With the recent close of the sale of the company’s Crucero property to GoldMining (TSX-V: GOLD), Lupaka Gold Corp. (TSX-V: LPK) has secured the funds to take the next step with its Invicta Gold project. Today, the company announced the commissioning of a Preliminary Economic Assessment “PEA” for the Invicta Gold Project.

With the backing of Pandion Finance and its gold purchase agreement providing the necessary funding, Lupaka is motivated to meet its obligations which makes now an exciting time for the company and its shareholders.

The company has hired SRK to prepare the PEA. This provides a continuity of project knowledge as the project’s 2012 resources estimate was prepared by SRK and the company’s own internal mining studies of Invicta were prepared with assistance from SVS Ingenieros of Lima “SVS”, Peru, a subsidiary of the SRK Consulting Group. The company plans the completion of the PEA technical report in the first quarter of 2018.

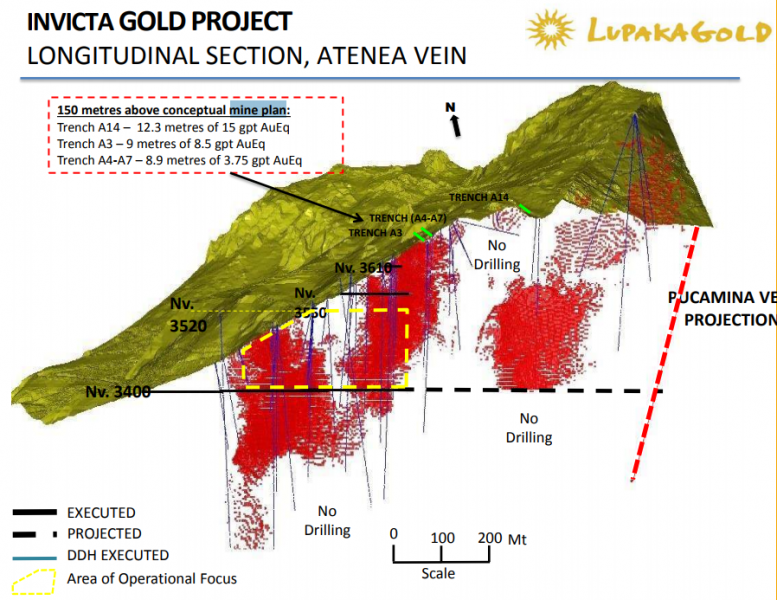

The initial six-year mine plan that was developed and prepared by SVS, which outlined ~735,000 tonnes at a grade of ~6.1 g/t AuEq. for 23,000 oz. of gold equivalent a year, according to a rough calculation. The plan was developed from the 3,400-metre level and extends up 120 metres.

Drill results indicated that the mineralization extends at least as far below the 3,400 level as it does above. In addition, there is a well-defined section of measured and indicated directly along strike to the northeast that is within a few hundred metres, and of the same characteristics as the segment in the mine plan.

The first bulk sample in October 2015 produced a copper, lead and zinc concentrate that was sold to an off-taker. The concentrate was exceptionally clean and was absent of any penalty elements, so buyers could pay well for it because they can mix it with less clean concentrate and blend it.

The company completed its second run-of-mine bulk test in February 2016 and achieved good recoveries in concentrate streams — returning 87.5% gold, 91.2% silver, 91.5% copper, 90.03% lead and 90.1% zinc. The sample was a blend of approximately 80 % run-of-mine material and 20 % from a low grade stockpile derived from development.

The bulk sample was processed with the prime objective of producing a saleable concentrate and no effort was made to optimize content of specific metals, according to the company. The resulting concentrate was clean, with few penalty elements which is ideal for sale and blending with other concentrates.

Once in production, the hope is that cash flow from Invicta will be used to grow the operation. There are numerous zones outside of the Atenea vein that contain mineralization, and the targeted Atenea resource could increase, as development offers access to high-grade intercepts and underground drill sites. In addition, based on gold and copper within the under-explored quartz-sulphide vein zones, the company believes the Invicta resource could expand.

At 350 tonnes per day, Invicta could operate for between 10 and 15 years based on the current measured and indicated resource in the Atenea zone. However, the project is permitted to operate at 1,000 tonnes per day and the company would like to increase their resources through drilling, expand operations to the 1,000 tpd rate and build their own mill on site but for the time being will use third party transport and processing contractors. All of this could take production to over 70,000 AuEq. oz/yr, according to a cocktail napkin calculation.

Proceeds from Invicta will also be used for more exploration at its other projects in Peru — Josnitaro which is a whole other story, worthy of an update of its own.

***MiningFeeds was compensated to provide marketing services. As always, do your own diligence. The writer of this article, Nicholas LePan does own shares.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.