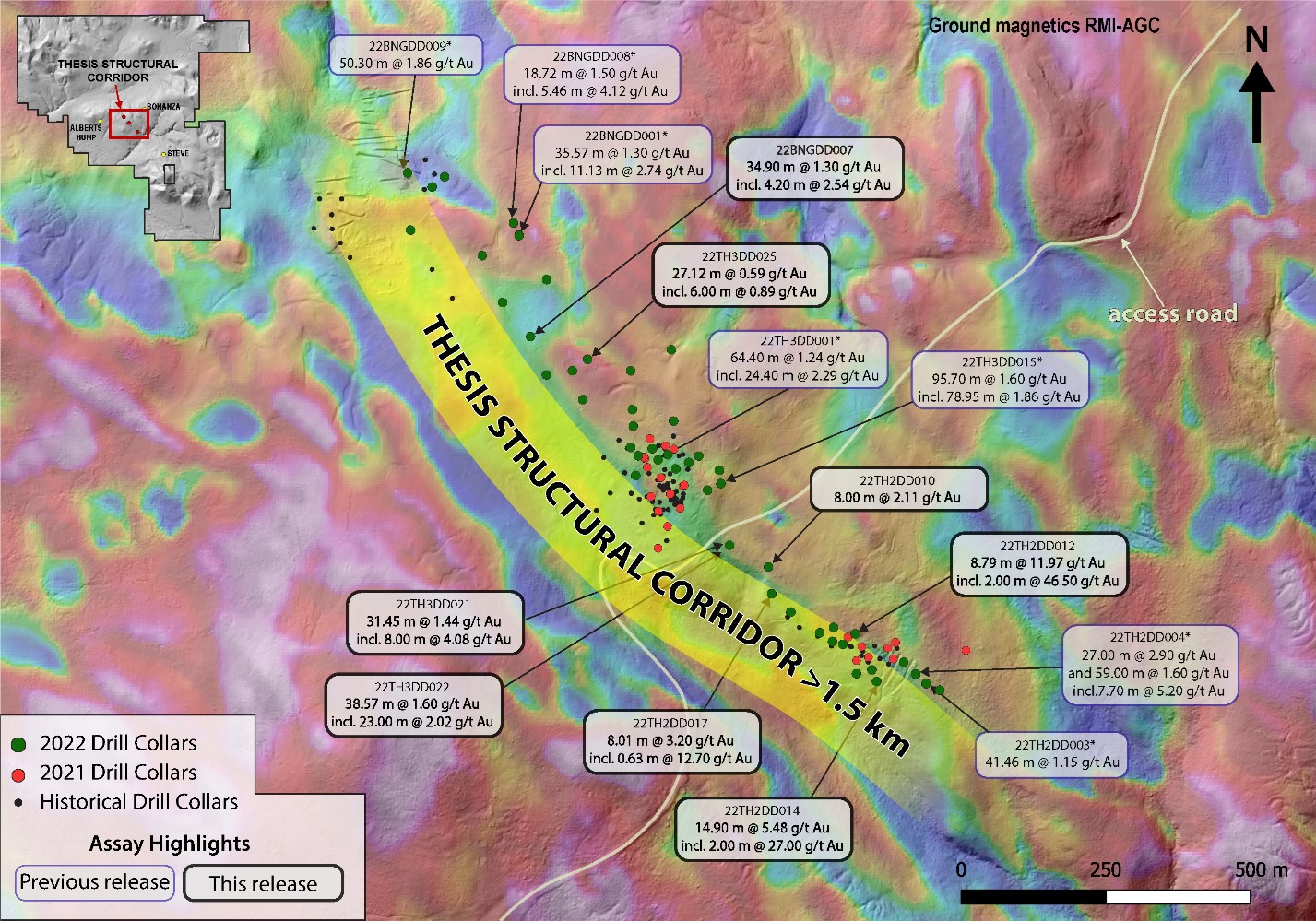

Thesis Gold (TSXV:TAU) has announced the latest assay results from its 2022 summer drill program at the Ranch Gold Project in British Columbia’s Toodoggone mining district. These results have significantly expanded the limits of the Bingo, Thesis III, and Thesis II zones, demonstrating gold mineralization along the more than 1.5-kilometre Thesis Structural Corridor.

Ewan Webster, President and CEO, commented in a press release: “From the outset of our drilling in the Thesis Structural Corridor, we believed that the system was much larger than previously documented. Today’s results continue to demonstrate our initial hypothesis was correct, we are now seeing significant growth come to fruition. The mineralization within the Corridor is showing excellent continuity along the 1.5 km strike extent, and as we continue to expand the mineralized footprint, we are discovering even more promising indications. Our team is currently planning for the 2023 drilling season, and the Thesis Structural Corridor is a primary focus for the upcoming campaign.”

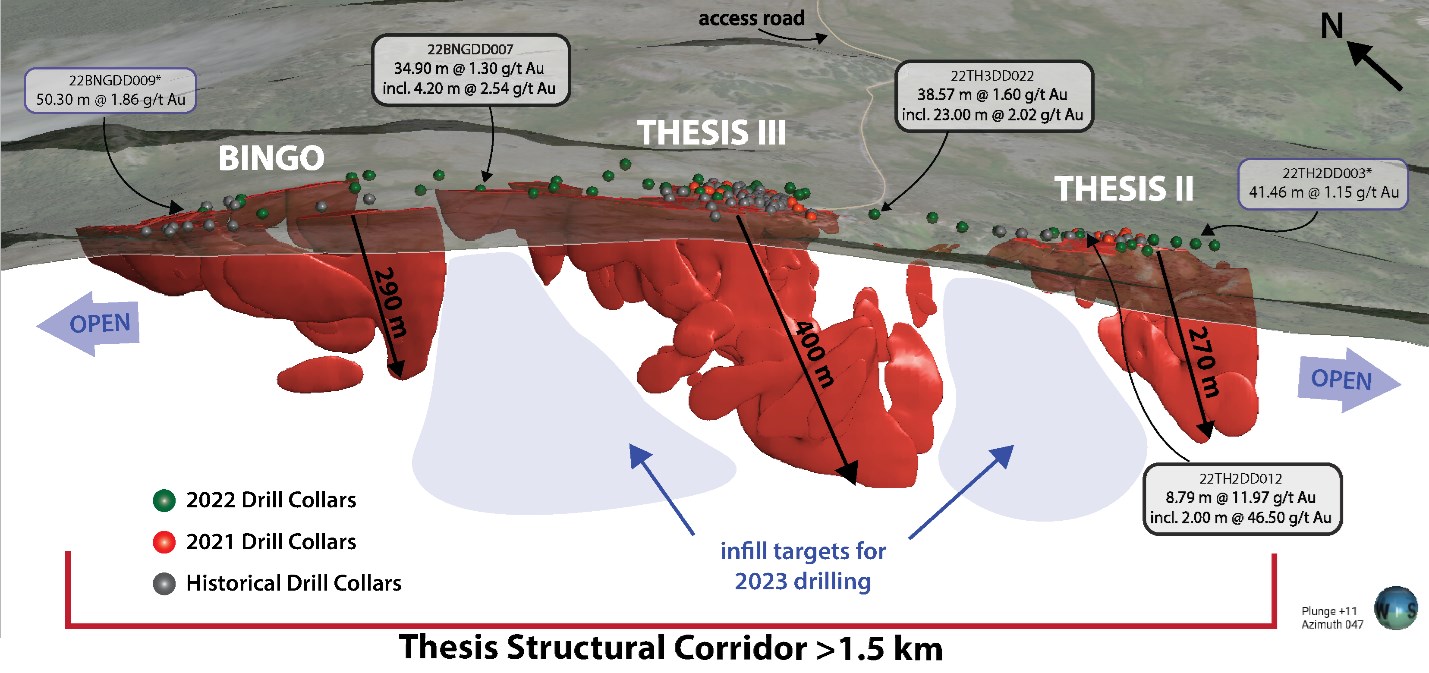

Historically, the Bingo, Thesis III, and Thesis II zones were considered as three separate zones of mineralization. However, drilling by Thesis has shown that they are likely part of a continuous structure that spans over 1.5 km in strike length and continues downdip for at least 400 m. The mineral domain models further support this, indicating that the three zones are interconnected.

The mineralized intercepts from the northern and southern-most extents of the corridor returned significant gold intervals. The northwestern-most drillhole at Bingo returned 50.30 m core length of 1.86 g/t Au, while drilling from the southern Thesis II zone returned 59.00 m core length of 1.60 g/t Au. Additionally, high-grade mineralization within the corridor has returned intervals up to 33.13 m core length of 17.49 g/t Au.

The geophysical expression of the Thesis Structural Corridor is best characterized by a 350-400 m-wide, NW-trending magnetic low that extends for over 4 km northwest and southeast, beyond the current limits of drilling. The linear trend is attributed to magnetic destruction, resulting from prolonged hydrothermal alteration along the TSC fault network.

Thesis Gold’s exploration work has shown that there is considerable potential for continued expansion of gold mineralization along the Thesis Structural Corridor. The continuation of the geophysical signature, in conjunction with strong gold mineralization at the flanks of the drill-tested area, indicates that there may be further opportunities for significant discoveries in the area.

All significant intercepts from the Thesis Structural Corridor have now been reported, and Thesis Gold is looking forward to continuing its exploration work in the region. These positive results have added to the company’s growing confidence in the potential of the Ranch Gold Project and its ability to deliver value to its stakeholders.

Highlights from the results are as follows:

- High-grade gold mineralization at Thesis II:

- 22TH2DD012 returned 8.79 metres (m) core length of 11.97 grams per tonne (g/t) gold (Au), including 2.00 m of 46.50 g/t Au (Table 1, Figure 2).

- 22TH2DD014 returned 14.90 m core length of 5.48 g/t Au including 2.00 m of 27.00 g/t Au.

- Infill drilling demonstrates mineralization along the 1.5 km-long portion of the Thesis Structural Corridor that has been drill tested to date (Figure 2).

- Between Thesis II and Thesis III, hole 22TH3DD022 returned 38.57 m of 1.6 g/t Au including 23.00 m of 2.02 g/t Au.

- Between Thesis III and Bingo, hole 22BNGDD007 intercepted 34.90 m of 1.30 g/t Au including 12.66 m of 1.73 g/t Au.

- Mineral domain modelling implies continuity along a 1.5 km trend that stretches from surface to over 400 m downdip in the Thesis III zone, and over 270 m in the Bingo and Thesis II zones.

- The Company will continue to test the Thesis Structural Corridor with both infill and expansion drilling, as the trend remains open both along strike and at depth.

Table 1: Drill core assay results from the Thesis Structural Corridor.

| Drillhole | From | To | Interval (m)* | Au (g/t) | Ag (g/t) | AuEq (Au/Ag)** | |

| 22TH2DD008 | 173.63 | 177.00 | 3.37 | 0.43 | 1.20 | 0.44 | |

| 22TH2DD009 | 134.58 | 140.00 | 5.42 | 0.74 | 0.60 | 0.74 | |

| incl. | 134.58 | 137.43 | 2.85 | 1.27 | 0.76 | 1.28 | |

| 22TH2DD010 | 124.17 | 128.67 | 4.50 | 0.81 | 0.61 | 0.82 | |

| 185.00 | 193.00 | 8.00 | 2.11 | 0.86 | 2.13 | ||

| incl. | 185.00 | 189.00 | 4.00 | 3.64 | 1.53 | 3.66 | |

| and incl. | 185.00 | 186.00 | 1.00 | 6.56 | 4.27 | 6.61 | |

| 317.00 | 328.00 | 11.00 | 0.69 | 0.64 | 0.70 | ||

| 22TH2DD011 | 28.90 | 32.00 | 3.10 | 2.77 | 0.56 | 2.78 | |

| incl. | 28.90 | 31.02 | 2.12 | 3.88 | 0.75 | 3.89 | |

| 43.00 | 45.00 | 2.00 | 0.21 | 0.08 | 0.22 | ||

| 69.00 | 70.00 | 1.00 | 0.27 | 0.14 | 0.27 | ||

| 22TH2DD012 | 138.00 | 146.79 | 8.79 | 11.97 | 10.49 | 12.10 | |

| incl. | 139.00 | 146.00 | 7.00 | 14.85 | 12.96 | 15.01 | |

| and incl. | 144.00 | 146.00 | 2.00 | 46.50 | 41.90 | 47.02 | |

| 22TH2DD013 | 23.16 | 57.24 | 34.08 | 0.87 | 1.72 | 0.89 | |

| Incl. | 23.16 | 34.00 | 10.84 | 1.75 | 4.34 | 1.81 | |

| 79.54 | 93.00 | 13.46 | 1.41 | 1.17 | 1.43 | ||

| Incl. | 80.00 | 87.22 | 7.22 | 2.26 | 1.74 | 2.28 | |

| 22TH2DD014 | 34.10 | 36.00 | 1.90 | 0.82 | 1.01 | 0.84 | |

| 56.00 | 59.00 | 3.00 | 0.03 | 51.60 | 0.68 | ||

| 130.10 | 145.00 | 14.90 | 5.48 | 8.20 | 5.58 | ||

| incl. | 131.00 | 141.57 | 10.57 | 7.61 | 11.33 | 7.75 | |

| and incl. | 133.00 | 135.00 | 2.00 | 27.00 | 33.80 | 27.42 | |

| 22TH2DD015 | 61.00 | 71.00 | 10.00 | 0.78 | 0.42 | 0.78 | |

| incl. | 61.00 | 62.00 | 1.00 | 6.04 | 0.10 | 6.04 | |

| 22TH2DD016 | 48.00 | 57.00 | 9.00 | 0.52 | 1.09 | 0.54 | |

| 22TH2DD017 | 30.45 | 38.46 | 8.01 | 3.20 | 0.72 | 3.21 | |

| incl. | 31.00 | 36.00 | 5.00 | 4.76 | 0.82 | 4.77 | |

| and incl. | 31.00 | 31.63 | 0.63 | 12.70 | 1.79 | 12.72 | |

| and incl. | 34.00 | 35.00 | 1.00 | 9.13 | 1.18 | 9.14 | |

| 22TH2DD018 | 35.00 | 40.00 | 5.00 | 1.16 | 0.51 | 1.17 | |

| 36.00 | 39.00 | 3.00 | 1.54 | 0.47 | 1.55 | ||

| 22TH3DD021 | 202.55 | 242.00 | 39.45 | 1.19 | 1.86 | 1.21 | |

| 202.55 | 234.00 | 31.45 | 1.44 | 2.23 | 1.47 | ||

| incl. | 204.00 | 212.00 | 8.00 | 4.08 | 7.20 | 4.17 | |

| and | 208.00 | 209.00 | 1.00 | 23.00 | 48.90 | 23.61 | |

| also incl. | 218.00 | 222.00 | 4.00 | 0.87 | 0.95 | 0.89 | |

| 281.00 | 284.00 | 3.00 | 0.42 | 0.27 | 0.43 | ||

| 22TH3DD022 | 113.21 | 123.74 | 10.53 | 0.36 | 1.17 | 0.37 | |

| 133.00 | 143.00 | 10.00 | 0.53 | 0.19 | 0.54 | ||

| 237.00 | 275.57 | 38.57 | 1.60 | 1.09 | 1.61 | ||

| incl. | 238.00 | 243.00 | 5.00 | 1.80 | 0.64 | 1.81 | |

| and incl. | 252.00 | 275.00 | 23.00 | 2.02 | 1.50 | 2.04 | |

| 22TH3DD025 | 23.00 | 50.12 | 27.12 | 0.59 | 1.84 | 0.61 | |

| 23.00 | 32.00 | 9.00 | 0.72 | 1.30 | 0.74 | ||

| 36.00 | 50.12 | 14.12 | 0.65 | 2.38 | 0.68 | ||

| incl. | 40.00 | 46.00 | 6.00 | 0.89 | 3.28 | 0.93 | |

| 22BNGDD006 | 137.87 | 164.57 | 26.70 | 0.49 | 2.76 | 0.53 | |

| incl. | 137.87 | 152.60 | 14.73 | 0.65 | 3.58 | 0.69 | |

| 175.72 | 188.49 | 12.77 | 0.62 | 4.37 | 0.68 | ||

| incl. | 184.91 | 187.54 | 2.63 | 1.25 | 7.89 | 1.35 | |

| 22BNGDD007 | 9.15 | 44.05 | 34.90 | 1.30 | 1.41 | 1.32 | |

| incl. | 13.00 | 23.00 | 10.00 | 1.66 | 1.17 | 1.67 | |

| incl. | 16.80 | 21.00 | 4.20 | 2.54 | 1.81 | 2.57 | |

| and incl. | 29.34 | 42.00 | 12.66 | 1.73 | 2.09 | 1.76 |

*True width of the intervals has not yet been established by drilling.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.