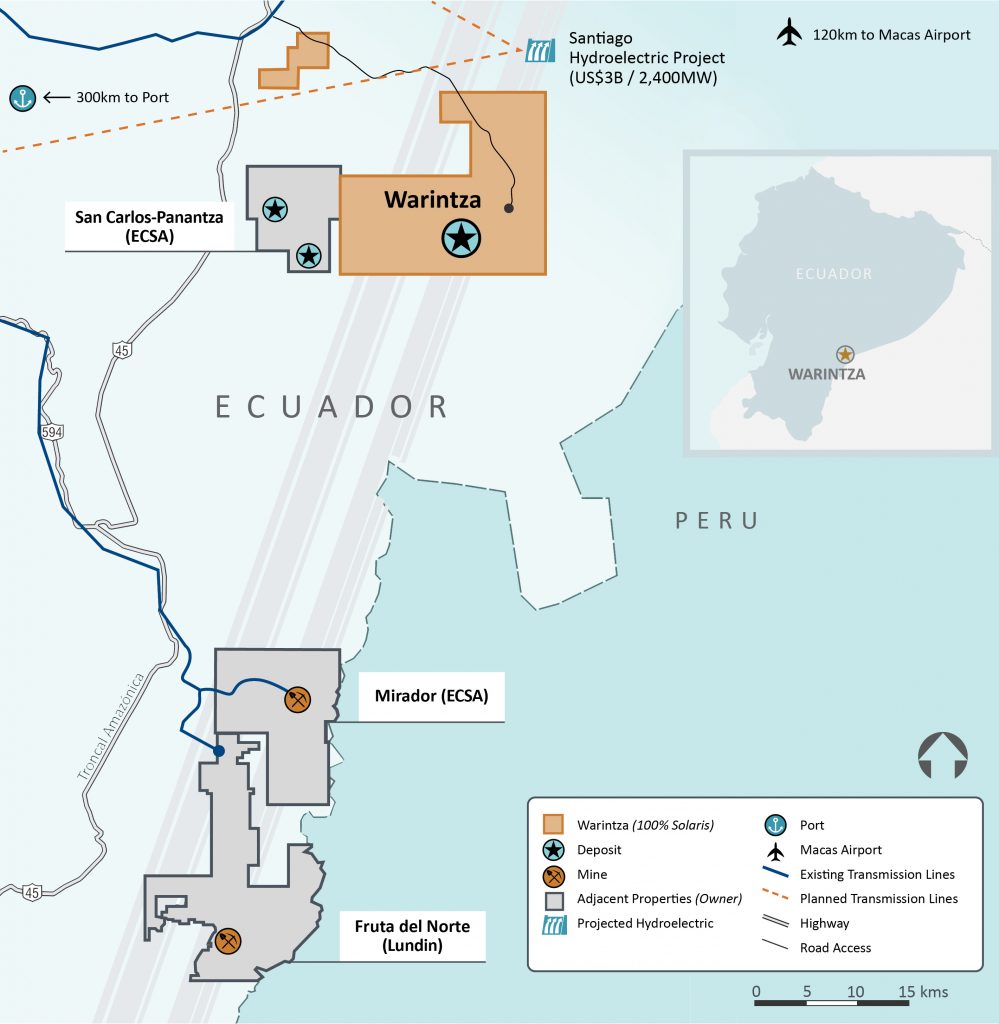

Solaris Resources (TSX:SLS) is preparing for a significant update to its mineral resource estimate for its flagship Warintza Project in southeastern Ecuador. The announcement, made in early January, comes in the middle of an ongoing drilling program and broader developments aimed at advancing the project towards potential development. What’s next for the project, and what are investors waiting for in 2024?

Mineral Resource Estimate Update in Sight

Investors and stakeholders are now waiting for the updated mineral resource estimate, expected in late Q2 2024. This revision will leverage nearly double the drilling data compared to the previous estimate, potentially leading to substantial growth in resource size and grade. The focus areas include Warintza Central, East, and Southeast, where drilling has targeted resource expansion and infill drilling.

A key aspect of the update is the incorporation of a “common pit shell,” which considers the economic viability of extracting all resources within a defined open pit. This approach provides a more realistic picture of the potentially mineable portion of the deposit and is will be critical for future development planning.

Active Drilling Campaign

Solaris is currently executing an ambitious drilling program for 2024, utilizing six drill rigs. This program serves a dual purpose:

- Resource expansion and infill drilling: This component directly supports the upcoming mineral resource estimate update by gathering additional data to refine geological understanding and resource definition.

- Exploration beyond the current resource: Drilling extends outwards from known zones, targeting areas with promising indications of copper mineralization. This proactive approach aims to identify new zones that could contribute to further resource growth in the future.

Beyond Warintza Central, exploration efforts are ongoing in other prospective areas within the project’s broader footprint. These regional activities add another layer to the ongoing exploration story at Warintza.

NYSE American Listing and Financial Backing Signal Confidence

In another significant development, Solaris announced plans to list its common shares on the NYSE American stock exchange. This move is expected to broaden the company’s investor base, particularly attracting interest from the U.S. market.

Financially, Solaris secured funding for its 2024 and 2025 exploration and development programs, ensuring continued momentum at Warintza. This financial backing highlights the company’s commitment to advancing the project and realizing its full potential.

The company’s progress at the Warintza Project received a significant boost in January 2024 with a strategic investment of $130 million from Zijin Mining Group Co., Ltd., a major Chinese mining company. This financing agreement provides crucial capital for ongoing exploration and development activities and represents a strong vote of confidence in the project’s potential.

Under the terms of the deal, Zijin acquired approximately 28.5 million common shares of Solaris at a subscription price of $4.55 per share, representing a 14% premium to the market price at the time. This translates to an ownership stake of roughly 15% for Zijin, granting them a seat on the Solaris board of directors.

The importance of this financing is threefold:

- Financial Security: The $130 million injection directly supports the company’s ambitious plans for 2024 and 2025, including the ongoing drilling program, resource estimation update, and potential future studies. This financial security allows Solaris to focus on advancing the project without immediate funding concerns.

- Strategic Partnership: Zijin’s expertise in developing large-scale copper projects offers valuable insights and potential collaboration opportunities for Solaris. This partnership could prove crucial in navigating the complexities of future development stages.

- Market Validation: The significant investment from a major player like Zijin serves as a strong validation of Warintza’s potential. This positive endorsement could attract further interest from investors and stakeholders, broadening the project’s support base.

Overall, the Zijin financing deal represents a critical milestone for Solaris and the Warintza Project and secures the necessary resources for continued progress.

The Warintza Project also holds the potential to bring significant benefits to Ecuador. Responsible development post-exploration could create many more jobs, stimulate the local economy, and generate tax revenue for the government. Solaris has continued to emphasize its commitment to operating in a sustainable and responsible manner, minimizing environmental impact and engaging with local communities.

Looking Ahead: Milestones and Continued Progress Expectations

The release of the updated mineral resource estimate in late Q2 2024 stands as a major milestone for the Warintza Project. This event will provide valuable insights into the project’s size, grade, and economic potential. Depending on the results, further studies such as preliminary economic assessments or feasibility studies could follow, outlining a potential path towards development.

Solaris remains focused on advancing the Warintza Project through ongoing exploration, resource definition, and potential future development activities. With a significant update on the horizon, active drilling underway, and a secured financial position, the world is watching for the next news update.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.