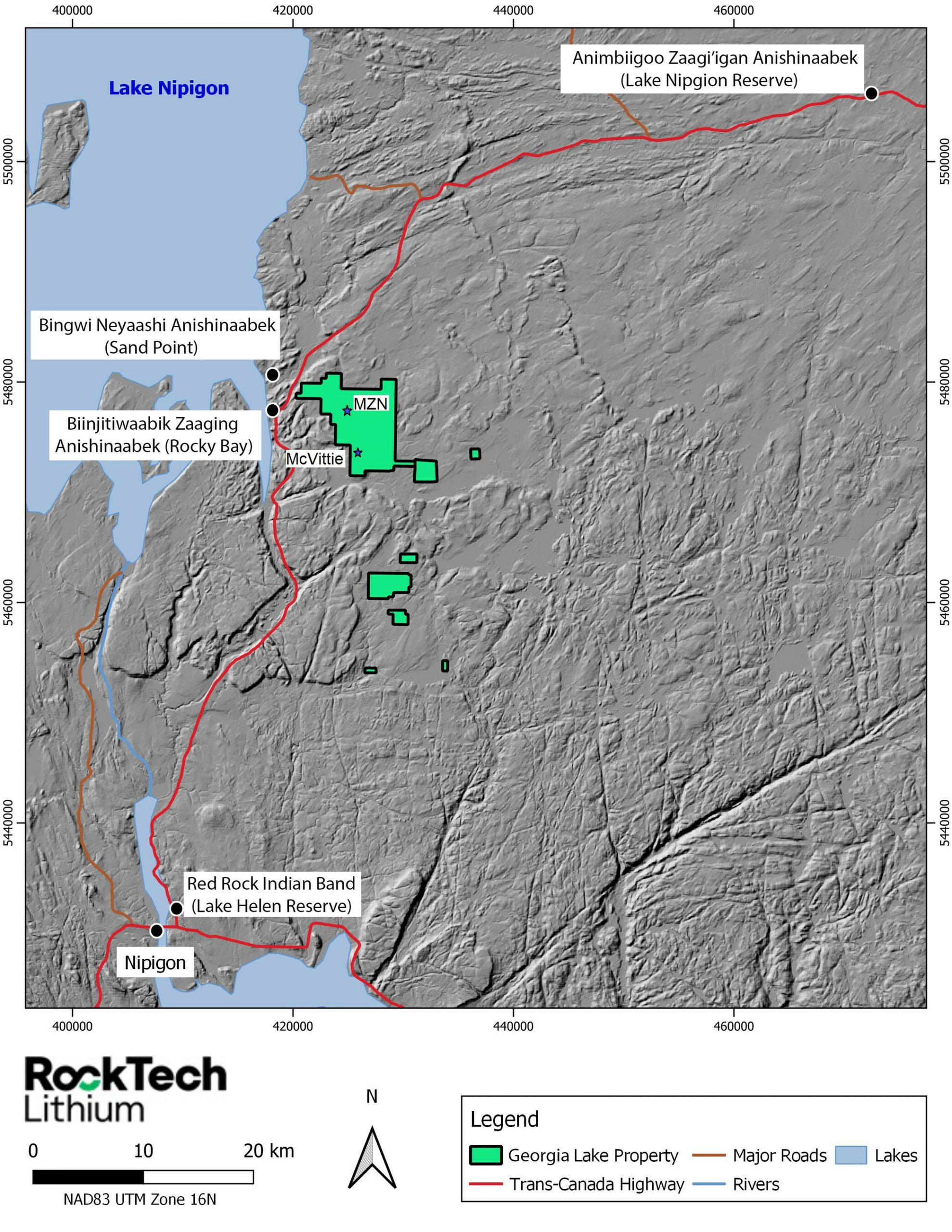

Rock Tech Lithium (TSXV:RCK) has announced that the first diamond drill rig for the first phase of its 2023 exploration drill campaign has been mobilized at the 100%-owned Georgia Lake Lithium project in the Thunder Bay Mining District, Ontario. The aim of the program is to increase the total mineral resources at the project between 2023 and 2024. Phase I will include the mobilization of a drill rig for the 3,500-metre program, with targeted drilling aimed at expanding the existing Spodumene mineralization at the Main Zone North (MZN) and McVittie Deposits.

MZN contains the largest Mineral Resource in the Georgia Lake Pegmatite Field, and it currently remains open along strike to the east. Drilling will aim to extend the Spodumene mineralization along strike to the east of MZN. Step-out drilling south of the MZN deposit will focus on extending mineralization where Rock Tech has already identified new mineralization throughout the course of the 2022 drilling program.

McVittie is comprised of three spodumene dikes; these have been mapped for a strike length of more than 600m. Inferred Resource at the deposit is 1Mt at 1.0% Li2O and is open at depth and along strike in both directions. Rock Tech also reported a Mineral Resource Estimate at the Georgia Lake Prefeasbility Study, outlining 10,60 million tonnes of Indicated Mineral Resource at a grade of 0.88% Li2O and 4.22 mt of Inferred Mineral Resource at a grade of 1.0% Li2O limited to eight deposits in the Northern and Southern Spodumene Pegmatite Areas.

Dirk Harbecke, Rock Tech’s Chief Executive, commented in a press release: “It is our aim for 2023 to unlock the exploration potential of our Georgia Lake Project by advancing our drilling and prospecting activities across the land package. We are pleased to be able to initiate a drill program which we believe will grow our MZN and McVittie deposits as the first phase of our 2023 exploration campaign. I expect that our exploration program will lead to a sizeable increase of our Resource over the next year.”

TABLE 1 | Overview of the Mineral Resource as of 2022’s Prefeasibility Study

2022 MINERAL RESOURCE

| Classification | Mining | Cut-off grade Li2O (%) | Zone | Tonnes | Li2O (%) |

| Indicated | Open pit | 0.3 | NSPA OP Indicated | 4,242,618 | 0.88 |

| Indicated | Underground | 0.6 | NSPA UG Indicated | 6,358,650 | 0.89 |

| Total Indicated | 10,601,268 | 0.88 | |||

| Inferred | Open pit | 0.3 | NSPA OP Inferred | 245,933 | 0.78 |

| Inferred | Underground | 0.6 | NSPA UG Inferred | 2,073,069 | 0.91 |

| Inferred | Underground | 0.6 | SSPA UG Inferred | 1,903,274 | 1.12 |

| Total Inferred | 4,222,276 | 1.00 |

| Notes: |

| a. CIM Definition Standards (2014) were used for reporting the Mineral Resources. |

| b. The Qualified Person is Dinara Nussipakynova, P.Geo. of AMC. |

| c. Cut-off grade for open pit Mineral Resources is 0.30% Li2O. |

| d. Open pit Mineral Resources are constrained by the optimization pits shell at a lithium concentrate price of USD 1,100/t with metallurgical recovery of 80% and concentrate grade of 6%. Both cut off use same parameters. |

| e. The pit optimization was based on following cost assumptions: |

| i. Mill feed mining costs of USD 4.5/t and waste mining cost of USD 4.5/t. |

| ii. Processing costs of USD 25/t and General and Administration costs of USD 15/t. |

| iii. Slope angle 45-48 degrees. |

| f. Cut-off grade for underground Mineral Resources is 0.60% Li2O based on a USD 45/t mining cost and processing and G&A the same as the open pit. |

| g. Underground Mineral Resources are not constrained. |

| h. Mineralized Density used as 2.69 t/m3. |

| i. Waste Density used as 2.75 t/m3. |

| j. Drilling results up to 31 July 2022. |

| k. The numbers may not compute exactly due to rounding. |

| j. Numbers may not compute exactly due to rounding. |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.