Solaris Resources (TSX:SLS) announced this morning its assay results from a set of additional holes from ongoing resource growth and discovery drilling programs at the Warintza Project in southeastern Ecuador.

Vice President, Exploration Mr. Jorge Fierro, commented: “We are pleased to see the continued growth of the Warintza Central zone, with every hole drilled having hit significant mineralization and the dimensions of the zone open and growing to the east, and broadening to the north and south where additional assays are expected soon. Our drilling fleet has now been fully reoriented to pursue aggressive growth and discovery drilling over the balance of the year and into 2022.”

The highlights from the project are as follows:

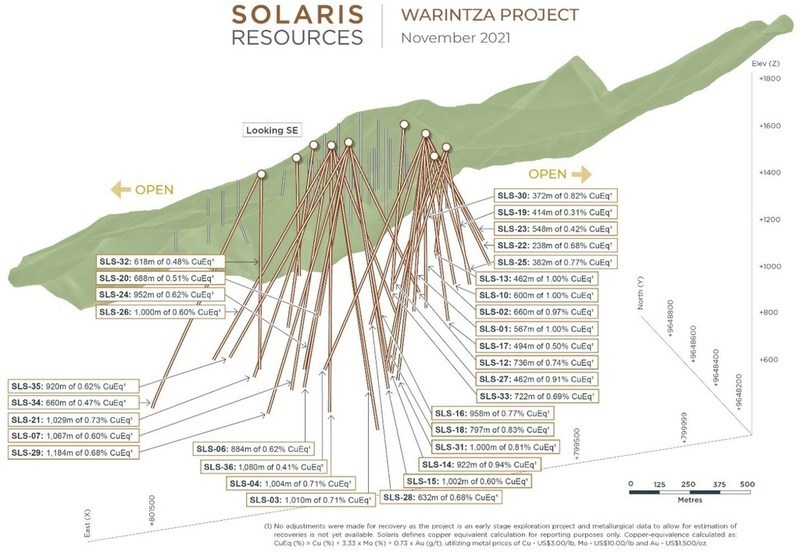

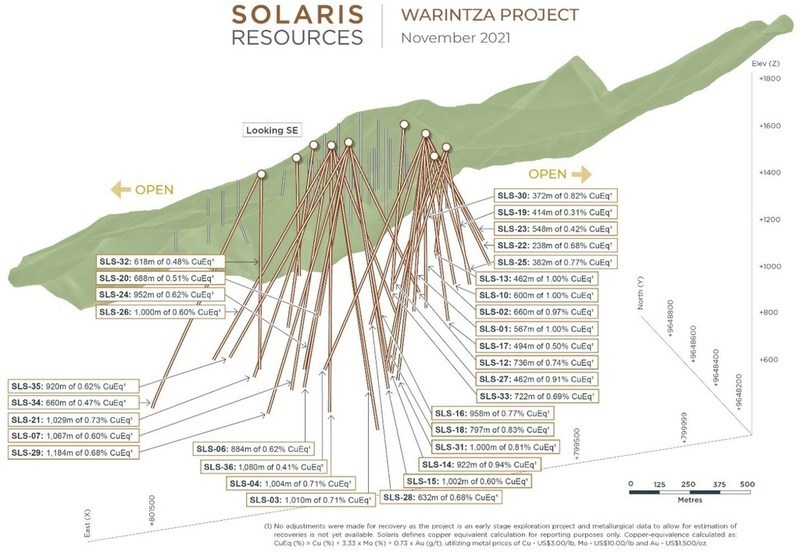

- Two additional holes reported in this press release have extended the dimensions of Warintza Central zone to the south and east, with the highest-grade intervals in each hole starting at or near surface

- Southern extension drilling in SLS-36 together with northern step-out drilling previously reported on October 12 in SLS-32, which returned 618m of 0.48% CuEq¹ from surface, including 372m of 0.64% CuEq¹ from 46m depth, have widened the Warintza Central zone

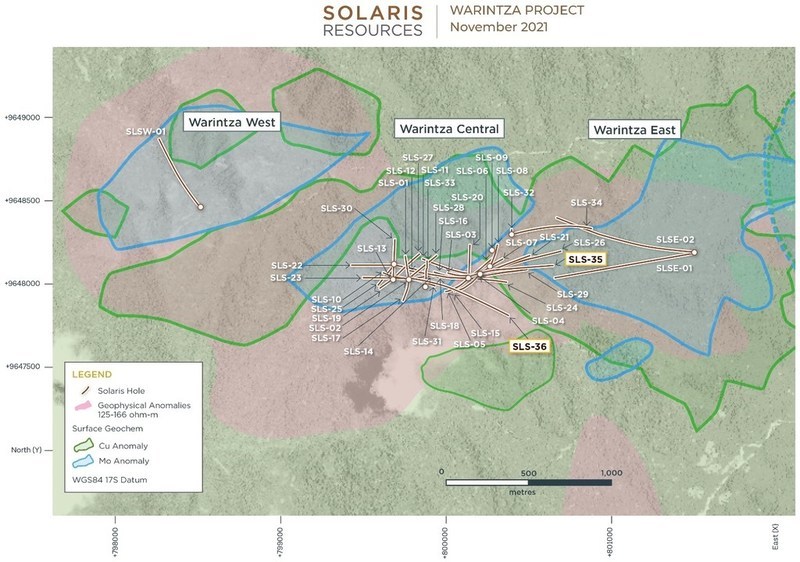

- SLS-35 was collared at the southeastern limit of the Warintza Central grid and drilled into a partially open volume to the east, returning 920m of 0.62% CuEq¹, including 326m of 0.80% CuEq¹ from 50m depth, extending mineralization to the east where it partially overlaps Warintza East

- SLS-36 was collared in the middle of the Warintza Central grid and drilled into an open volume to the southeast, returning 1,080m of 0.41% CuEq¹ from surface, including 290m of 0.81% CuEq¹ from 46m depth, extending mineralization by at least 200m to the south where it remains open

- To date, 50 holes have been completed at Warintza Central with assays reported for 36 of these

Source: Solaris Resources

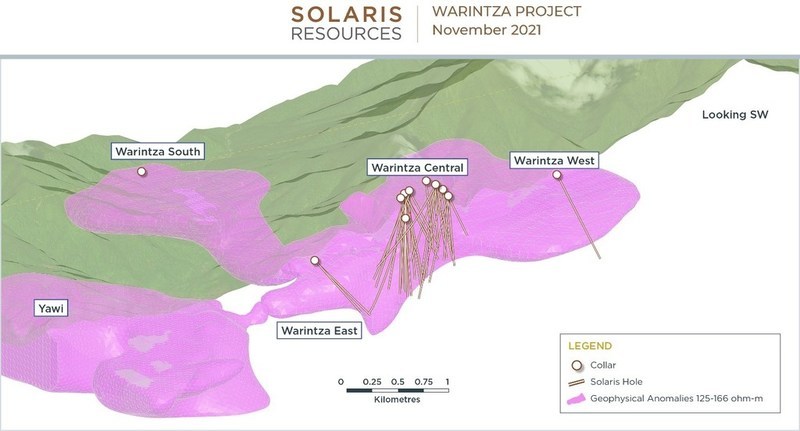

Future drilling will be focused on extensional and step-out drilling. This includes establishing the potential link to the Warintza East zone, discovery drilling at the other well-defined targets within the 7km x 5km Warintza cluster of copper porphyries, and focusing on the untested gold potential.

Drilling Continues in Harmonious Alliance

A strategic alliance was made between Solaris and the Shuar communities of Warints and Yawi in 2019 to overlook and engage in direct and transparent dialogue regarding all Warintza Project-related activities. This alliance allows the people of the community to build and promote trust, reciprocal support, cooperation and strengthen the decision-making capacity of the community. It allows them to have a voice in their community when direct change is taking place.

The company states the mandate will include but not be limited to positive results including employment, business development opportunities, appropriate health care, and emergency care services, development of community infrastructure, and education and skills training.

The Warintza Project is situated in southeastern Ecuador, in the same belt as the Fruta del Norte and Mirador mines, adjacent to San Carlos – Panantza copper deposits. Solaris Resources also has four other current gold and copper projects, including La Verde in Mexico in which Solaris has earned a 60% interest via JV with Teck Resources.

There is also the Tamarugo in Chile which is an undrilled, grassroots copper porphyry exploration target in the Chilean copper belt, and the Capricho Paco Orco in Peru which is a Grassroots exploration project. The final project is Ricardo in Chile, it is a brownfield copper porphyry exploration project immediately contiguous and on the same structure as Chuquicamata, one of the largest copper mines in Chile.

Table 1 – Assay Results

|

Hole ID |

Date Reported |

From (m) |

To (m) |

Interval (m) |

Cu (%) |

Mo (%) |

Au (g/t) |

CuEq¹ (%) |

||

|

SLS-36 |

Nov 15, 2021 |

2 |

1082 |

1080 |

0.33 |

0.01 |

0.04 |

0.41 |

||

|

Including |

46 |

336 |

290 |

0.67 |

0.03 |

0.08 |

0.81 |

|||

|

SLS-35 |

48 |

968 |

920 |

0.53 |

0.02 |

0.04 |

0.62 |

|||

|

Including |

50 |

376 |

326 |

0.69 |

0.02 |

0.05 |

0.80 |

|||

|

SLS-34 |

Oct 25, 2021 |

52 |

712 |

660 |

0.36 |

0.02 |

0.06 |

0.47 |

||

|

SLS-33 |

40 |

762 |

722 |

0.55 |

0.03 |

0.05 |

0.69 |

|||

|

SLSE-02 |

0 |

1160 |

1160 |

0.20 |

0.01 |

0.04 |

0.25 |

|||

|

SLS-32 |

Oct 12, 2021 |

0 |

618 |

618 |

0.38 |

0.02 |

0.05 |

0.48 |

||

|

SLS-31 |

8 |

1008 |

1000 |

0.68 |

0.02 |

0.07 |

0.81 |

|||

|

SLS-30 |

2 |

374 |

372 |

0.57 |

0.06 |

0.06 |

0.82 |

|||

|

SLSE-01 |

Sep 27, 2021 |

0 |

1213 |

1213 |

0.21 |

0.01 |

0.03 |

0.28 |

||

|

SLS-29 |

Sep 7, 2021 |

6 |

1190 |

1184 |

0.58 |

0.02 |

0.05 |

0.68 |

||

|

SLS-28 |

6 |

638 |

632 |

0.51 |

0.04 |

0.06 |

0.68 |

|||

|

SLS-27 |

22 |

484 |

462 |

0.70 |

0.04 |

0.08 |

0.91 |

|||

|

SLS-26 |

July 7, 2021 |

2 |

1002 |

1000 |

0.51 |

0.02 |

0.04 |

0.60 |

||

|

SLS-25 |

62 |

444 |

382 |

0.62 |

0.03 |

0.08 |

0.77 |

|||

|

SLS-24 |

10 |

962 |

952 |

0.53 |

0.02 |

0.04 |

0.62 |

|||

|

SLS-19 |

6 |

420 |

414 |

0.21 |

0.01 |

0.06 |

0.31 |

|||

|

SLS-23 |

May 26, 2021 |

10 |

558 |

548 |

0.31 |

0.02 |

0.06 |

0.42 |

||

|

SLS-22 |

86 |

324 |

238 |

0.52 |

0.03 |

0.06 |

0.68 |

|||

|

SLS-21 |

2 |

1031 |

1029 |

0.63 |

0.02 |

0.04 |

0.73 |

|||

|

SLS-20 |

April 19, 2021 |

18 |

706 |

688 |

0.35 |

0.04 |

0.05 |

0.51 |

||

|

SLS-18 |

78 |

875 |

797 |

0.62 |

0.05 |

0.06 |

0.83 |

|||

|

SLS-17 |

12 |

506 |

494 |

0.39 |

0.02 |

0.06 |

0.50 |

|||

|

SLS-16 |

Mar 22, 2021 |

20 |

978 |

958 |

0.63 |

0.03 |

0.06 |

0.77 |

||

|

SLS-15 |

2 |

1231 |

1229 |

0.48 |

0.01 |

0.04 |

0.56 |

|||

|

SLS-14 |

0 |

922 |

922 |

0.79 |

0.03 |

0.08 |

0.94 |

|||

|

SLS-13 |

Feb 22, 2021 |

6 |

468 |

462 |

0.80 |

0.04 |

0.09 |

1.00 |

||

|

SLS-12 |

22 |

758 |

736 |

0.59 |

0.03 |

0.07 |

0.74 |

|||

|

SLS-11 |

6 |

694 |

688 |

0.39 |

0.04 |

0.05 |

0.57 |

|||

|

SLS-10 |

2 |

602 |

600 |

0.83 |

0.02 |

0.12 |

1.00 |

|||

|

SLS-09 |

122 |

220 |

98 |

0.60 |

0.02 |

0.04 |

0.71 |

|||

|

SLS-08 |

Jan 14, 2021 |

134 |

588 |

454 |

0.51 |

0.03 |

0.03 |

0.62 |

||

|

SLS-07 |

0 |

1067 |

1067 |

0.49 |

0.02 |

0.04 |

0.60 |

|||

|

SLS-06 |

Nov 23, 2020 |

8 |

892 |

884 |

0.50 |

0.03 |

0.04 |

0.62 |

||

|

SLS-05 |

18 |

936 |

918 |

0.43 |

0.01 |

0.04 |

0.50 |

|||

|

SLS-04 |

0 |

1004 |

1004 |

0.59 |

0.03 |

0.05 |

0.71 |

|||

|

SLS-03 |

Sep 28, 2020 |

4 |

1014 |

1010 |

0.59 |

0.02 |

0.10 |

0.71 |

||

|

SLS-02 |

0 |

660 |

660 |

0.79 |

0.03 |

0.10 |

0.97 |

|||

|

SLS-01 |

Aug 10, 2020 |

1 |

568 |

567 |

0.80 |

0.04 |

0.10 |

1.00 |

||

|

Notes to table: True widths cannot be determined at this time. |

||||||||||

Table 2 – Collar Location

|

Hole ID |

Easting |

Northing |

Elevation (m) |

Depth (m) |

Azimuth (degrees) |

Dip (degrees) |

|

SLS-36 |

799765 |

9648033 |

1571 |

1088 |

97 |

-60 |

|

SLS-35 |

800124 |

9648044 |

1568 |

995 |

78 |

-60 |

|

Notes to table: The coordinates are in WGS84 17S Datum. |

||||||

|

(1) No adjustments were made for recovery as the project is an early-stage exploration project and metallurgical data to allow for estimation of recoveries is not yet available. Solaris defines copper equivalent calculation for reporting purposes only. Copper-equivalence calculated as: CuEq (%) = Cu (%) + 3.33 × Mo (%) + 0.73 × Au (g/t), utilizing metal prices of Cu – US$3.00/lb, Mo – US$10.00/lb and Au – US$1,500/oz. |

Figure 1 – Long Section of Warintza Central Drilling Looking Southeast

Figure 2 – Plan View of Warintza Drilling Released to Date

Figure 3 – Long Section of 3D Geophysics Looking Southwest

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.