness (“ETT”) based on an average dip / dip direction of -65° / 095° to represent the orientation of the mineralized zone in Block 4. ETT only calculated for Blocks 1 and 4. | |||||||

| ** Significant intervals calculated using a 0.3 g/t Au cutoff, 10m minimum length and 10m maximum consecutive internal waste. Included intervals calculated using a 1.5 g/t Au cutoff, 3m minimum length and a 2m maximum consecutive internal waste. | |||||||

Table 3 – Significant Intervals reported from Blocks 5 and 6.

| Hole ID | From (m) |

To (m) |

Downhole Interval (m) |

Au Grade (g/t) |

Grade x Downhole Interval (gm/t) |

Cutoff ** (Au g/t) |

| OKWD23-366 | 0.6 | 13.1 | 12.5 | 0.48 | 6 | 0.3 |

| OKWD23-366 | 81.0 | 126.0 | 45.0 | 1.85 | 83 | 0.3 |

| inc. | 107.1 | 114.4 | 7.3 | 2.52 | 18 | 1.5 |

| inc. | 117.6 | 121.7 | 4.2 | 3.12 | 13 | 1.5 |

| OKWD23-367 | 31.5 | 61.0 | 29.5 | 0.97 | 29 | 0.3 |

| inc. | 39.8 | 45.7 | 6.0 | 1.71 | 10 | 1.5 |

| OKWD23-369 | 0.0 | 24.5 | 24.5 | 0.84 | 21 | 0.3 |

| OKWD23-369 | 106.0 | 120.0 | 14.0 | 0.58 | 8 | 0.3 |

| OKWD24-370 | 92.0 | 109.0 | 17.0 | 0.43 | 7 | 0.3 |

| OKWD24-370 | 161.2 | 171.9 | 10.7 | 1.08 | 12 | 0.3 |

| inc. | 21.6 | 25.5 | 3.9 | 2.74 | 11 | 1.5 |

| OKWD23-356 | 190.0 | 202.0 | 12.0 | 1.56 | 19 | 0.3 |

| ** Significant intervals calculated using a 0.3 g/t Au cutoff, 10m minimum length and 10m maximum consecutive internal waste. Included intervals calculated using a 1.5 g/t Au cutoff, 3m minimum length and a 2m maximum consecutive internal waste. | ||||||

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.