It has taken a few weeks to play out but our warning of a correction in precious metals (first on August 18) is coming to pass.

Last week Gold, Silver and GDX all formed big bearish reversals at multi-year resistance levels. Yes, these resistance levels (Gold $1550, Silver $18.50, GDX 31) date back to 2013.

Bonds and precious metals have benefitted from the shift in Fed policy as well as fears of recession and growth in negative interest rate bonds.

These drivers could pause or shift temporarily and that would be supportive of stocks and not precious metals. Let me explain.

First, the fears of recession are driven by the inversion of the yield curve. But the problem is the timing.

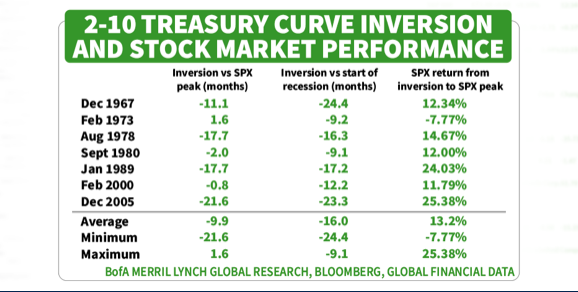

There is a lag between the inversion and the peak in the stock market, and stocks tend to perform well during that lag period. The data below shows an average gain of 13% and an average lag time of 10 months.

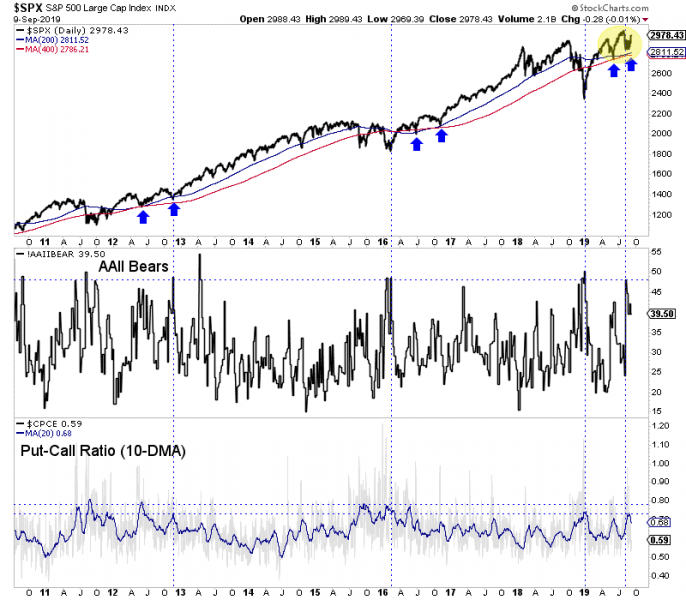

The U.S. stock market has held up very well despite growing recession fears and persistent bearish sentiment. In the chart below we plot the S&P 500 along with two sentiment indicators.

In recent weeks, the number of AAII Bears and the put-call ratio together hit their third highest level in nearly the past seven years. Despite that sentiment, the S&P appears to be emerging from its recent lows in the manner it did in 2012 and 2016.

A sustained rally in the stock market is going to allay some recession fears and suck some capital out of bonds thereby leading to higher yields.

This will cause precious metals to correct but that is no surprise given what the charts are already showing us. How much and how long of a correction will depend on Fed policy.

If the Fed continues to cut rates well into 2020 then that is bullish for precious metals even if the long end of the yield curve is rising. If the Fed cuts in September and stands pat until March 2020 then precious metals will continue to correct and digest recent gains.

Ultimately, the mix of a stronger dollar, inverted yield curve and political pressure is more likely than not to lead to continued rate cuts over the next 15 months.

Therefore if you missed the recent run in precious metals, don’t panic. It’s best to be patient and let this correction run its course. Better value and new opportunities will emerge. To learn the stocks we own and intend to buy that have 3x to 5x potential, consider learning more about our premium service.

by Jordan Roy-Byrne CMT, MFTA

September 10, 2019

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.