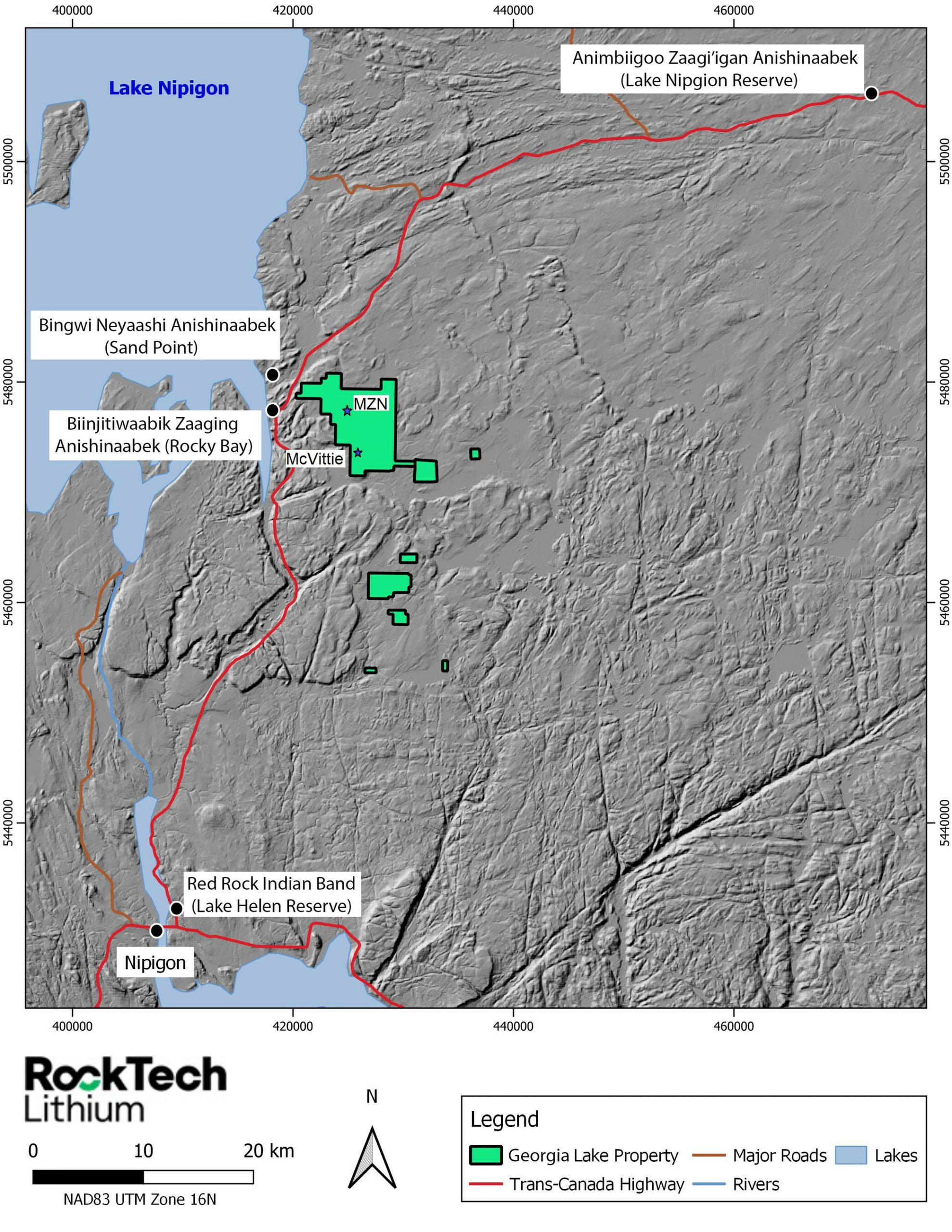

Rock Tech Lithium (TSXV:RCK) has announced that the first diamond drill rig for the first phase of its 2023 exploration drill campaign has been mobilized at the 100%-owned Georgia Lake Lithium project in the Thunder Bay Mining District, Ontario. The aim of the program is to increase the total mineral resources at the project between 2023 and 2024. Phase I will include the mobilization of a drill rig for the 3,500-metre program, with targeted drilling aimed at expanding the existing Spodumene mineralization at the Main Zone North (MZN) and McVittie Deposits.

MZN contains the largest Mineral Resource in the Georgia Lake Pegmatite Field, and it currently remains open along strike to the east. Drilling will aim to extend the Spodumene mineralization along strike to the east of MZN. Step-out drilling south of the MZN deposit will focus on extending mineralization where Rock Tech has already identified new mineralization throughout the course of the 2022 drilling program.

McVittie is comprised of three spodumene dikes; these have been mapped for a strike length of more than 600m. Inferred Resource at the deposit is 1Mt at 1.0% Li2O and is open at depth and along strike in both directions. Rock Tech also reported a Mineral Resource Estimate at the Georgia Lake Prefeasbility Study, outlining 10,60 million tonnes of Indicated Mineral Resource at a grade of 0.88% Li2O and 4.22 mt of Inferred Mineral Resource at a grade of 1.0% Li2O limited to eight deposits in the Northern and Southern Spodumene Pegmatite Areas.

Dirk Harbecke, Rock Tech’s Chief Executive, commented in a press release: “It is our aim for 2023 to unlock the exploration potential of our Georgia Lake Project by advancing our drilling and prospecting activities across the land package. We are pleased to be able to initiate a drill program which we believe will grow our MZN and McVittie deposits as the first phase of our 2023 exploration campaign. I expect that our exploration program will lead to a sizeable increase of our Resource over the next year.”

TABLE 1 | Overview of the Mineral Resource as of 2022’s Prefeasibility Study

2022 MINERAL RESOURCE

| Classification | Mining | Cut-off grade Li2O (%) | Zone | Tonnes | Li2O (%) |

| Indicated | Open pit | 0.3 | NSPA OP Indicated | 4,242,618 | 0.88 |

| Indicated | Underground | 0.6 | NSPA UG Indicated | 6,358,650 | 0.89 |

| Total Indicated | 10,601,268 | 0.88 | |||

| Inferred | Open pit | 0.3 | NSPA OP Inferred | 245,933 | 0.78 |

| Inferred | Underground | 0.6 | NSPA UG Inferred | 2,073,069 | 0.91 |

| Inferred | Underground | 0.6 | SSPA UG Inferred | 1,903,274 | 1.12 |

| Total Inferred | 4,222,276 | 1.00 |

| Notes: |

| a. CIM Definition Standards (2014) were used for reporting the Mineral Resources. |

| b. The Qualified Person is Dinara Nussipakynova, P.Geo. of AMC. |

| c. Cut-off grade for open pit Mineral Resources is 0.30% Li2O. |

| d. Open pit Mineral Resources are constrained by the optimization pits shell at a lithium concentrate price of USD 1,100/t with metallurgical recovery of 80% and concentrate grade of 6%. Both cut off use same parameters. |

| e. The pit optimization was based on following cost assumptions: |

| i. Mill feed mining costs of USD 4.5/t and waste mining cost of USD 4.5/t. |

| ii. Processing costs of USD 25/t and General and Administration costs of USD 15/t. |

| iii. Slope angle 45-48 degrees. |

| f. Cut-off grade for underground Mineral Resources is 0.60% Li2O based on a USD 45/t mining cost and processing and G&A the same as the open pit. |

| g. Underground Mineral Resources are not constrained. |

| h. Mineralized Density used as 2.69 t/m3. |

| i. Waste Density used as 2.75 t/m3. |

| j. Drilling results up to 31 July 2022. |

| k. The numbers may not compute exactly due to rounding. |

| j. Numbers may not compute exactly due to rounding. |

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Lithium production is full-steam ahead this year, and companies like Rock Tech Lithium (TSXV:RCK) want to dominate. The company’s mission from the start has been to source raw material in Canada at its 100% owned Georgia Lake spodumene project in Ontario, Canada.

The company is developing the project while advancing plans in Germany for a battery-metals plant near the sites of key suppliers and customers. Those customers include Elon Musk’s TEsla Inc. and BASF SE.

This strategic location was also chosen due to its proximity to Gruenhide, which is the site of Tesla’s plant. The electric vehicle automaker is planning to start producing vehicles at the plant this year, but has not received approval for the project yet. The plant will be built in Brandenburg, a German state outside Berlin, and the same state that Tesla is completing its vehicle factory – its first in Europe.

To fund the battery-metals plants, Rock Tech may be preparing a Nasdaq listing. The company requires approximately $545 million to finance the new project and may require an equity raise next year.

Rock Tech is backed by billionaire venture capitalist Peter Thiel. The German-American entrepreneur believes that Germany will have a leading role to play as Europe and the US transition to electric vehicles in the coming years. The company is betting on hundreds of thousands of cars being put into production.

The plant could begin operating as soon as 2024. This will mark Europe’s first lithium converter, with a production capacity of 24,000 tonnes per year. That means the plant would be able to supply lithium-ion batteries for approximately 500,000 cars according to Rock Tech.

Rock Tech Lithium is already listed on the Toronto and Frankfurt exchanges, and the new listing would broaden its investor accessibility in the U.S. It could provide the financing needed for the project and more as it plans to expand.

The company’s mission has always focused on lithium. While it is developing a mining project in Canada, Rock Tech (TSXV:RCK) is positioning itself as a converted-lithium processor and supplier. This would make it a partner of the electric vehicle industry as well as the mining industry. By controlling extraction and processing, the company can keep costs lower and profits higher.

Rock Tech’s investor list is also impressive, with Peter Thiel holding a significant position, Christian Angermayer and hedge fund billionaire Alan Howard. The company also has retired BMW AG and Deutsche Bank finance head Stefan Krause in a top management position as CFO.

Li-Ion Takes Centre Stage

Lithium-ion batteries have a higher energy density than lead-acid batteries and nickel-metal hydroxide batteries, and it is possible to produce battery sizes smaller than others while maintaining the storage capacity. Li-ion battery cells contain electrodes of metal alloys and carbon-based materials such as graphite and their electrolyte contains lithium ions. Nissan’s lithium-ion battery technology uses materials that enable a higher density of lithium-ion.

Due to their high energy density, lithium batteries weigh less than a NIMH battery of the same capacity. Cheaper and safer battery models use lithium-nickel, manganese and cobalt oxide batteries that have the potential to charge a car in just ten minutes on a charge of up to 250 miles. These batteries are lighter and last much longer than previous battery technologies.

Different battery types differ in terms of the ion type, the electrode material, and the associated electrolyte. The individual batteries consist of a metal cathode of lithium mixed with other elements such as nickel, cobalt, manganese, iron, and graphite, an anode separator, and a liquid electrolyte made of lithium salts. Certain elements, including carbon, graphite metal oxide and lithium salts, form the positive and negative electrodes that connect to the electrolyte to generate the electric current that gets the battery going and powers your vehicle.

To power a car, thousands of cells are bundled into a series of modules that are wired to the battery pack and enclosed in a protective metal housing.

Batteries in electric vehicles are characterised by their high power-to-weight ratio and specific energy density (energy density). Small and lighter batteries are therefore desirable because they reduce the weight of the vehicle and improve its performance. Batteries can weigh thousands of pounds, with the F150 Lightning battery alone weighing more than 2,000 pounds. Compared to liquid fuels, most current battery technologies have lower specific energy, which affects the maximum electric range of a vehicle.

These features allow solid-state batteries to be lighter, have a higher energy density, and offer more range when recharged. The most common types of batteries for modern electric vehicles are lithium-ion and lithium-polymer, because they have a higher energy density compared to their weight. Other types of rechargeable batteries used in electric vehicles include lead-acid, flooded, low-cyclic, valve-controlled lead-acid, nickel-cadmium, nickel hydride, zinc-air, sodium-nickel chloride, and zebra batteries. However, companies like Rock Tech and Tesla are betting on a lithium-ion future for EVs.

Beyond Cars

Lithium-ion batteries are used in most portable consumer electronics, such as mobile phones and laptops, because they have high energy per mass unit compared to other electrical storage devices. They have a high power-weight ratio, high energy efficiency, good high-temperature performance, and low self-discharge. A major advantage of using nickel batteries is that they contribute to high energy density, greater storage capacity, and lower costs.

The market for lithium will continue to expand as more elements of the economy require energy storage and lithium-ion batteries. Rock Tech’s mission is primarily to supply the electric vehicle industry but has an open lane to supply other industries and sectors in the future.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

New Age Exploration Limited New Age Exploration Limited |

NAE.AX | +33.33% |

|

CASA.V | +30.00% |

|

VKA.AX | +28.57% |

|

CTO.AX | +25.00% |

|

BSX.TO | +22.22% |

|

ANK.V | +21.74% |

|

SRI.V | +20.00% |

|

NEV.V | +20.00% |

|

IB.V | +18.18% |

|

SLL.V | +16.42% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan