While serious concerns linger in the markets about the strength of the swing up, gold mining stocks have continued their leg higher. The first quarter of 2021 was a positive period for gold miners, creating a new extended rally to bring most back to pre-pandemic levels. While most of the biggest miners have been doing well, a drop in the gold stock benchmark and trading vehicle GDX VanEck Vectors Gold Miners ETF of 9.8% in Q1 demonstrates a lack of equality in the gains.

Sentiment Uncertainty Turns to Directional Confidence

Gold itself lost 10% through the period, but has rebounded quickly in Q2. This has been a big boost to miners, particularly in the US. It has been the majors that propped up the GDX in Q1; these stocks often amplify gold’s material moves by two or three times. As spot gold continues to recover, so does sentiment for gold miners, and the majors are seeing this more than others. The GDX reverted 21.8% higher in May, and continued to climb this month. During the same time, gold prices climbed 6.6%, with all indicators pointing to a better sentiment around gold and gold mining stocks.

Q1 2021 reported results show that the majors in particular are outperforming all other gold miners, with strong results and a growing share of the dominant gold-stock ETF. The top 25 GDX gold miners now account for 88.1% of the market cap of the ETF. This dominance is also borne out in the results, with almost all of the top gold mines by production and expansion in the U.S. being owned and operated by those same companies.

The top 25 stocks in the GDX reported recovering and powerful production numbers for Q1. Although total production dropped 2.8% in the period, total revenues jumped 10.5% YoY to $13.7B. This is one of the best quarters ever for this group.

Higher Commodity Prices Boosting Everything

The lower output was offset by 13.4% higher gold prices in the same period, boosting their bottom lines and pushing their financials along healthily. This has been a recurring trend in the mining industry as commodity prices continue to push higher every month with reopenings driving demand along and a positive outlook for the industry expands with every new project and restart announced. Production is nearing pre-pandemic levels again and investment in the first quarter picked up rapidly as miners raced to get back on track for 2021.

The bottom lines of the major gold miners in the ETF was impressive, with 47.1% high YoY earnings. Those soaring earnings and profits seem to be in line with a recovering industry and one that is moving faster than many other parts of the global economy. While some have tried to attribute this to low comparison from 2020, looking at most of these companies shows that this performance comes on the back of normal performance and not any over-compensation from the slowdown of last year.

The List of Winners

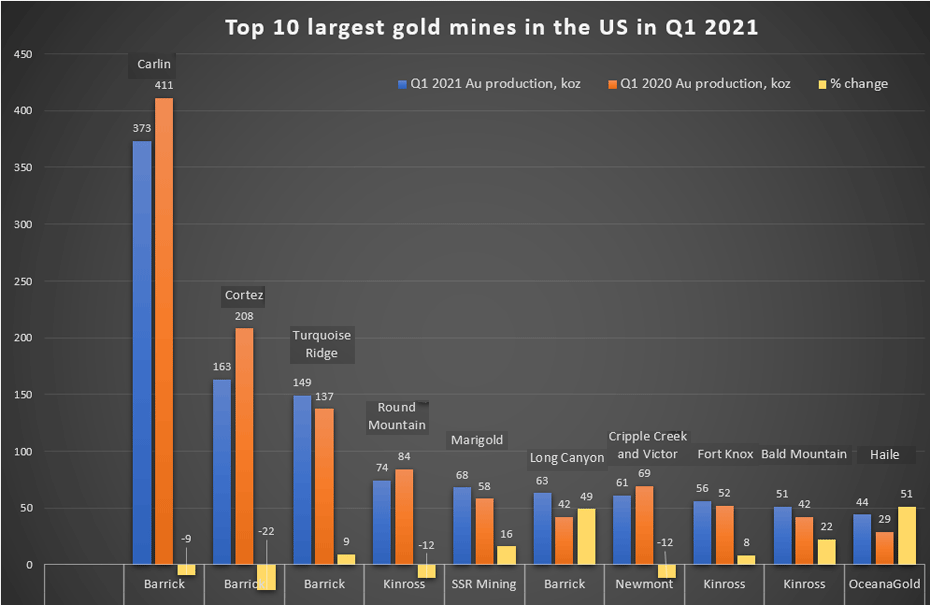

Kitco has put together a list of the top largest gold mines in the US based on gold production in Q1 2021, and it is clear that the biggest players continue to dominate not just the biggest gold stock ETF, but also production quantities.

Barrick takes four of the top ten spots, including the three top spots that seem to generally be reserved for the company across its Carlin, Cortez, and Turquoise Ridge mines. The biggest miners in the industry continue to dominate production and profits right now, but they are also lifting other stocks with them as gold prices rise and industry sentiment begins to reverse in Q2 2021.

| Operation | Major Owner/Operator | Q1 2021 Au production, koz | Q1 2020 Au production, koz | % Change | |

| 1 | Carlin | Barrick | 373 | 411 | -9 |

| 2 | Cortez | Barrick | 163 | 208 | -22 |

| 3 | Turquoise Ridge | Barick | 149 | 137 | 9 |

| 4 | Round Mountain | Kinross | 74 | 84 | -12 |

| 5 | Marigold | SSR Mining | 68 | 58 | 16 |

| 6 | Long Canyon | Barrick | 63 | 42 | 49 |

| 7 | Cripple Creek and Victor | Newmont | 61 | 69 | -12 |

| 8 | Fort Knox | Kinross | 56 | 52 | 8 |

| 9 | Bald Mountain | Kinross | 51 | 42 | 22 |

| 10 | Haile | OceanaGold | 44 | 29 | 51 |

Source: Kitco

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.