The widely-held mega-cap stocks that dominate the U.S. markets recently finished reporting their Q4 2018 financial results. Because the tenor of stock markets changed radically last quarter, this latest earnings season is more important than usual. An extreme monster bull market suddenly rolled over into a severe near-bear correction in Q4. How major corporations fared offers insights into whether a young bear is upon us.

Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Required by the U.S. Securities and Exchange Commission, these 10-Qs and 10-Ks contain the best fundamental data available to traders. They dispel all the sentiment distortions inevitably surrounding prevailing stock-price levels, revealing corporations’ underlying hard fundamental realities.

While 10-Qs with filing deadlines of 40 days after quarter-ends are required for normal quarters, 10-K annual reports are instead mandated after quarters ending fiscal years. Most big companies logically run their accounting on calendar years, so they issue 10-Ks after Q4s. Since these annual reports are larger and must be audited by independent CPAs, their filing deadlines are extended to 60 days after quarter-ends.

So the 10-K filing season just wrapped up last Friday, revealing how the biggest and best U.S. companies were doing in Q4 2018. They are the stocks of the flagship S&P 500 stock index (SPX). At the end of Q4 they commanded a gigantic collective market capitalization of $22.2t! The vast majority of investors own the big U.S. stocks of the SPX, as some combination of them are usually the top holdings of nearly every fund.

The major ETFs that track the S&P 500 dominate the increasingly-popular passive-investment strategies as well. The SPY SPDR S&P 500 ETF, IVV iShares Core S&P 500 ETF, and VOO Vanguard S&P 500 ETF are among the largest in the world. This past week they reported colossal net assets running $262.4b, $160.5b, and $103.2b respectively! Overall stock-market fortunes are totally dependent on big U.S. stocks.

Q4 2018 proved extraordinary. Leading into it, the SPX hit a dazzling all-time record high in late September about a week before Q4 arrived. That extended an extreme monster stock bull to 333.2% gains over 9.5 years, the 2nd-largest and 1st-longest in all of U.S. stock-market history! But as I warned days after that euphoric peaking, the Fed’s unprecedented quantitative-tightening campaign would finally ramp to full speed in Q4.

Stock markets artificially inflated by $3625b of Fed QE over 6.7 years couldn’t react well to Fed QT finally starting to unwind that epic monetary inflation. With QT hitting $50b per month starting in Q4, the stock markets indeed wilted. Over the next 3.1 months into Christmas Eve, the SPX plummeted 19.8%! That was right on the verge of a new bear market at -20%. The SPX suffered its worst December since 1931, -9.2%.

That sure looked like a young bear market, really freaking out traders. But since those deep and ominous lows, the SPX has soared 19.3% at best in a massive rally! That has reversed nearly 4/5ths of the total correction losses largely suffered in Q4. This looked and acted like a classic bear-market rally, rocketing higher to eradicate fear and restore universal complacency. New-bear worries have shriveled to nothing.

Given Q4 2018’s colossal stock-market inflection and subsequent huge rebound, whether the SPX narrowly evaded the overdue-bear bullet or not is supremely important. Bear markets exist for one reason, to maul overvalued stocks back down below historic fair-value levels. So how the major U.S. corporations actually fared last quarter, how large their earnings were compared to their stock prices, offers essential bull-bear clues.

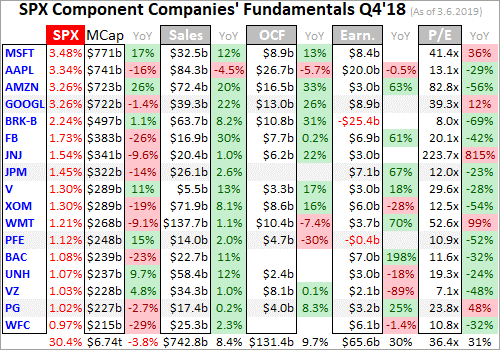

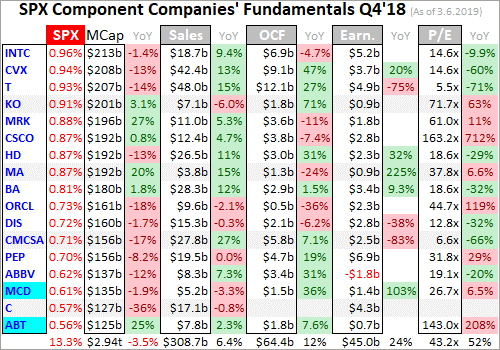

Every quarter I analyze the top 34 SPX/SPY component stocks ranked by market cap. This is just an arbitrary number that fits neatly into the tables below, but is a dominant sample of the SPX. At the end of Q4, these American giants alone commanded fully 43.7% of the SPX’s total weight! Their $9.7t collective market cap exceeded that of the bottom 437 SPX companies. Big U.S. stocks’ importance cannot be overstated.

I wade through the 10-K or 10-Q SEC filings of these top SPX companies for a ton of fundamental data I dump into a spreadsheet for analysis. The highlights make it into these tables below. They start with each company’s symbol, weighting in the SPX and SPY, and market cap as of the final trading day of Q4 2018. That’s followed by the year-over-year change in each company’s market capitalization, a key metric.

Major U.S. corporations have been engaged in a wildly-unprecedented stock-buyback binge ever since the Fed forced interest rates to deep artificial lows during 2008’s stock panic. Thus the appreciation in their share prices also reflects shrinking shares outstanding. Looking at market-cap changes instead of just underlying share-price changes effectively normalizes out stock buybacks, offering purer views of value.

That’s followed by quarterly sales along with their y/y changes. Top-line revenues are one of the best indicators of businesses’ health. While profits can be easily manipulated quarter to quarter by playing with all kinds of accounting estimates, sales are tougher to artificially inflate. Ultimately sales growth is necessary for companies to expand, as bottom-line profits growth driven by cost-cutting is inherently limited.

Operating cash flows are also important, showing how much capital companies’ businesses are actually generating. Using cash to make more cash is a core tenet of capitalism. Unfortunately many companies are now obscuring quarterly OCFs by reporting them in year-to-date terms, lumping in multiple quarters together. So the Q4 2018 OCFs shown are mostly calculated by subtracting Q3’18 YTD OCFs from full-year ones.

Next are the actual hard quarterly earnings that must be reported to the SEC under Generally Accepted Accounting Principles. Lamentably companies now tend to use fake pro-forma earnings to downplay real GAAP results. These are derided as EBS profits, Everything but the Bad Stuff! Certain expenses are simply ignored on a pro-forma basis to artificially inflate reported corporate profits, often misleading traders.

While we’re also collecting the earnings-per-share data Wall Street loves, it’s more important to consider total profits. Stock buybacks are executed to manipulate EPS higher, because the shares-outstanding denominator of its calculation shrinks as shares are repurchased. Raw profits are a cleaner measure, again effectively neutralizing the impacts of stock buybacks. They better reflect underlying business performance.

Finally the trailing-twelve-month price-to-earnings ratios as of the end of Q4 2018 are noted. TTM P/Es look at the last four reported quarters of actual GAAP profits compared to prevailing stock prices. They are the gold-standard metric for valuations. Wall Street often intentionally conceals these hard P/Es by using the fictional forward P/Es instead, which are literally mere guesses about future profits that often prove far too optimistic.

These are mostly calendar-Q4 results, but some big U.S. stocks use fiscal quarters offset from normal ones. Walmart, Home Depot, and Cisco have quarters ending one month after calendar ones, so their results here are current to the end of January instead of December. Oracle uses quarters that end one month before calendar ones, so its results are as of the end of November. Offset reporting ought to be banned.

Reporting on offset quarters renders companies’ results way less comparable with the vast majority that report on calendar quarters. We traders all naturally think in calendar-quarter terms too. Decades ago there were valid business reasons to run on offset fiscal quarters. But today’s sophisticated accounting systems that are largely automated running in real-time eliminate all excuses for not reporting normally.

Stocks with symbols highlighted in blue have newly climbed into the ranks of the SPX’s top 34 companies over the past year, as investors bid up their stock prices and thus market caps relative to their peers. Overall the big U.S. stocks’ Q4 2018 results looked impressive, with good sales and profits growth. But that masks a sharp slowdown from prior quarters that will be exacerbated as the corporate-tax-cut transition year ends.

2018 was a banner year for corporate earnings because of Republicans’ massive corporate tax cuts. The Tax Cuts and Jobs Act was signed into law on December 22nd, 2017 to go into effect on January 1st, 2018. Its centerpiece was slashing the U.S. corporate tax rate from 35% to 21%, which naturally boosted reported profits. But 2018’s four quarters were the only ones that would experience anomalous TCJA growth.

Q4 2018 was the last quarter comparing year-over-year growth between a pre-TCJA quarter and post-TCJA quarter. That major discontinuity distorted corporate-earnings growth. Profits soared last year not just because companies were doing better, but because they were paying taxes at much-lower rates. But starting in Q1 2019, that TCJA-transition boost is gone forever. Normal same-tax-regime y/y comparisons will return.

But before we get to all-important corporate earnings and resulting valuations, let’s work our way through these tables. Thanks to the SPX’s brutal 14.0% plunge in Q4, this leading broad-market stock index lost 6.2% last year. The biggest and best US companies fared a little better, with the collective market cap of the top 34 sliding 5.2% y/y. These elite corporations had average market-cap losses running 3.6% y/y.

That certainly isn’t calamitous, but the deceleration is neck-snapping! In the prior four quarters starting in Q4 2017, the SPX’s top 34 components saw enormous average YoY market-cap gains of 29.2%, 14.6%, 23.5%, and 24.2%. Make no mistake, Q4’18 saw a massive and ominous stock-market inflection. The severe near-bear correction’s selling pressure was even heavier in smaller SPX stocks below the top 34.

That pushed the top 34’s share of the SPX’s total weighting to 43.7%, a big increase from Q4 2017’s 41.8%. The more capital concentrated in fewer stocks, the riskier the entire stock markets become. Big down days driven by company-specific news in highly-weighted individual stocks can drag down the entire stock markets. A great example occurred in mighty Apple just after Q4 ended, when it warned on weak Q4 sales.

For years Apple had been the largest U.S. stock by market cap, commanding the highest ranking in the SPX and SPY. Just after 2019’s first trading day closed, Apple cut its Q4 revenue guidance by 7.7% from its own midpoint given 2 months earlier. The next day AAPL stock collapsed by 10.0%, which pummeled the entire SPX 2.5% lower in its worst loss so far this year. When a top U.S. stock sneezes, markets catch a cold.

Falling stock markets exert a strong negative wealth effect. Both consumers and corporations get scared as stocks suffer big and fast drops, so they pull in their horns on spending. That left all kinds of economic data covering parts of Q4 weaker than expected, sometimes shockingly so. Lower spending weighs on corporate revenues, as fewer people buy less goods and services. Would the top 34’s Q4 2018 sales reflect this?

On the surface these biggest-and-best U.S. companies looked immune. Their total Q4 sales of $1051.6b still climbed an impressive 4.2% YoY in the stock markets’ worst quarter since Q3 2011. These companies averaged big sales growth of 7.4% y/y, which was surprisingly robust given the stock-market carnage. Yet even that good top-line growth still reflects a major slowdown for the top 34 from the past year’s pace.

In the preceding four quarters, the SPX’s top 34 component stocks averaged y/y revenues growth way up at 10.8%, 14.0%, 14.0%, and 11.5%. So Q4’s was a serious deceleration, which may be an ominous portent for 2019. Q4’s revenues growth may be overstated too. Nearly 2/3rds of the SPX’s spending-sapping Q4 plunge came in December alone, after much of the surge in holiday shopping was already over.

If big U.S. companies’ sales growth continues slowing or even starts shrinking in 2019, corporate-profits growth will collapse. While Q1 2019’s earnings season doesn’t start for another 5 weeks or so, plenty of companies have warned that they see revenues slowing much more than Wall Street expected. If Q4 2018 was indeed a major stock-market trend change from bull to bear, corporate results will continue deteriorating.

The mega-cap companies dominating the SPX and American investors’ portfolios also enjoyed strong operating-cash-flow-generation growth in Q4. Their collective OCFs surged 11.5% y/y to $195.8b. Individual companies enjoyed average OCF gains of 10.8% y/y. That looks great on the surface, but just like sales it represents a sharp slowdown from huge y/y OCF growth seen in the prior four quarters.

Starting in Q4 2017 the SPX top 34’s operating cash flows averaged growth of 17.0%, 52.5%, 30.3%, and 20.6% YoY. So Q4’18’s still-strong OCF growth actually decelerated by almost 2/3rds from the precedent of the prior year. That was the prevailing theme of Q4’18 results, good numbers but already slowing fast from the rest of 2018’s even though last quarter had easy annual comparisons across those corporate tax cuts.

Actual corporate profits among these elite U.S. companies are critical to prevailing valuations. The price-to-earnings ratio is the classic measure of how expensive stock prices are. It simply divides companies’ current stock prices by their total earnings per share over the last four reported quarters. So profits are really the only corporate results that matter for valuations, making their growth trends the most important of all.

Interestingly the top 34 SPX components’ total GAAP profits actually shrunk 1.4% y/y to $110.6b in Q4! That doesn’t make sense given their total revenues growth of 4.2%, which earnings should’ve amplified. But a couple big factors played into that surprising decline. After the Tax Cuts and Jobs Act was passed near the end of 2017, companies had to make huge adjustments to overpaid or underpaid taxes on their books.

These are called deferred tax assets and liabilities, which would suddenly be valued very differently under the new corporate-tax rules. So as I analyzed last year, the top 34 SPX companies ran a staggering $209.2b of TCJA adjustments through their earnings in Q4’17! Thus that earlier comparable quarter to Q4 2018 was a mess in GAAP-earnings terms. Q4 2017 was probably the most-distorted quarter in SPX history.

But with about half those one-time TCJA adjustments resulting in profits gains and half in losses, the net impact to overall SPX-top-34 earnings in Q4 2017 was essentially a wash at +$2.7b. That merely boosted overall Q4 2017 profits by 2.5%. A far-more-important factor in Q4’18’s YoY earnings decline came from a single company, Warren Buffett’s Berkshire Hathaway. It was the 5th-largest SPX component as 2018 ended.

BRK suffered a catastrophic $25.4b GAAP loss last quarter! That was almost entirely due to the sharp stock-market decline, which hammered Berkshire’s gigantic investment portfolio lower. It suffered $27.6b of non-cash losses that now have to be run through quarterly earnings. A new accounting rule now requires that unrealized capital gains and losses must be flushed through the bottom line, really irritating Buffett.

In BRK’s 2018 annual report he wrote “As I emphasized in the 2017 annual report, neither Berkshire’s Vice Chairman, Charlie Munger, nor I believe that rule to be sensible. Rather, both of us have consistently thought that at Berkshire this mark-to-market change would produce what I described as “wild and capricious swings in our bottom line.” … Wide swings in our quarterly GAAP earnings will inevitably continue.”

“That’s because our huge equity portfolio – valued at nearly $173 billion at the end of 2018 – will often experience one-day price fluctuations of $2 billion or more, all of which the new rule says must be dropped immediately to our bottom line. … Our advice? Focus on operating earnings, paying little attention to gains or losses of any variety.” Berkshire’s operating earnings were $5.7b in Q4’18, soaring 71.4% y/y!

If BRK’s epic unrealized capital loss is ignored, total SPX-top-34 earnings would’ve surged 23.2% y/y in Q4 2018. On average these top 34 SPX companies reporting profits in both Q4 2017 and Q4 2018 averaged similar 27.8% y/y gains. But the same sharp-deceleration story seen in revenues and OCFs also applies here. The previous four quarters saw far-stronger average growth of 137.0%, 45.9%, 44.5%, and 53.8% y/y!

The massive swings in Berkshire’s enormous investment portfolio are going to distort overall corporate profits in all future quarters with significant SPX gains or losses. We’ll have to watch that going forward, and adjust for it if necessary. But overall corporate profits will be much cleaner in coming years with the TCJA transition year of 2018 behind us. Apples-to-apples comparisons will once again become the norm.

The major slowdown in big U.S. companies’ revenues, operating cash flows, and earnings growth in Q4 2018 is certainly ominous. Especially since the majority of the SPX’s plunge last quarter came relatively late in December. But the most-important thing for attempting to divine whether that monster bull remains alive and well having merely suffered a severe correction, or a young bear is underway, is how valuations look.

These top 34 SPX companies that earned GAAP profits over the past four quarters averaged trailing-twelve-month price-to-earnings ratios way up at 39.7x as Q4 ended! That’s 29.4% above Q4 2017’s average a year earlier, and well into dangerous bubble territory. Over the past century-and-a-quarter or so, U.S. stock markets have averaged 14x earnings which is fair value. Twice that at 28x is where bubble territory begins.

Despite remaining scary-high, big U.S. companies’ average valuations did moderate considerably in Q4. The prior four quarters saw the SPX top 34’s average TTM P/Es run 30.6x, 46.0x, 53.4x, and 49.0x. So the severe near-bear correction definitely did some real work in mauling valuations down. And the P/Es in these tables are as of the end of Q4, which of course didn’t yet reflect the solid y/y growth in Q4 earnings.

By the end of February the top 34 SPX companies’ average TTM P/Es had further dropped to 26.4x, still very expensive but no longer bubble levels. That includes these Q4 results and is even despite the SPX’s powerful rebound rally out of late December’s near-bear lows. So the situation today is nowhere near as dire as at the end of Q4’18 on the valuation front. But that doesn’t mean stock markets are out of the woods.

Bear markets exist because stocks get too expensive leading into the ends of preceding bulls. At 14x fair value it takes 14 years for a company to earn back the price investors are paying for it. The reciprocal of that is a 7.1% return, which is mutually beneficial for both investors with surplus capital and companies that need it. Once extreme bubble valuations birth bear markets, they don’t hibernate until stocks are cheap.

Throughout all of 2018 the U.S. stock markets were trading at extreme bubble valuations. Then in Q4 that severe 19.8% correction hammered the SPX to the verge of formal bear territory. The rebound since has all the hallmarks of a massive bear-market rally. Wall Street’s oft-cited belief that Q4’s plunge was more than enough to restore balance to these stock markets isn’t credible. Bears don’t stop with stocks still expensive!

Historical bear markets after major bulls nearly always maul prevailing US-stock-market valuations back down to cheap levels at 7x to 10x earnings in TTM P/E terms. With the top U.S. stocks averaging 39.7x as Q4 waned and 26.4x at the end of February, the valuation-mean-reversion work still has a long way to go. It is certainly not safe to assume no bear is coming until the SPX trades under 14x, which is far lower.

The SPX soared 11.1% YTD by the end of February, hitting 2784.5. Merely to get to fair value at 14x earnings, not even overshoot to the downside, the SPX has to fall to 1476.6! That’s another 46.7% under this week’s levels! And if corporate earnings actually start retreating this year, the SPX downside targets will fall proportionally. Big bears are normal and inevitable after big bulls, as I explained in depth in late December.

Nearly a decade of Fed-QE-goosed bull market has left traders forgetting how dangerous bears are. The SPX’s last two bears were a 49.1% decline over 2.6 years ending in October 2002, and a 56.8% plunge in 1.4 years climaxing in a stock panic to a March 2009 low! With the big U.S. stocks sporting extreme bubble valuations all of last year, and still near bubble valuations now, it’s hard to believe we aren’t in a young bear.

If that proves true, investors need to lighten up on their stock-heavy portfolios, or at least put stop losses in place. Cash is king in bear markets, since its buying power grows. Investors who hold cash during a 50% bear market can double their holdings at the bottom by buying back their stocks at half-price. But cash doesn’t appreciate in value like gold, which actually grows wealth during major stock-market bears.

Gold investment demand surges as stock markets weaken, as we got a taste of in December. While the SPX plunged 9.2%, gold rallied 4.9% as investors flocked back. The gold miners’ stocks which leverage gold’s gains fared even better, with their leading index surging 10.7% higher. The last time a major SPX selloff awakened gold in the first half of 2016, it soared 30% higher fueling a massive 182% gold-stock upleg!

Absolutely essential in bear markets is cultivating excellent contrarian intelligence sources. That’s our specialty at Zeal. After decades studying the markets and trading, we really walk the contrarian walk. We buy low when few others will, so we can later sell high when few others can. While Wall Street will deny this likely young stock-market bear all the way down, we will help you both understand it and prosper during it.

We’ve long published acclaimed weekly and monthly newsletters for speculators and investors. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. As of Q4, we’ve recommended and realized 1076 newsletter stock trades since 2001. Their average annualized realized gain is +16.1%! That’s nearly double the long-term stock-market average. Subscribe today for just $12 per issue!

The bottom line is big U.S. stocks’ Q4 2018 results looked impressive on the surface. Good annual growth in sales, operating cash flows, and even earnings excluding Berkshire’s huge mark-to-market losses appeared to buck Q4’s major stock-market selloff. But these growth rates all suffered sharp decelerations from those seen in preceding quarters, suggesting a slowdown is underway. That’s a real problem for stock markets.

Valuations remain dangerously high, deep into bubble territory at the end of Q4. And even after the Q4 earnings were included by late February, near-bubble valuations persisted. That means the likely bear has barely started its stock-price-mauling work to mean revert expensive valuations. On top of that, 2018’s anomalous corporate-tax-cut-transition growth rates are history. All this will continue to pressure stock prices.

Adam Hamilton, CPA

March 11, 2019

Copyright 2000 – 2019 Zeal LLC (www.ZealLLC.com)

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.