Thesis Gold (TSXV:TAU) has announced assay results from 2023 drilling at the Thesis II and Thesis III zones of its 100% owned Ranch Gold Project, located in the Toodoggone Mining District of northern British Columbia, Canada.

Ewan Webster, President and CEO, commented in a press release: “The 2023 drilling results at Thesis II and Thesis III represent yet another step towards unlocking the full potential of the Ranch Project. Our targeted strategy for the 2023 program focused on furthering our understanding of the high-grade, near-surface potential at Ranch as we progress towards a maiden resource estimate. We view this as a stepping stone in our ongoing efforts to extend the mineralization at Ranch. Today’s notable step-out headline hole of 60.00 m at 4.53 g/t Au strongly suggests that there is still much to be discovered.”

The drilling is part of a strategic plan to support the development of a maiden resource estimate at Ranch – an important milestone ahead of a forthcoming Preliminary Economic Assessment update. Together with the adjacent Lawyers Gold-Silver Project, Ranch forms Thesis Gold’s contiguous 325 km2 land package in the region.

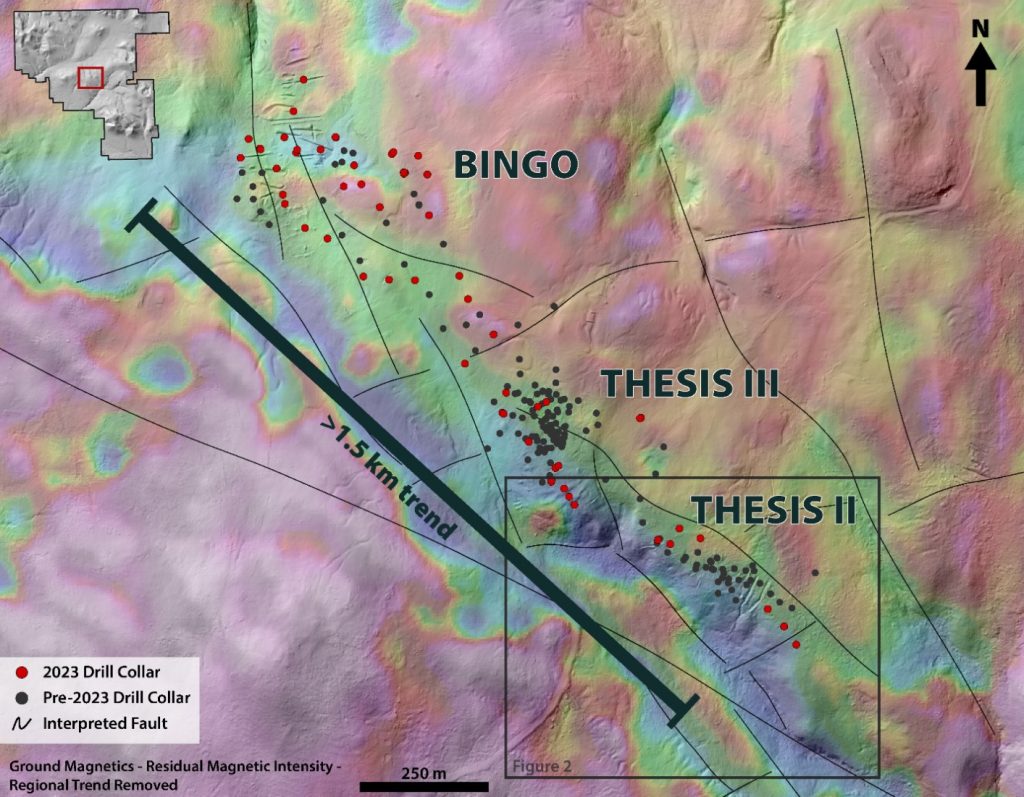

Thesis II and III represent the southern and central zones along the multi-kilometre scale Thesis Structural Corridor, which hosts multiple mineralized domains together with the emerging Bingo zone. On a regional, district and deposit scale, mineralization occurs along intersecting NW-SE and E-W trending faults that have been mapped using magnetic surveys. These regional faults are believed to have acted as conduits for mineralizing fluids in the project’s porphyry and epithermal systems.

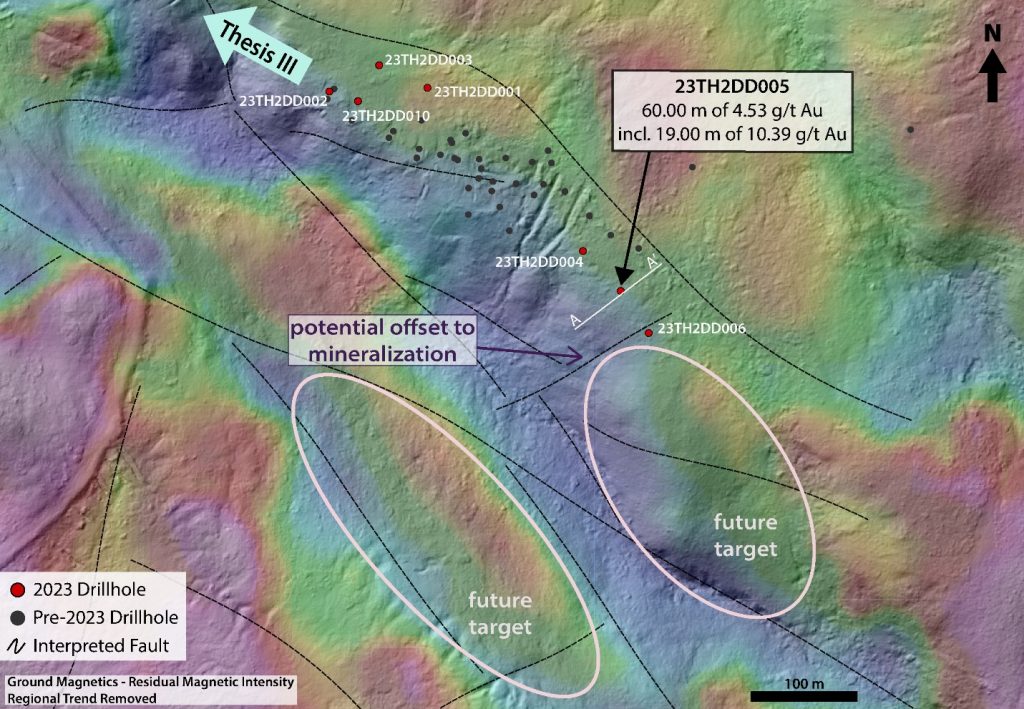

Recent drilling has improved the understanding of how these local faults control the geometry of the gold-mineralized bodies. One exploration hole at the southern end of Thesis II intercepted 60 meters grading 4.53 g/t gold, while a subsequent step-out hole returned only low-grade mineralization. This suggests the NE-oriented structure between the two holes may offset the mineralization to the southwest.

Altered and mineralized rock typically shows a reduced magnetic signature compared to surrounding unaltered host rock. Thesis’ technical team is developing new drill targets along the low-moderate magnetic lineaments that parallel known mineralized trends. Exceptionally broad high-grade intercepts continue to highlight the potential for expansion and new discoveries across the wider Ranch Project over the next year.

Thesis Gold is focused on unlocking the combined potential of the adjoining Lawyers and Ranch projects after its 2022 strategic merger with Benchmark Metals. A recent preliminary economic study outlined plans for a 12-year open pit operation at Lawyers yielding over 160,000 gold-equivalent ounces per year. Integrating the Ranch project aims to improve project economics further. The company’s plans include releasing a combined resource estimate in Q2 2024, followed by an updated preliminary economic assessment in Q3 2024 to showcase the full potential of the projects.

- Drilling at Thesis II was designed to test deeper mineralization identified at the end of the 2022 drilling campaign:

- 23TH2DD005 intersected 60.00 metres (m) of 4.53 grams per tonne gold (g/t Au) beginning 84 m from surface (vertical depth).

- Including 19.00 m of 10.39 g/t Au.

- 23TH2DD005 intersected 60.00 metres (m) of 4.53 grams per tonne gold (g/t Au) beginning 84 m from surface (vertical depth).

- Drilling at Thesis III returned strong near surface mineralization:

- 23TH3DD013 intersected 24.32 m of 2.93 g/t Au beginning at a vertical depth of 32 m.

- 23TH3DD017 intersected 39.90 m of 2.39 g/t Au beginning at vertical depth of 4 m.

- Confirmation and infill drilling from the 2023 season will be incorporated into an upcoming, maiden mineral resource estimate for the Ranch Project scheduled for Q2 2024.

Table 1: 2023 drill results from Thesis II and Thesis III.

| Hole ID | From (m) | To (m) | Interval (m)* | Au (g/t) | |

| 23TH2DD001 | 108.12 | 114.20 | 6.08 | 0.53 | |

| 23TH2DD002 | No Significant Results | ||||

| 23TH2DD003 | No Significant Results | ||||

| 23TH2DD004 | 130.26 | 133.00 | 2.74 | 0.83 | |

| 23TH2DD005 | 31.67 | 33.81 | 2.14 | 0.59 | |

| and | 128.28 | 129.92 | 1.64 | 44.80 | |

| and | 141.00 | 201.00 | 60.00 | 4.53 | |

| incl | 153.00 | 199.80 | 46.80 | 5.61 | |

| incl | 168.00 | 187.00 | 19.00 | 10.39 | |

| incl | 169.00 | 172.00 | 3.00 | 32.84 | |

| incl | 170.00 | 171.00 | 1.00 | 75.60 | |

| incl | 184.00 | 187.00 | 3.00 | 19.09 | |

| incl | 185.00 | 186.00 | 1.00 | 38.30 | |

| 23TH2DD006 | 170.00 | 171.00 | 1.00 | 0.61 | |

| 23TH3DD001 | 11.00 | 24.00 | 13.00 | 1.06 | |

| incl | 21.00 | 24.00 | 3.00 | 2.78 | |

| and | 33.00 | 90.00 | 57.00 | 0.76 | |

| incl | 77.00 | 78.00 | 1.00 | 7.15 | |

| and | 106.00 | 107.00 | 1.00 | 6.79 | |

| 23TH3DD003 | 106.38 | 110.00 | 3.62 | 0.45 | |

| 23TH3DD004 | No Significant Results | ||||

| 23TH3DD005 | 37.00 | 38.28 | 1.28 | 0.72 | |

| 23TH3DD006 | 44.05 | 44.70 | 0.65 | 13.85 | |

| 23TH3DD007 | 9.00 | 16.00 | 7.00 | 3.77 | |

| and | 78.53 | 97.00 | 18.47 | 0.46 | |

| 23TH3DD008 | 6.00 | 14.00 | 8.00 | 1.75 | |

| and | 39.00 | 58.96 | 19.96 | 0.66 | |

| 23TH3DD010 | 16.83 | 31.00 | 14.17 | 0.30 | |

| 23TH3DD011 | No Significant Results | ||||

| 23TH3DD012 | No Significant Results | ||||

| 23TH3DD013 | 2.96 | 5.00 | 2.04 | 0.64 | |

| and | 40.68 | 65.00 | 24.32 | 2.93 | |

| incl | 44.00 | 51.00 | 7.00 | 6.79 | |

| incl | 48.00 | 50.00 | 2.00 | 12.68 | |

| 23TH3DD014 | 119.75 | 121.00 | 1.25 | 1.29 | |

| 23TH3DD015 | 4.00 | 5.00 | 1.00 | 2.30 | |

| and | 21.00 | 33.00 | 12.00 | 0.20 | |

| and | 38.00 | 39.00 | 1.00 | 1.63 | |

| and | 55.00 | 59.00 | 4.00 | 0.47 | |

| 23TH3DD017 | 5.10 | 45.00 | 39.90 | 2.39 | |

| and | 54.08 | 60.00 | 5.92 | 0.67 | |

| 23TH3DD018 | No Significant Results | ||||

| 23TH3DD019 | 124.83 | 133.40 | 8.57 | 0.20 | |

| 23TH3DD020 | No Significant Results | ||||

| 23TH3DD021 | 286.28 | 301.34 | 15.06 | 0.63 | |

| incl | 289.67 | 292.38 | 2.71 | 1.29 | |

| and incl | 298.00 | 300.80 | 2.80 | 1.45 | |

| and | 341.20 | 352.00 | 10.80 | 0.50 | |

| 23TH3DD022 | 280.00 | 285.00 | 5.00 | 0.58 | |

| and | 309.00 | 353.00 | 44.00 | 0.88 | |

| incl | 309.00 | 339.00 | 30.00 | 1.11 | |

| incl | 323.00 | 337.00 | 14.00 | 1.80 | |

| and incl | 346.00 | 353.00 | 7.00 | 0.75 | |

| and | 360.00 | 363.07 | 3.07 | 0.35 | |

*Intervals are core length.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

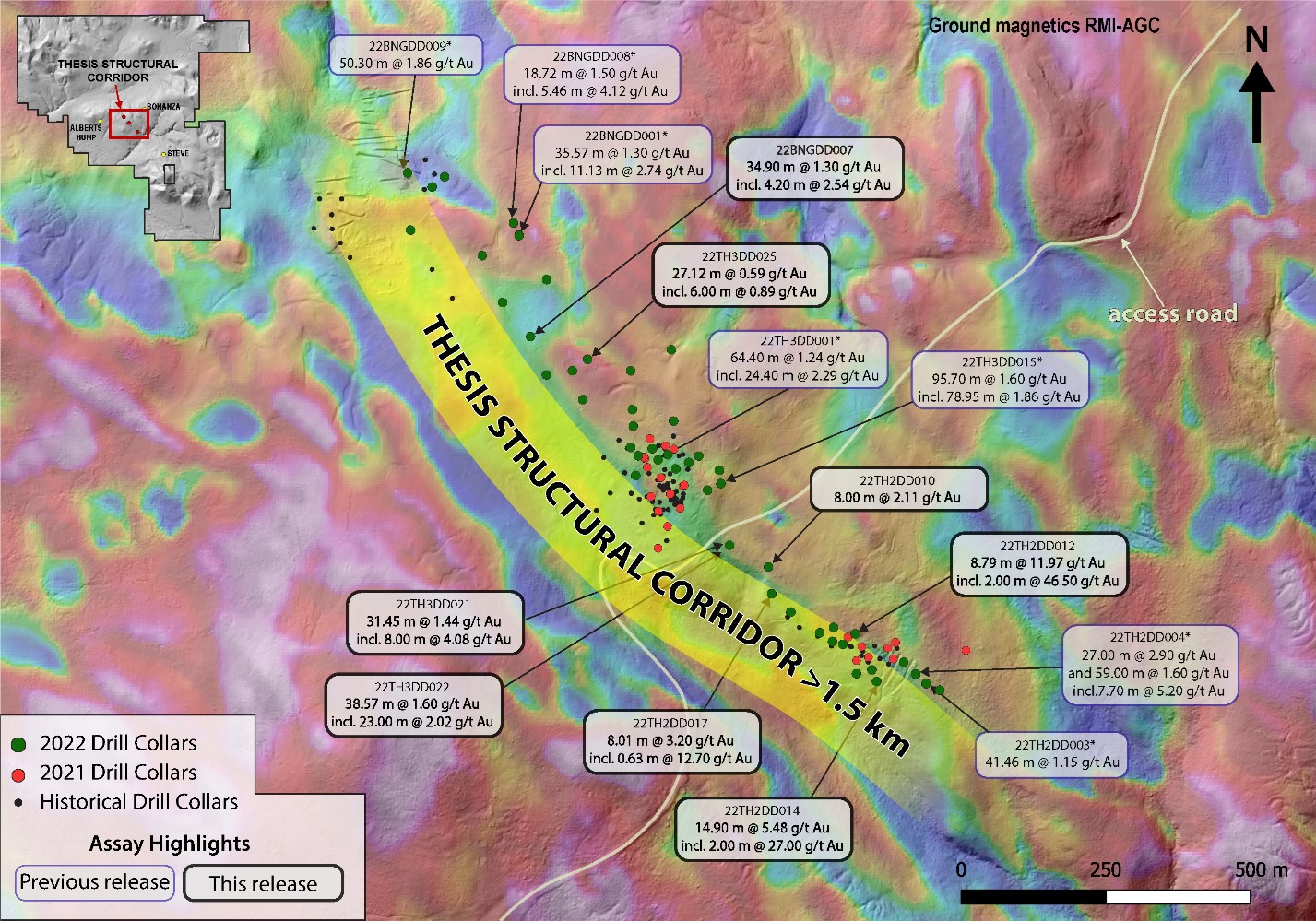

Thesis Gold (TSXV:TAU) has announced the latest assay results from its 2022 summer drill program at the Ranch Gold Project in British Columbia’s Toodoggone mining district. These results have significantly expanded the limits of the Bingo, Thesis III, and Thesis II zones, demonstrating gold mineralization along the more than 1.5-kilometre Thesis Structural Corridor.

Ewan Webster, President and CEO, commented in a press release: “From the outset of our drilling in the Thesis Structural Corridor, we believed that the system was much larger than previously documented. Today’s results continue to demonstrate our initial hypothesis was correct, we are now seeing significant growth come to fruition. The mineralization within the Corridor is showing excellent continuity along the 1.5 km strike extent, and as we continue to expand the mineralized footprint, we are discovering even more promising indications. Our team is currently planning for the 2023 drilling season, and the Thesis Structural Corridor is a primary focus for the upcoming campaign.”

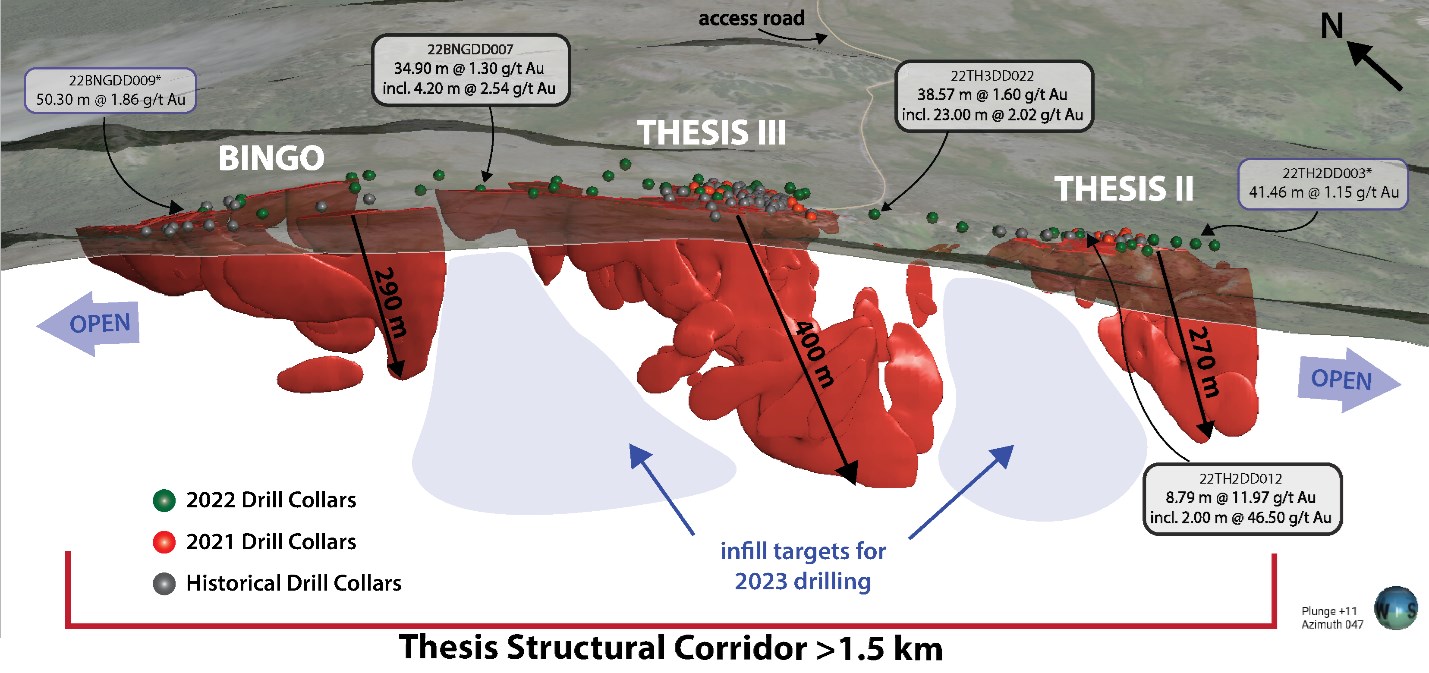

Historically, the Bingo, Thesis III, and Thesis II zones were considered as three separate zones of mineralization. However, drilling by Thesis has shown that they are likely part of a continuous structure that spans over 1.5 km in strike length and continues downdip for at least 400 m. The mineral domain models further support this, indicating that the three zones are interconnected.

The mineralized intercepts from the northern and southern-most extents of the corridor returned significant gold intervals. The northwestern-most drillhole at Bingo returned 50.30 m core length of 1.86 g/t Au, while drilling from the southern Thesis II zone returned 59.00 m core length of 1.60 g/t Au. Additionally, high-grade mineralization within the corridor has returned intervals up to 33.13 m core length of 17.49 g/t Au.

The geophysical expression of the Thesis Structural Corridor is best characterized by a 350-400 m-wide, NW-trending magnetic low that extends for over 4 km northwest and southeast, beyond the current limits of drilling. The linear trend is attributed to magnetic destruction, resulting from prolonged hydrothermal alteration along the TSC fault network.

Thesis Gold’s exploration work has shown that there is considerable potential for continued expansion of gold mineralization along the Thesis Structural Corridor. The continuation of the geophysical signature, in conjunction with strong gold mineralization at the flanks of the drill-tested area, indicates that there may be further opportunities for significant discoveries in the area.

All significant intercepts from the Thesis Structural Corridor have now been reported, and Thesis Gold is looking forward to continuing its exploration work in the region. These positive results have added to the company’s growing confidence in the potential of the Ranch Gold Project and its ability to deliver value to its stakeholders.

Highlights from the results are as follows:

- High-grade gold mineralization at Thesis II:

- 22TH2DD012 returned 8.79 metres (m) core length of 11.97 grams per tonne (g/t) gold (Au), including 2.00 m of 46.50 g/t Au (Table 1, Figure 2).

- 22TH2DD014 returned 14.90 m core length of 5.48 g/t Au including 2.00 m of 27.00 g/t Au.

- Infill drilling demonstrates mineralization along the 1.5 km-long portion of the Thesis Structural Corridor that has been drill tested to date (Figure 2).

- Between Thesis II and Thesis III, hole 22TH3DD022 returned 38.57 m of 1.6 g/t Au including 23.00 m of 2.02 g/t Au.

- Between Thesis III and Bingo, hole 22BNGDD007 intercepted 34.90 m of 1.30 g/t Au including 12.66 m of 1.73 g/t Au.

- Mineral domain modelling implies continuity along a 1.5 km trend that stretches from surface to over 400 m downdip in the Thesis III zone, and over 270 m in the Bingo and Thesis II zones.

- The Company will continue to test the Thesis Structural Corridor with both infill and expansion drilling, as the trend remains open both along strike and at depth.

Table 1: Drill core assay results from the Thesis Structural Corridor.

| Drillhole | From | To | Interval (m)* | Au (g/t) | Ag (g/t) | AuEq (Au/Ag)** | |

| 22TH2DD008 | 173.63 | 177.00 | 3.37 | 0.43 | 1.20 | 0.44 | |

| 22TH2DD009 | 134.58 | 140.00 | 5.42 | 0.74 | 0.60 | 0.74 | |

| incl. | 134.58 | 137.43 | 2.85 | 1.27 | 0.76 | 1.28 | |

| 22TH2DD010 | 124.17 | 128.67 | 4.50 | 0.81 | 0.61 | 0.82 | |

| 185.00 | 193.00 | 8.00 | 2.11 | 0.86 | 2.13 | ||

| incl. | 185.00 | 189.00 | 4.00 | 3.64 | 1.53 | 3.66 | |

| and incl. | 185.00 | 186.00 | 1.00 | 6.56 | 4.27 | 6.61 | |

| 317.00 | 328.00 | 11.00 | 0.69 | 0.64 | 0.70 | ||

| 22TH2DD011 | 28.90 | 32.00 | 3.10 | 2.77 | 0.56 | 2.78 | |

| incl. | 28.90 | 31.02 | 2.12 | 3.88 | 0.75 | 3.89 | |

| 43.00 | 45.00 | 2.00 | 0.21 | 0.08 | 0.22 | ||

| 69.00 | 70.00 | 1.00 | 0.27 | 0.14 | 0.27 | ||

| 22TH2DD012 | 138.00 | 146.79 | 8.79 | 11.97 | 10.49 | 12.10 | |

| incl. | 139.00 | 146.00 | 7.00 | 14.85 | 12.96 | 15.01 | |

| and incl. | 144.00 | 146.00 | 2.00 | 46.50 | 41.90 | 47.02 | |

| 22TH2DD013 | 23.16 | 57.24 | 34.08 | 0.87 | 1.72 | 0.89 | |

| Incl. | 23.16 | 34.00 | 10.84 | 1.75 | 4.34 | 1.81 | |

| 79.54 | 93.00 | 13.46 | 1.41 | 1.17 | 1.43 | ||

| Incl. | 80.00 | 87.22 | 7.22 | 2.26 | 1.74 | 2.28 | |

| 22TH2DD014 | 34.10 | 36.00 | 1.90 | 0.82 | 1.01 | 0.84 | |

| 56.00 | 59.00 | 3.00 | 0.03 | 51.60 | 0.68 | ||

| 130.10 | 145.00 | 14.90 | 5.48 | 8.20 | 5.58 | ||

| incl. | 131.00 | 141.57 | 10.57 | 7.61 | 11.33 | 7.75 | |

| and incl. | 133.00 | 135.00 | 2.00 | 27.00 | 33.80 | 27.42 | |

| 22TH2DD015 | 61.00 | 71.00 | 10.00 | 0.78 | 0.42 | 0.78 | |

| incl. | 61.00 | 62.00 | 1.00 | 6.04 | 0.10 | 6.04 | |

| 22TH2DD016 | 48.00 | 57.00 | 9.00 | 0.52 | 1.09 | 0.54 | |

| 22TH2DD017 | 30.45 | 38.46 | 8.01 | 3.20 | 0.72 | 3.21 | |

| incl. | 31.00 | 36.00 | 5.00 | 4.76 | 0.82 | 4.77 | |

| and incl. | 31.00 | 31.63 | 0.63 | 12.70 | 1.79 | 12.72 | |

| and incl. | 34.00 | 35.00 | 1.00 | 9.13 | 1.18 | 9.14 | |

| 22TH2DD018 | 35.00 | 40.00 | 5.00 | 1.16 | 0.51 | 1.17 | |

| 36.00 | 39.00 | 3.00 | 1.54 | 0.47 | 1.55 | ||

| 22TH3DD021 | 202.55 | 242.00 | 39.45 | 1.19 | 1.86 | 1.21 | |

| 202.55 | 234.00 | 31.45 | 1.44 | 2.23 | 1.47 | ||

| incl. | 204.00 | 212.00 | 8.00 | 4.08 | 7.20 | 4.17 | |

| and | 208.00 | 209.00 | 1.00 | 23.00 | 48.90 | 23.61 | |

| also incl. | 218.00 | 222.00 | 4.00 | 0.87 | 0.95 | 0.89 | |

| 281.00 | 284.00 | 3.00 | 0.42 | 0.27 | 0.43 | ||

| 22TH3DD022 | 113.21 | 123.74 | 10.53 | 0.36 | 1.17 | 0.37 | |

| 133.00 | 143.00 | 10.00 | 0.53 | 0.19 | 0.54 | ||

| 237.00 | 275.57 | 38.57 | 1.60 | 1.09 | 1.61 | ||

| incl. | 238.00 | 243.00 | 5.00 | 1.80 | 0.64 | 1.81 | |

| and incl. | 252.00 | 275.00 | 23.00 | 2.02 | 1.50 | 2.04 | |

| 22TH3DD025 | 23.00 | 50.12 | 27.12 | 0.59 | 1.84 | 0.61 | |

| 23.00 | 32.00 | 9.00 | 0.72 | 1.30 | 0.74 | ||

| 36.00 | 50.12 | 14.12 | 0.65 | 2.38 | 0.68 | ||

| incl. | 40.00 | 46.00 | 6.00 | 0.89 | 3.28 | 0.93 | |

| 22BNGDD006 | 137.87 | 164.57 | 26.70 | 0.49 | 2.76 | 0.53 | |

| incl. | 137.87 | 152.60 | 14.73 | 0.65 | 3.58 | 0.69 | |

| 175.72 | 188.49 | 12.77 | 0.62 | 4.37 | 0.68 | ||

| incl. | 184.91 | 187.54 | 2.63 | 1.25 | 7.89 | 1.35 | |

| 22BNGDD007 | 9.15 | 44.05 | 34.90 | 1.30 | 1.41 | 1.32 | |

| incl. | 13.00 | 23.00 | 10.00 | 1.66 | 1.17 | 1.67 | |

| incl. | 16.80 | 21.00 | 4.20 | 2.54 | 1.81 | 2.57 | |

| and incl. | 29.34 | 42.00 | 12.66 | 1.73 | 2.09 | 1.76 |

*True width of the intervals has not yet been established by drilling.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

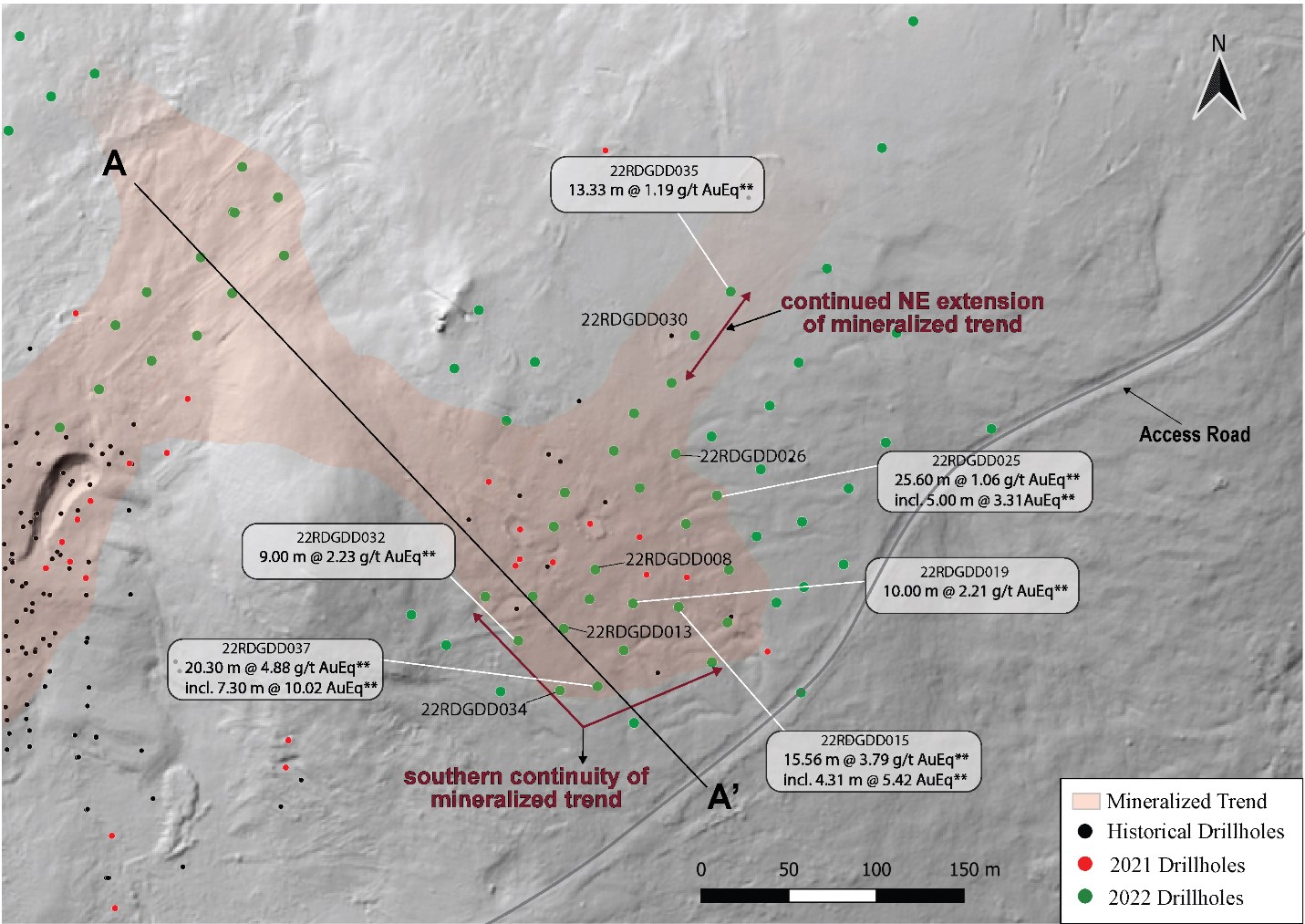

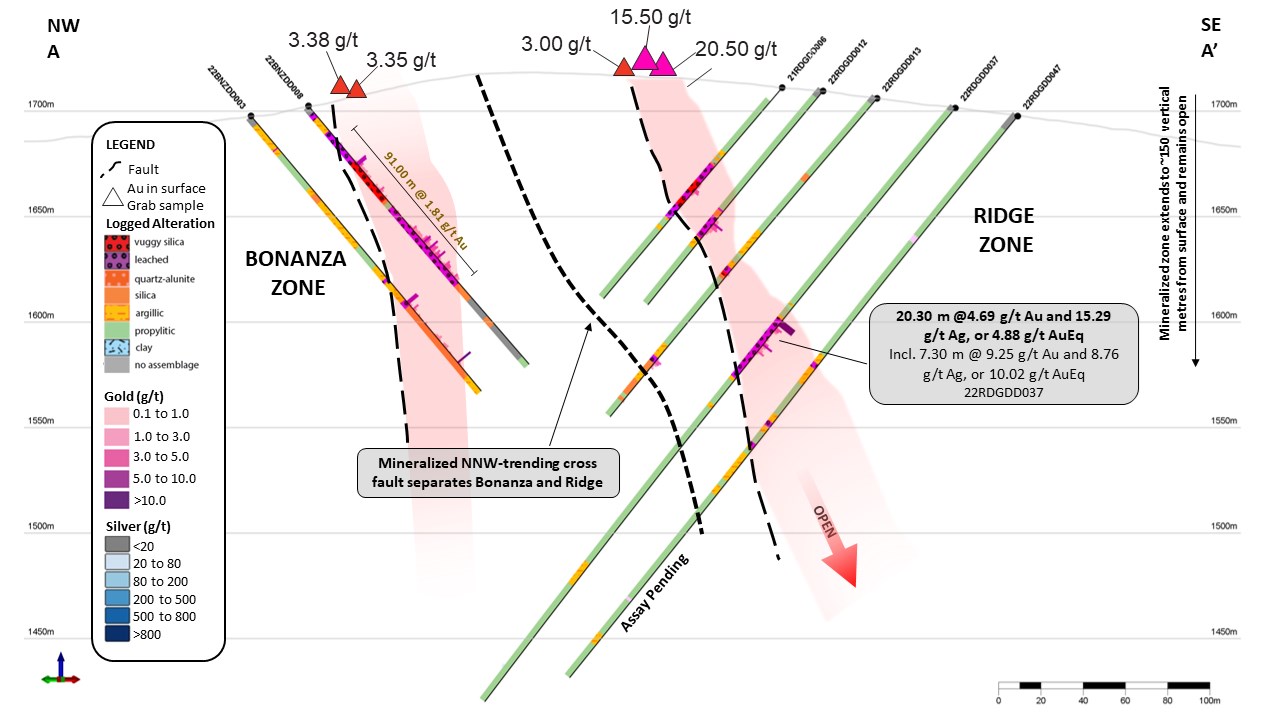

Thesis Gold (TSXV:TAU) has announced new assay results from 11 holes at the Bonanza-Ridge Zone during the 2022 field season. The company’s results expand the mineralized footprint at the Bonanza-Ridge Zone located at the Ranch Gold Project in north-central British Columbia.

The reported results increase the footprint of the previous metal mineralization at the Ridge Zone. The company continues to work on northeast and southwest-directed step-out drilling at Ridge Zone in an effort to intersect broad 10-25m wide intervals of mineralization. Thesis is extending the strike length of the Bonanza-Ridge Zone to over 700m.

The current mineralized structure at the Bonanza-Ridge Zone coincides with linear magnetic lows and shows potential across multiple datasets the company has compiled. This means the project remains highly prospective for further expansion with future drilling.

Ewan Webster, President and CEO, commented in a press release: “Drilling at the Bonanza-Ridge Zone continues to return significant gold and silver intercepts at surface, while delivering continuity and consistent grade to depth. The consistency of results received thus far supports the tremendous upside on the resource potential of this rapidly expanding target, it will remain a key focus for our 2023 drill program.”

Highlights from the drill results are as follows:

- Ridge hole 22RDGDD037 returned 20.30 metres (m) core length of 4.69 grams per tonne (g/t) gold (Au), 15.29 g/t silver (Ag) or 4.88 g/t AuEq** (Table 1), including 7.30 m of 9.25 g/t Au, 8.76 g/t Ag or 10.02 g/t AuEq** (Figures 1 & 2).

- High-grade gold (17.08 g/t Au) was intersected over a 3.30 m interval beginning at 129.70 m depth.

- High-grade gold in hole 037 demonstrates excellent downdip continuity across numerous drill holes and high-grade gold in rock samples collected at surface (Figure 2).

- Strong gold mineralization over wide intercepts at the Ridge Zone further extended mineralization at depth and along strike (Figure 1 and Table 1).

- 22RDGDD015: 15.56 m of 3.79 g/t AuEq**

- 22RDGDD025: 25.60 m of 1.14 g/t AuEq**

- 22RDGDD035: 13.33 m of 1.19 g/t AuEq** – (Furthest NE confirmed mineralization)

- Bonanza-Ridge mineralization now extends over 700 m along strike

- Mineralization associated with northwest and northeast-oriented structures continues to demonstrate good continuity and remains open along strike.

- The Company will continue to provide additional results from the 2022 drill program as they become available.

Table 1: Drill core assay results from the Ridge Zone.

| Drillhole | From | To | Interval | Au (g/t) | Ag (ppm) | AuEq** | |

| 22RDGDD008 | 109.83 | 121.00 | 11.17 | 0.42 | 48.64 | 1.02 | |

| incl. | 111.00 | 115.00 | 4.00 | 1.15 | 116.93 | 2.61 | |

| 22RDGDD013 | 106.24 | 113.71 | 7.47 | 0.51 | 11.47 | 0.66 | |

| incl. | 106.24 | 111.03 | 4.79 | 0.79 | 12.59 | 0.95 | |

| and | 161.14 | 175.00 | 13.86 | 1.31 | 4.81 | 1.37 | |

| incl. | 161.14 | 167.00 | 5.86 | 2.42 | 6.59 | 2.50 | |

| and | 186.00 | 187.87 | 1.87 | 0.98 | 5.29 | 1.05 | |

| 22RDGDD015 | 146.02 | 161.58 | 15.56 | 2.96 | 66.33 | 3.79 | |

| incl. | 150.69 | 155.00 | 4.31 | 4.27 | 92.06 | 5.42 | |

| and | 242.00 | 244.00 | 2.00 | 0.00 | 58.50 | 0.73 | |

| 22RDGDD019 | 132.00 | 142.00 | 10.00 | 1.83 | 30.37 | 2.21 | |

| incl. | 135.00 | 142.00 | 7.00 | 2.56 | 23.31 | 2.85 | |

| 22RDGDD025 | 127.40 | 153.00 | 25.60 | 1.10 | 3.94 | 1.14 | |

| incl. | 129.00 | 134.00 | 5.00 | 3.29 | 1.78 | 3.31 | |

| and | 161.00 | 162.00 | 1.00 | 0.07 | 25.40 | 0.39 | |

| 22RDGDD026 | 100.00 | 120.00 | 20.00 | 0.86 | 8.22 | 0.96 | |

| incl. | 105.00 | 112.00 | 7.00 | 2.01 | 7.48 | 2.11 | |

| 22RDGDD030 | 89.00 | 111.00 | 22.00 | 0.41 | 5.90 | 0.48 | |

| incl. | 89.00 | 95.00 | 6.00 | 1.00 | 4.29 | 1.05 | |

| and incl. | 101.79 | 105.00 | 3.21 | 0.76 | 11.00 | 0.90 | |

| 22RDGDD032 | 72.35 | 92.00 | 19.65 | 0.06 | 46.03 | 0.64 | |

| incl. | 83.00 | 92.00 | 9.00 | 0.12 | 77.10 | 1.09 | |

| and | 137.00 | 146.00 | 9.00 | 2.15 | 6.47 | 2.23 | |

| incl. | 137.00 | 143.00 | 6.00 | 2.97 | 7.61 | 3.07 | |

| and | 161.00 | 185.00 | 24.00 | 0.66 | 1.90 | 0.69 | |

| incl. | 162.00 | 170.00 | 8.00 | 1.24 | 2.22 | 1.27 | |

| and incl. | 174.56 | 177.26 | 2.70 | 0.86 | 2.65 | 0.90 | |

| 22RDGDD034 | 110.00 | 113.00 | 3.00 | 2.08 | 5.27 | 2.14 | |

| incl. | 110.00 | 111.00 | 1.00 | 3.36 | 4.97 | 3.42 | |

| and | 281.00 | 282.00 | 1.00 | 0.00 | 17.25 | 0.22 | |

| 22RDGDD035 | 100.67 | 114.00 | 13.33 | 1.06 | 10.33 | 1.19 | |

| incl. | 100.67 | 110.00 | 9.33 | 1.51 | 10.15 | 1.64 | |

| 22RDGDD037 | 120.83 | 123.00 | 2.17 | 0.01 | 30.30 | 0.39 | |

| and | 129.70 | 150.00 | 20.30 | 4.69 | 15.29 | 4.88 | |

| incl. | 129.70 | 137.00 | 7.30 | 9.25 | 8.76 | 10.02 | |

| and incl. | 129.70 | 133.00 | 3.30 | 17.08 | 7.40 | 17.17 | |

| and | 143.00 | 150.00 | 7.00 | 3.46 | 13.97 | 3.64 | |

| and | 161.00 | 165.15 | 4.15 | 0.14 | 17.11 | 0.35 |

*True width of the intervals has not yet been established by drilling.

**AuEq calculated on 1:80 gold-to-silver.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

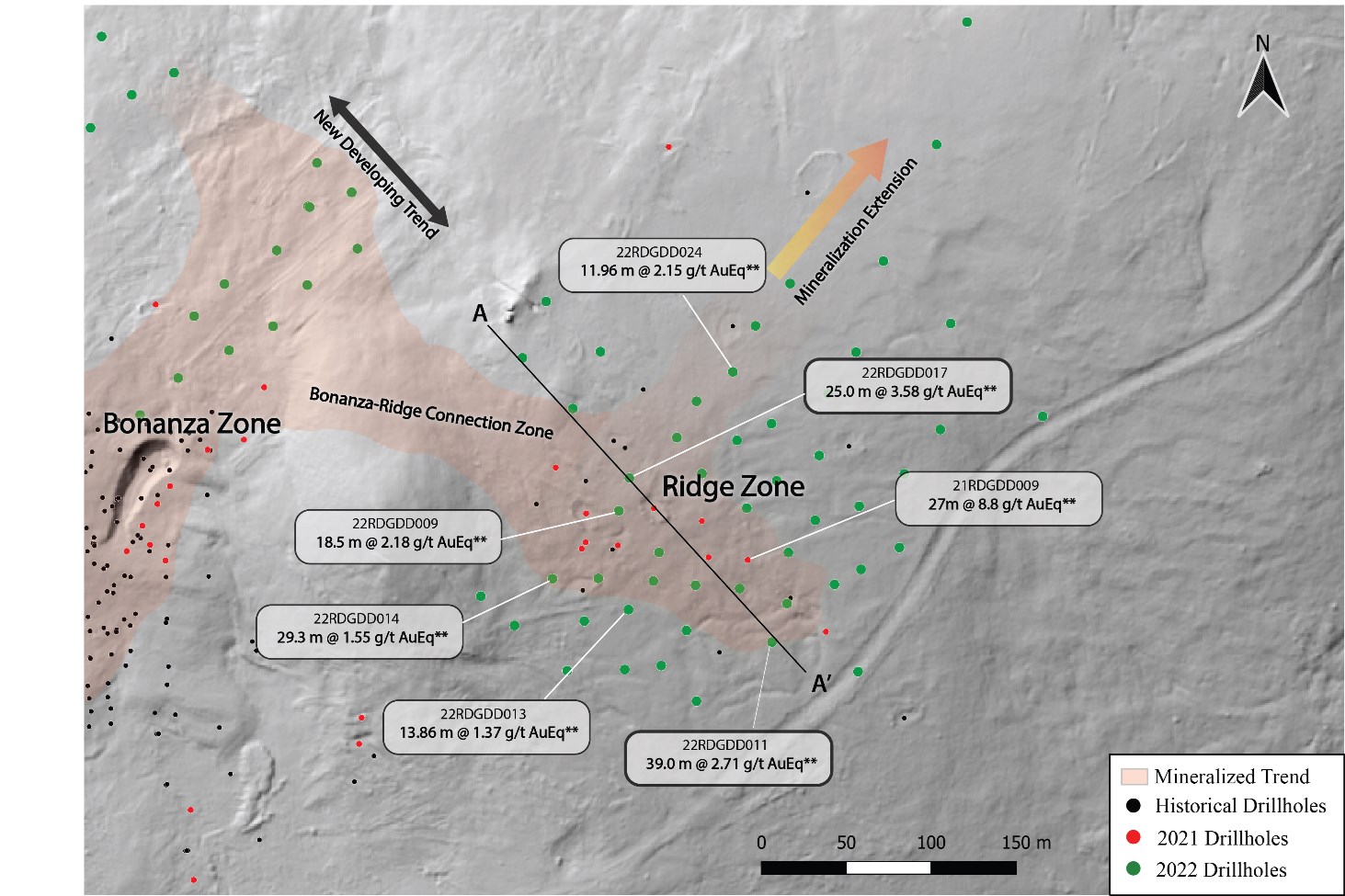

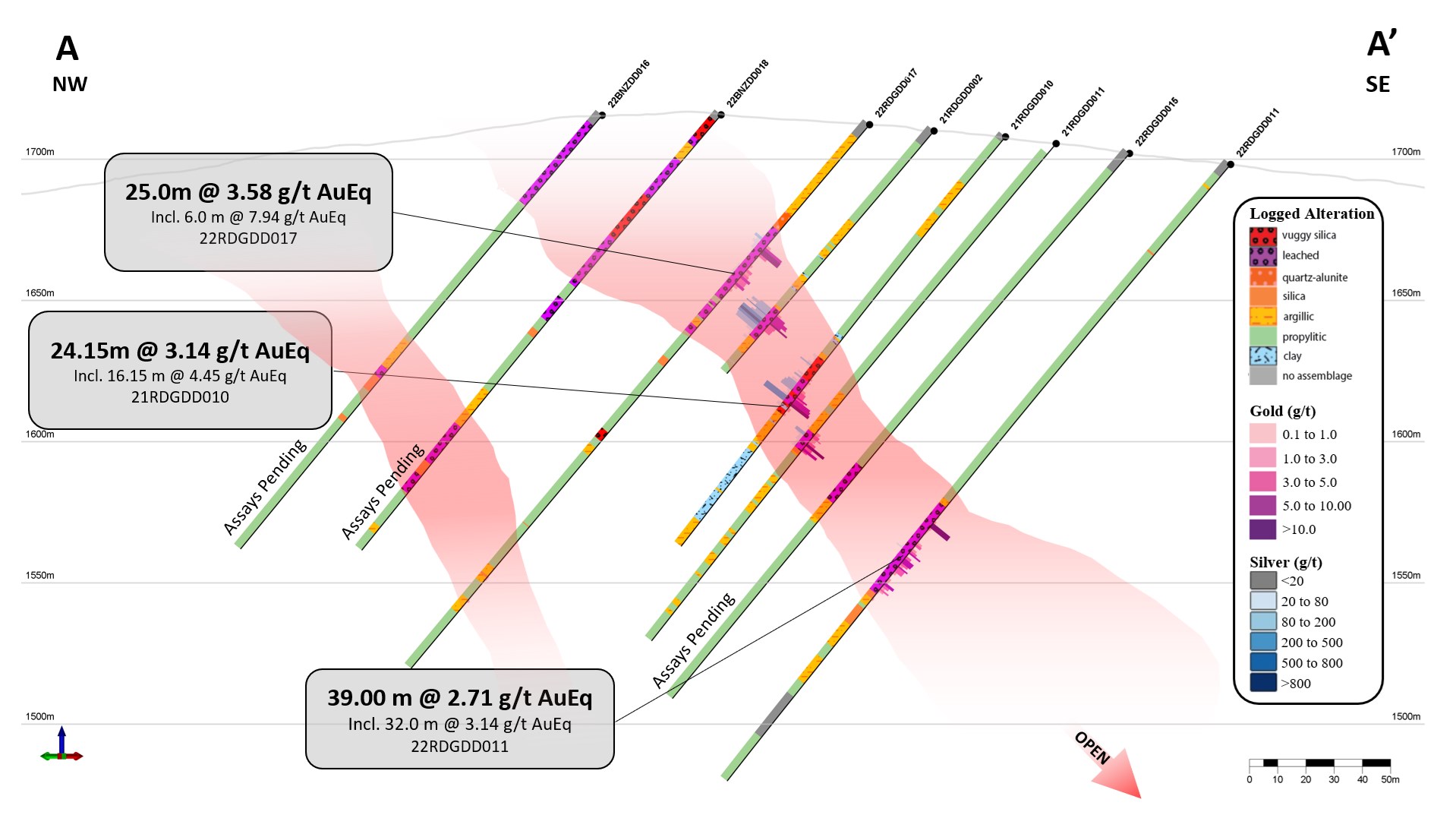

Thesis Gold (TSXV:TAU) has provided an update on the recent assay results from its 2022 summer drill program from the Ridge zone at the Ranch Gold Project in British Columbia, Canada. The company has received results with broad mineralization and a high success ratio of drilling at the site, with 75% of the results for the holes still to be received.

Ewan Webster, President and CEO, commented in a press release: “The early assay results that we have received from the Bonanza-Ridge zone continue to deliver robust intervals of broad mineralization, demonstrating continuity along strike and at depth. The success ratio of drilling so far this season has been exceptional and over 75% of holes have yet to be received.”

Highlights from the updated results are as follows:

- Ridge hole 22RDGDD011 returned 39.00 metres (m) core length of 2.56 grams per tonne (g/t) gold (Au), 11.99 g/t silver (Ag) or 2.71 g/t AuEq** (Table 1), including 32.00 m of 2.97 g/t Au, 13.75 g/t Ag or 3.14 g/t AuEq (Table 1, Figures 1&2)

- Ridge hole 22RDGDD017 returned 25.00 m of 3.22 g/t Au, 28.78 Ag or 3.58 g/t AuEq, including 6.00 m of 7.26 g/t Au, 4.15 g/t Ag, or 7.94 g/t AuEq (Table 1, Figure 1)

- These positive drill results represent significant mineralized intersections demonstrating the continued expansion of the mineralized domains along dominant northwest and northeast oriented structures within the broader mineralizing system at the Bonanza-Ridge zones.

- Drillhole 22RDGDD011 tested the depth extent of mineralization and confirmed continuity along broad scale fault structures that transect the Ridge Zone, mineralization remains open along strike and at depth.

- Drillholes 22RDGDD009 & 017 intersected significant mineralization between the Ridge and Bonanza zones. Adjacent Bonanza drillholes 22BNZDD016 & 018 (pending assay results, Figure 2) intersected significant near surface, vuggy silica zones typically closely associated with mineralization at the Bonanza-Ridge zones.

- The majority of initial assay results from the 2022 drill program have delivered strong, consistent intervals of significant mineralization.

Early-stage results from the step out drill campaign at the Ridge Zone have expanded the mineralized domain(s) and provided essential geological context which will be integrated into future expansion programs. Drillholes 22RDGDD013 & 24 (Figure 1) occur on the southern and northern extents of the Ridge Zone and were part of a larger step out drilling program at the Ridge Zone designed to test the extent of mineralization along the NE oriented fault structure. Drillholes 22RDG0011 & 17 tested the SE and SW extents (Figures 1&2) of the Ridge Zone and successfully delivered broad zones of mineralization, with 22RDGDD011 further expanding the SE extent of known mineralization, and 22RDGDD017 helping infill the gap between the mineralized domains of the northern extent of the Bonanza Zone, and the southern extent of the Ridge Zone (Figure 2).

Table 1: Assay Results from the Ridge Zone

| Drillhole | From | To | Interval | Au (g/t) | Ag (ppm) | AuEq | Zone | |

| 22RDGDD007 | 188.31 | 201.00 | 12.69 | 1.31 | 7.14 | 1.40 | Ridge | |

| incl. | 188.31 | 191.07 | 2.76 | 5.66 | 22.35 | 5.94 | ||

| 22RDGDD009 | 67.22 | 85.72 | 18.50 | 1.85 | 26.42 | 2.18 | Ridge | |

| incl. | 70.00 | 82.00 | 12.00 | 2.63 | 26.83 | 2.97 | ||

| 22RDGDD011 | 161.00 | 200.00 | 39.00 | 2.56 | 11.99 | 2.71 | Ridge | |

| incl. | 164.00 | 196.00 | 32.00 | 2.97 | 13.75 | 3.14 | ||

| and incl. | 164.00 | 170.00 | 6.00 | 4.68 | 14.40 | 4.86 | ||

| and incl. | 173.68 | 188.00 | 14.32 | 3.28 | 19.97 | 3.53 | ||

| and incl. | 190.00 | 196.00 | 6.00 | 3.03 | 9.25 | 3.15 | ||

| 22RDGDD013 | 106.24 | 113.71 | 7.47 | 0.51 | 11.47 | 0.65 | Ridge | |

| incl. | 106.24 | 111.03 | 4.79 | 0.79 | 12.59 | 0.95 | ||

| and | 161.14 | 175.00 | 13.86 | 1.31 | 4.81 | 1.37 | ||

| incl. | 161.14 | 167.00 | 5.86 | 2.42 | 6.59 | 2.50 | ||

| and | 186.00 | 187.87 | 1.87 | 0.98 | 5.29 | 1.05 | ||

| 22RDGDD017 | 53.00 | 78.00 | 25.00 | 3.22 | 28.78 | 3.58 | Ridge | |

| incl. | 55.00 | 61.00 | 6.00 | 7.26 | 54.15 | 7.94 | ||

| and incl. | 67.00 | 76.00 | 9.00 | 3.40 | 27.82 | 3.75 | ||

| and | 209.37 | 211.14 | 1.77 | 0.94 | 3.00 | 0.98 | ||

| and | 220.21 | 221.24 | 1.03 | 1.10 | 1.44 | 1.12 | ||

| 22RDGDD024 | 78.04 | 90.00 | 11.96 | 1.99 | 12.49 | 2.15 | Ridge | |

| incl. | 81.00 | 88.00 | 7.00 | 3.15 | 12.40 | 3.31 | ||

| and | 101.00 | 107.00 | 6.00 | 0.36 | 6.65 | 0.44 | ||

| and | 115.00 | 116.00 | 1.00 | 0.00 | 21.30 | 0.27 |

*Intervals are core-length. True width is estimated between 70-90% of core length.

**AuEq calculated based on a 1:80 gold to silver ratio.

The promising results of the 2022 drill program have significantly progressed the understanding of the structural characteristics associated with mineralization at the Ranch Property including broadscale, interconnected fault zones with shallow high-grade zones encapsulated by broad intervals of significant mineralization, providing a strong case for the major resource potential of the Ranch Property.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

New Age Exploration Limited New Age Exploration Limited |

NAE.AX | +33.33% |

|

CASA.V | +30.00% |

|

VKA.AX | +28.57% |

|

CTO.AX | +25.00% |

|

BSX.TO | +22.22% |

|

ANK.V | +21.74% |

|

SRI.V | +20.00% |

|

NEV.V | +20.00% |

|

IB.V | +18.18% |

|

SLL.V | +16.42% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan